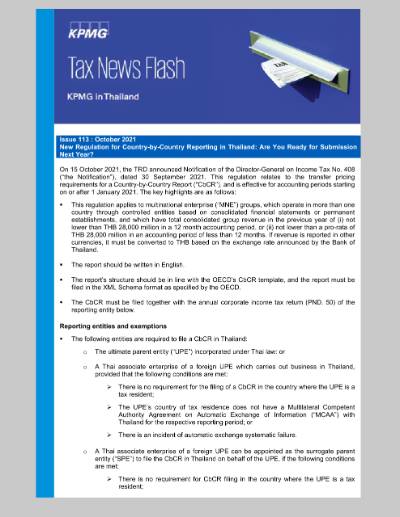

On 15 October 2021, the TRD announced Notification of the Director-General on Income Tax No. 408 (“the Notification”), dated 30 September 2021. This regulation relates to the transfer pricing requirements for a Country-by-Country Report (“CbCR”), and is effective for accounting periods starting on or after 1 January 2021. The key highlights are as follows:

- This regulation applies to multinational enterprise (“MNE”) groups, which operate in more than one country through controlled entities based on consolidated financial statements or permanent establishments, and which have total consolidated group revenue in the previous year of (i) not lower than THB 28,000 million in a 12 month accounting period, or (ii) not lower than a pro-rata of THB 28,000 million in an accounting period of less than 12 months. If revenue is reported in other currencies, it must be converted to THB based on the exchange rate announced by the Bank of Thailand.

- The report should be written in English.

- The report’s structure should be in line with the OECD’s CbCR template, and the report must be filed in the XML Schema format as specified by the OECD.

- The CbCR must be filed together with the annual corporate income tax return (PND. 50) of the reporting entity below.

Reporting entities and exemptions

- The following entities are required to file a CbCR in Thailand:

- The ultimate parent entity (“UPE”) incorporated under Thai law: or

- A Thai associate enterprise of a foreign UPE which carries out business in Thailand, provided that the following conditions are met:

- There is no requirement for the filing of a CbCR in the country where the UPE is a tax resident;

- The UPE’s country of tax residence does not have a Multilateral Competent Authority Agreement on Automatic Exchange of Information (“MCAA”) with Thailand for the respective reporting period; or

- There is an incident of automatic exchange systematic failure.

- A Thai associate enterprise of a foreign UPE can be appointed as the surrogate parent entity (“SPE”) to file the CbCR in Thailand on behalf of the UPE, if the following conditions are met:

- There is no requirement for CbCR filing in the country where the UPE is a tax resident;

- The UPE must prepare an SPE appointment letter and notify the competent authority in Thailand of such an appointment; and

- The accounting period of the SPE must be the same as the UPE.

- The ultimate parent entity (“UPE”) incorporated under Thai law: or

- However, an associate enterprise carrying on business in Thailand will be exempted from the obligation to file a CbCR in Thailand, if the following conditions are met:

- a UPE must appoint an SPE to file a CbCR in the country where the SPE is a tax resident (other than Thailand), and the SPE must notify its tax residence country of the SPE appointment;

- the country where the SPE is a tax resident has a local regulation to require CbCR filing in that country, has an effective MCAA with Thailand before the CbCR filing deadline in Thailand, and has no incident of automatic exchange systematic failure; and

- a Thai associate enterprise must notify the competent authority in Thailand of the SPE appointment.

- a UPE must appoint an SPE to file a CbCR in the country where the SPE is a tax resident (other than Thailand), and the SPE must notify its tax residence country of the SPE appointment;

Definitions of an ultimate parent entity

A UPE is defined as:

- An entity which has direct or indirect control of other entities within an MNE group,

- is required to prepare consolidated financial statements in accordance with the generally accepted accounting rules of the country where the UPE is a tax resident; or

- would otherwise be required to prepare consolidated financial statements if it was listed in the stock exchange of the country where the entity is a tax resident or in Thailand; and

- is not controlled in the same manner by any other entities within the same MNE group.

- is required to prepare consolidated financial statements in accordance with the generally accepted accounting rules of the country where the UPE is a tax resident; or

- An entity (other than (1) above) that carries on business through a permanent establishment in another country.

KPMG’s observations and recommendations

According to the Notification, the CbCR filing deadline in Thailand matches the filing deadline for an annual corporate income tax return, i.e., 150 days from the end of an accounting period. This filing deadline is more imminent than most countries, which typically allow the CbCR to be filed within 12 months after the end of the UPE’s fiscal period.

In addition, please note that even if a UPE of an MNE group does not currently prepare consolidated financial statements, as it is not listed on a stock exchange, it would also be subject to this Notification by virtue of the deemed listing provision.

Due to the tight submission deadline in Thailand, it is strongly recommended that a Thai reporting entity (i.e., a Thai UPE, an overseas MNE group which is considering appointing a Thai associated enterprise as its SPE in Thailand, etc.) should pro-actively evaluate whether it meets the threshold of total consolidated group revenue, especially if the MNE group has never prepared consolidated financial data/statements.

It is important to highlight that with CbCR submission the tax authorities would have access to more financial data of not only taxpayers in Thailand but also taxpayers around the world in consolidated groups. Therefore, it is strongly recommended that before submission, groups should conduct tax and transfer pricing risk assessments, as well as preparing supporting documents and explanations in advance – especially in case there may be tax and transfer pricing inquiries and audits by the tax authorities.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia