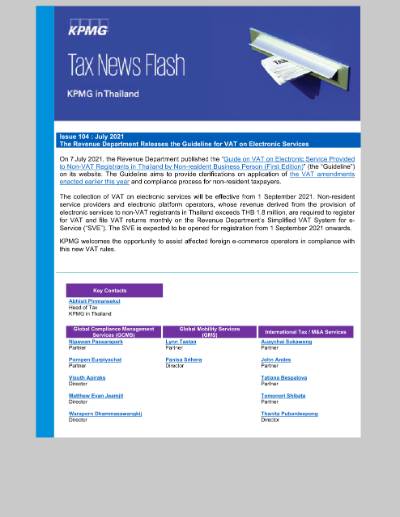

On 7 July 2021, the Revenue Department published the “Guide on VAT on Electronic Service Provided to Non-VAT Registrants in Thailand by Non-resident Business Person (First Edition)” (the “Guideline”) on its website. The Guideline aims to provide clarifications on application of the VAT amendments enacted earlier this year and compliance process for non-resident taxpayers.

The collection of VAT on electronic services will be effective from 1 September 2021. Non-resident service providers and electronic platform operators, whose revenue derived from the provision of electronic services to non-VAT registrants in Thailand exceeds THB 1.8 million, are required to register for VAT and file VAT returns monthly on the Revenue Department’s Simplified VAT System for e-Service (“SVE”). The SVE is expected to be opened for registration from 1 September 2021 onwards.

KPMG welcomes the opportunity to assist affected foreign e-commerce operators in compliance with this new VAT rules.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia