The COVID-19 pandemic has led to uncertainties and challenges in both demand and supply for businesses across all sectors. Over the past 12 months, issues such as delayed customer payments, shortage of supply of key materials or even production closures have become common occurrences. All of these have impacted the level of working capital and cash flow required to manage day to day operations and CFOs have had their work cut out to ensure they strike the right balance.

Whilst working capital management is not a new concept, recent events have highlighted the importance of pro-actively managing working capital and cash flow to ensure you are not left with bad debts or stock write offs, lost sales, or damaged supplier relationships when payments can’t be met.

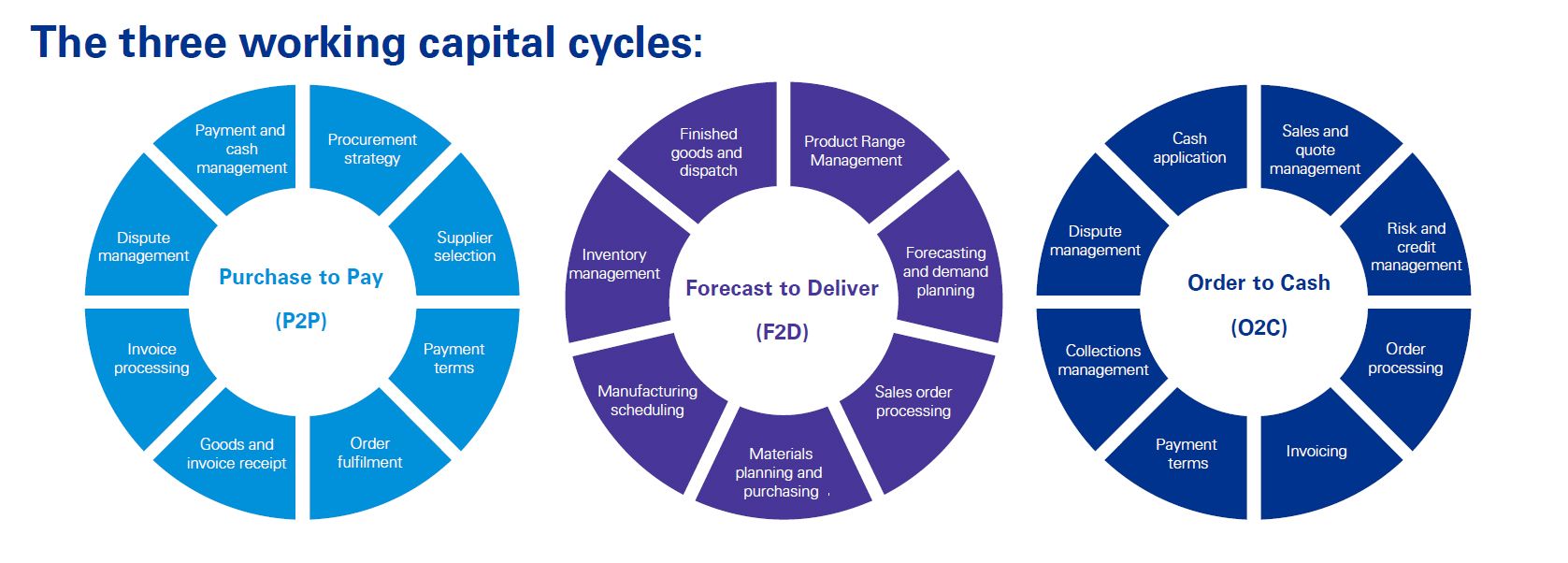

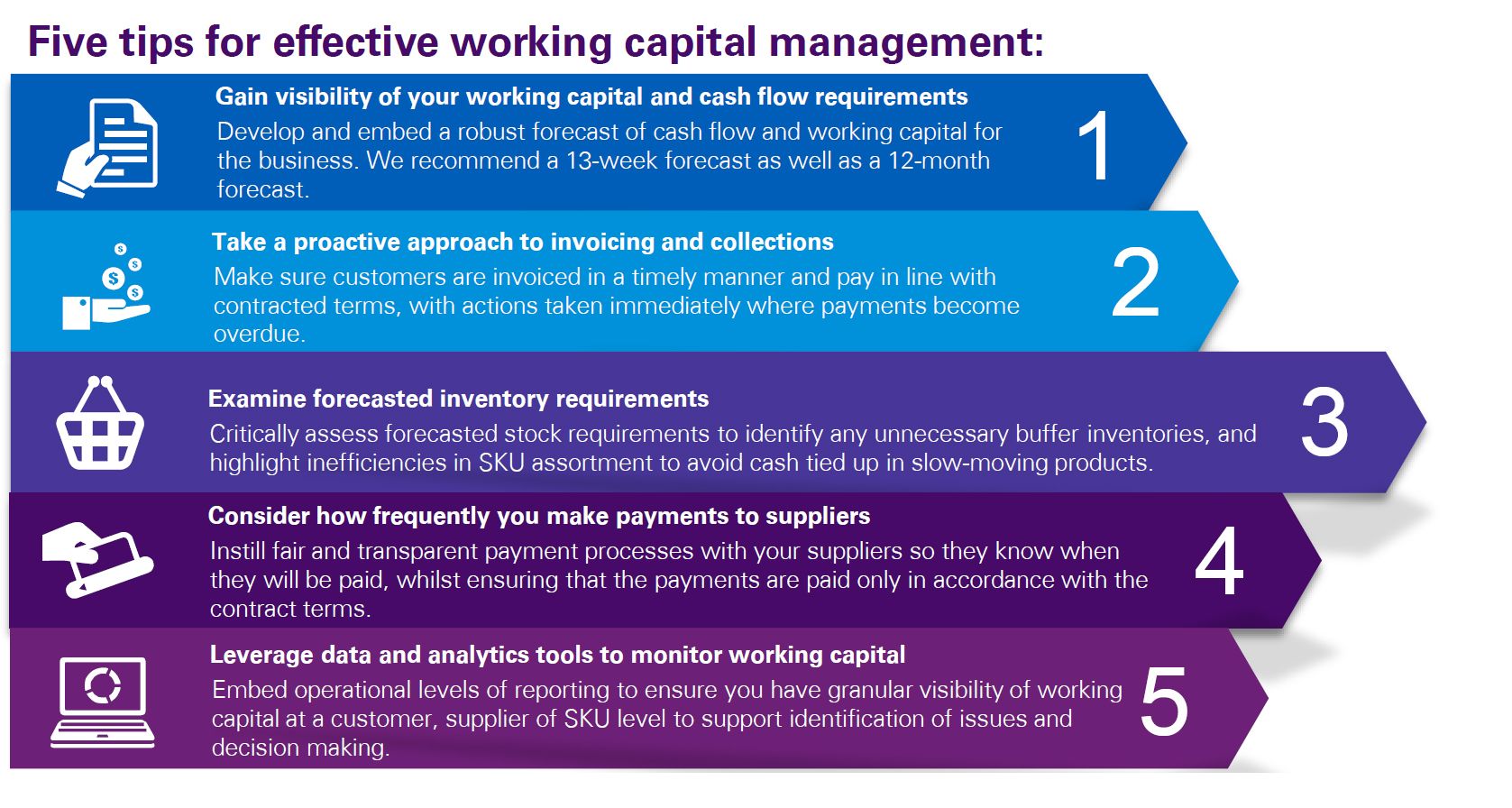

We outline below the core components of working capital management, and five tips that best-in-class organizations are adopting.

Whether you are still struggling to recover from the recession, experiencing a surge in demand, or launching a new business venture, focusing on effective working capital management will allow you to generate additional cash flow to repay debt, or fund growth and ensure you are best placed to react in times of uncertainty.

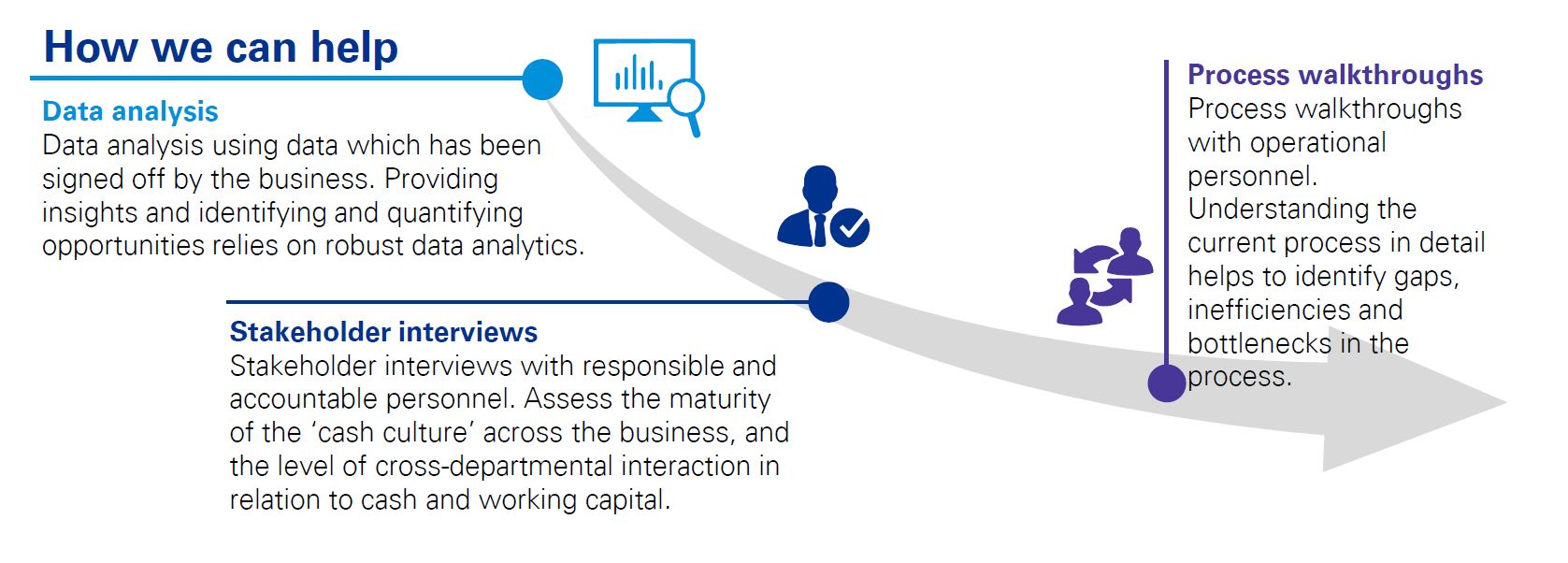

Leading data analytics tools

KPMG’s leading working capital diagnostic methodology utilizes proprietary cutting-edge data visualization software. Drawing from multiple, standard, ERP data outputs our software is able to quickly analyse and prioritize working capital enhancement opportunities.

This output is dynamic and users have the ability to interact ‘live’ with their data, adjusting assumptions and performing sensitivity analysis in a real time environment, quickly getting to the root cause of problems. Coupled with our extensive experience of where to look, this is a powerful methodology to enhance working capital performance.