1 min read

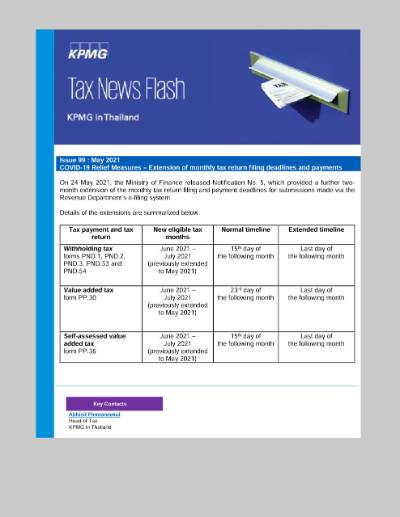

On 24 May 2021, the Ministry of Finance released Notification No. 5, which provided a further two-month extension of the monthly tax return filing and payment deadlines for submissions made via the Revenue Department’s e-filing system.

Details of the extensions are summarized below.

| Tax payment and tax return | New eligible tax months | Normal timeline | Extended timeline |

|---|---|---|---|

Withholding tax forms PND.1, PND.2, PND.3, PND.53 and PND.54 |

June 2021 – July 2021 (previously extended to May 2021) |

15th day of the following month | Last day of the following month |

Value added tax form PP.30 |

June 2021 – July 2021 (previously extended to May 2021) |

23rd day of the following month | Last day of the following month |

Self-assessed value added tax form PP.36 |

June 2021 – July 2021 (previously extended to May 2021) |

15th day of the following month | Last day of the following month |

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia