Following the promising signs of a recovery in Q1, the third wave of COVID-19 has severely dampened the recovery of the Thai economy in Q2. As a result, the Bank of Thailand (BoT) has reduced projected GDP growth from 3.2% and 4.8% to 3.0% and 4.7% in 2021 and 2022 respectively(1) whilst the Monetary Policy Committee (MPC) has announced that interest rates will remain at 0.5% to support business recovery. Risk and uncertainty are often the greatest barriers to an economic recovery, and these remain strong sentiments with the unpredictable severity and duration of this wave of COVID-19. However, with the vaccination program officially launched this month, this could provide a road to recovery and the long-awaited return of international tourists.

Following this third wave and the unrelenting pressures on business liquidity, the Bank of Thailand (BoT) and the Ministry of Finance (MOF) have launched two additional financial measures to support business recovery, comprising a further soft loan facility for businesses of THB250 billion and the asset warehousing scheme totaling THB100 billion, effective from 10 April 2021.

The soft loan facility for businesses aims to address the limited accessibility of the previous soft loan package by expanding eligible borrower criteria and providing loans with interest rates of no more than 2% per annum during the first two years, and an average of no more than 5% over five years, with the government supporting the interest burden on the first six months. The asset warehousing scheme allows businesses to restructure their debt by using pledged collateral to repay existing debt. Debtors could reduce their debt burden with the right to lease the assets for business operations and the option to buy back within five years.

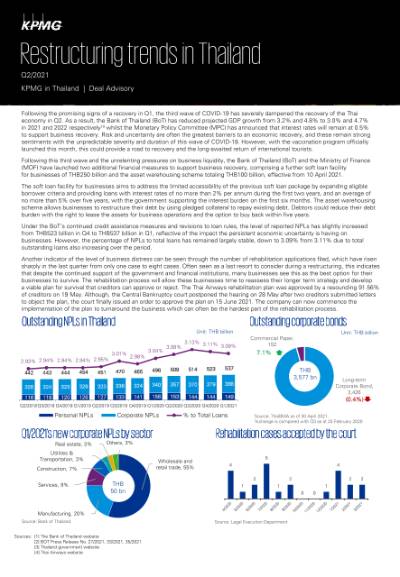

Under the BoT’s continued credit assistance measures and revisions to loan rules, the level of reported NPLs has slightly increased from THB523 billion in Q4 to THB537 billion in Q1, reflective of the impact the persistent economic uncertainty is having on businesses. However, the percentage of NPLs to total loans has remained largely stable, down to 3.09% from 3.11% due to total outstanding loans also increasing over the period.

Another indicator of the level of business distress can be seen through the number of rehabilitation applications filed, which have risen sharply in the last quarter from only one case to eight cases. Often seen as a last resort to consider during a restructuring, this indicates that despite the continued support of the government and financial institutions, many businesses see this as the best option for their businesses to survive. The rehabilitation process will allow these businesses time to reassess their longer term strategy and develop a viable plan for survival that creditors can approve or reject. The Thai Airways rehabilitation plan was approved by a resounding 91.56% of creditors on 19 May. Although, the Central Bankruptcy court postponed the hearing on 28 May after two creditors submitted letters to object the plan, the court finally issued an order to approve the plan on 15 June 2021. The company can now commence the implementation of the plan to turnaround the business which can often be the hardest part of the rehabilitation process.

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represent the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumer. The percentage to total loans represent the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q1/2021 increase in corporate NPLs by sector’ represents the new and re-entered NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has accepted for consideration. The court may reject the application for rehabilitation.

KPMG Deal Advisory

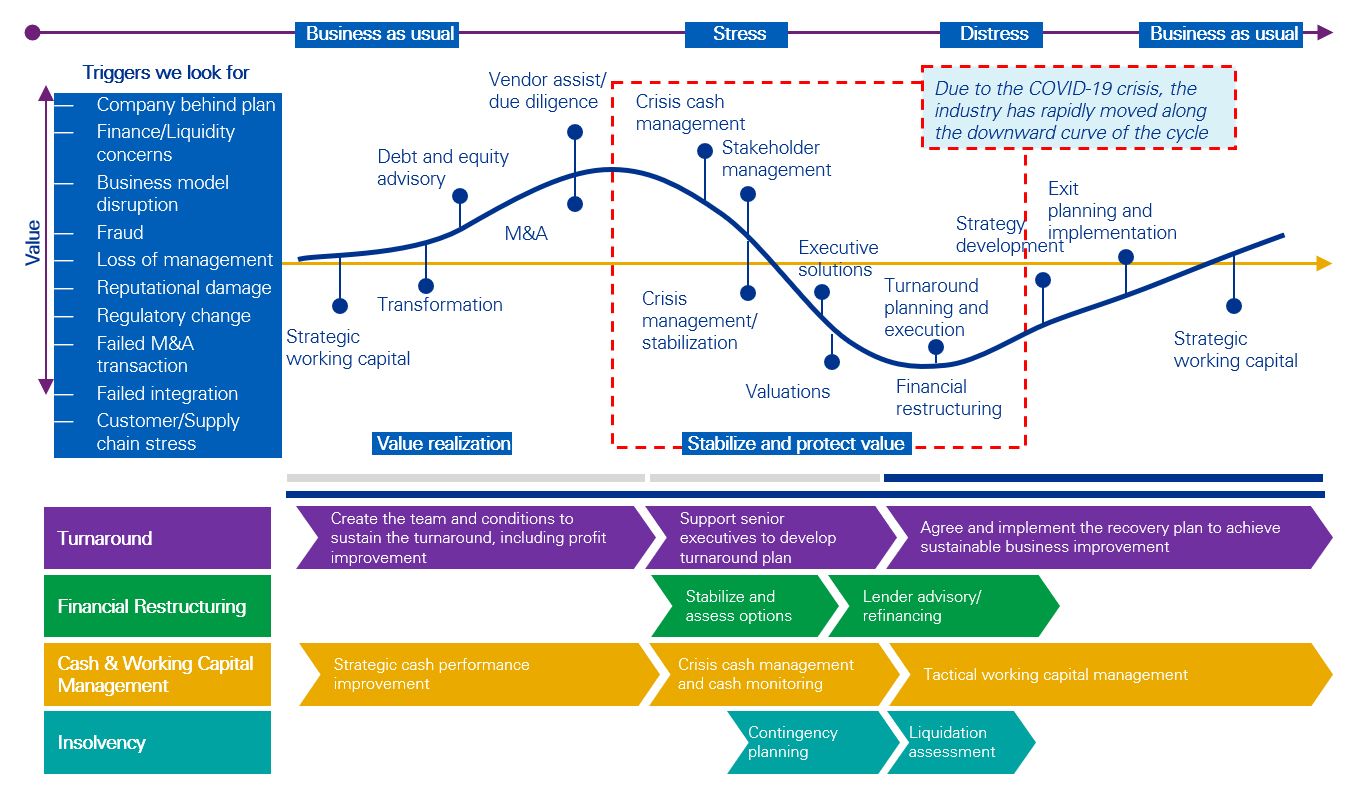

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach bring valuable insights and guidance to help you to stabilize, protect value, and then ready the business to emerge.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia