1 min read

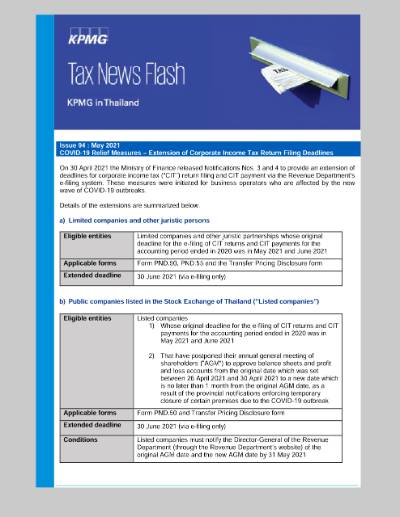

On 30 April 2021 the Ministry of Finance released Notifications Nos. 3 and 4 to provide an extension of deadlines for corporate income tax (“CIT”) return filing and CIT payment via the Revenue Department’s e-filing system. These measures were initiated for business operators who are affected by the new wave of COVID-19 outbreaks.

Details of the extensions are summarized below.

a) Limited companies and other juristic persons

| Eligible entities | Limited companies and other juristic partnerships whose original deadline for the e-filing of CIT returns and CIT payments for the accounting period ended in 2020 was in May 2021 and June 2021 |

| Applicable forms | Form PND.50, PND.55 and the Transfer Pricing Disclosure form |

| Extended deadline | 30 June 2021 (via e-filing only) |

b) Public companies listed in the Stock Exchange of Thailand (“Listed companies”)

| Eligible entities | Listed companies

|

| Applicable forms | Form PND.50 and Transfer Pricing Disclosure form |

| Extended deadline | 30 June 2021 (via e-filing only) |

| Conditions | Listed companies must notify the Director-General of the Revenue Department (through the Revenue Department’s website) of the original AGM date and the new AGM date by 31 May 2021 |

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia