Increasing optimism in Thailand was dampened by the second wave of COVID-19 in December 2020, which required further lock downs at the start of 2021. However, like many other countries around the world, the economic impact of the second wave is less severe than the first with businesses and governments better positioned to continue operations under the restrictions, which have been largely withdrawn as of March 2021.

The National Economic and Social Development Council (NESDC) reported Thailand's gross domestic product shrank by 6.1% in 2020(1), the steepest decline since the Tom Yum Kung crisis in 1997. However, the economy has started to recover gradually from continued government support measures and recovery in exports with The Bank of Thailand (BoT) projecting GDP growth of 3.2% and 4.8% in 2021 and 2022 respectively(2). Thai merchandise exports are expected to increase by 5.7% in 2021, driven by the economic recovery of key trading partners. The revival of international tourism remains a key factor for the long-term recovery of Thailand, and whilst hopes of a recovery have been hit by the second wave, the success of some countries in rolling out vaccines provides positive signs. Latest projections from the BoT anticipate that there could be 5.5 million foreign tourists in Thailand in 2021, which could rise to 23 million in 2022 if Thailand is able to open borders without restrictions for travelers who have not received the vaccine.

The BoT has reviewed the impact of remedial fiscal and monetary measures launched last year with a priority to develop more targeted measures in 2021. Of the total soft loan package of THB500 billion, only 75,000 SMEs accessed a total amount of THB130 billion, utilizing just 26% of the available funds, whilst the debt moratorium, which ended in October 2020, supported 11 million debtors with a total debt amount of THB5.6 trillion(3). Since the end of the debt moratorium, the BoT has encouraged banks to continue support through repayment holidays and interest relief until 30 June 2021, which the banks are continuing to do on a case by case basis.

Any further government measures are expected to be more targeted at sectors such as aviation and hospitality. One such example is the asset warehousing program which is being considered by the BoT and focused on companies which are asset rich but cash poor, such as hospitality and real estate. The asset warehousing concept would allow businesses to transfer property to the bank as collateral under a buy-back agreement. Debt repayments can then be suspended for a specific agreed timeline after which the business would have the option to lease back the assets from creditors and continue to operate as normal. Under this scheme, banks would obtain more control over the assets, and therefore security, providing them with more flexibility to support companies with liquidity. However, each debtor would need to assess the merits of the arrangement based on their business condition and liquidity requirements.

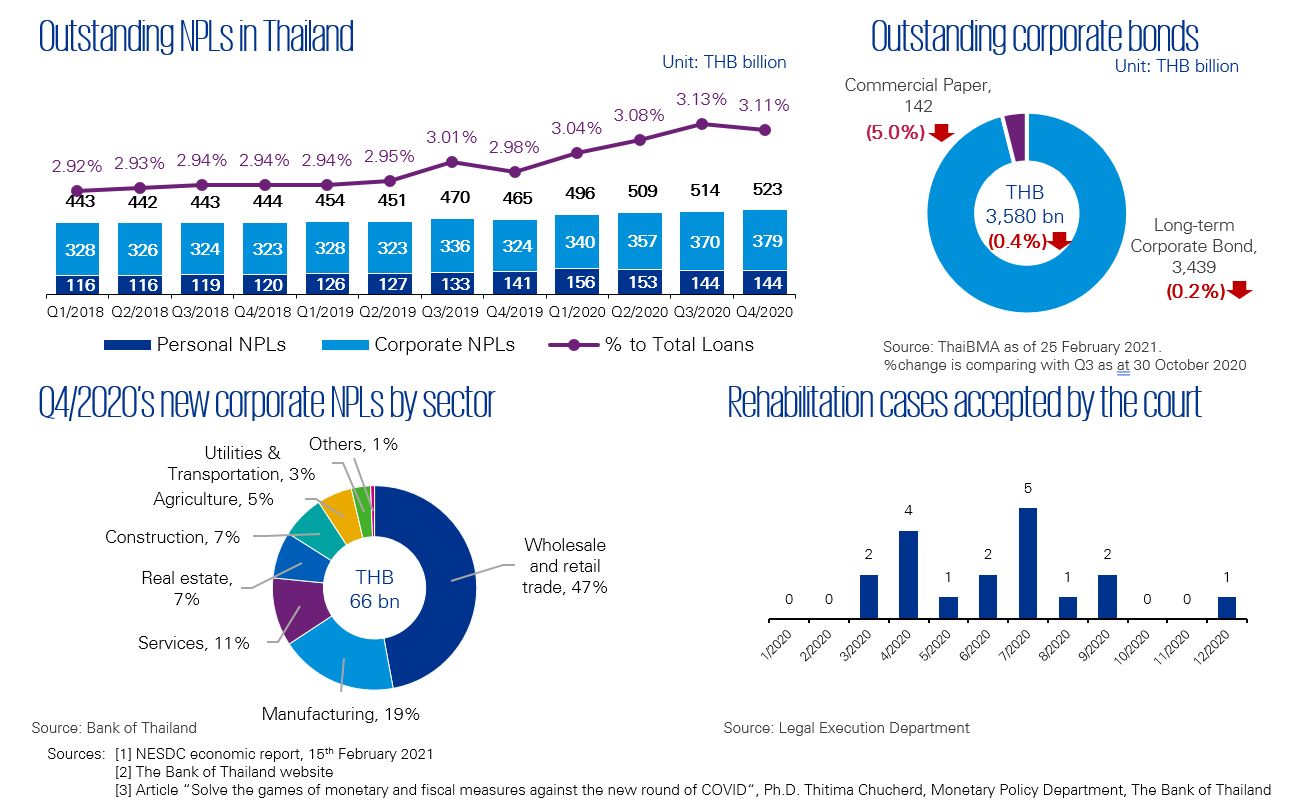

Outstanding Non-Performing Loans reduced marginally from 3.13% of the total loans in Q3 to 3.11% in Q4, reflecting the continued support measures and the relaxation of the classification criteria for NPLs. As a further indication of the support measures, there has been only one new rehabilitation application in the last quarter, although we can already see an increase in Q1 2021. All eyes are on Thai Airways, where the business rehabilitation plan has now been submitted. Whilst a uniquely complex case, other debtors may use this to assess the merits of using the court rehabilitation process

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represent the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumer. The percentage to total loans represent the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q4/2020 increase in corporate NPLs by sector’ represents the new and re-entered NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has accepted for consideration. The court may reject the application for rehabilitation.

KPMG Deal Advisory

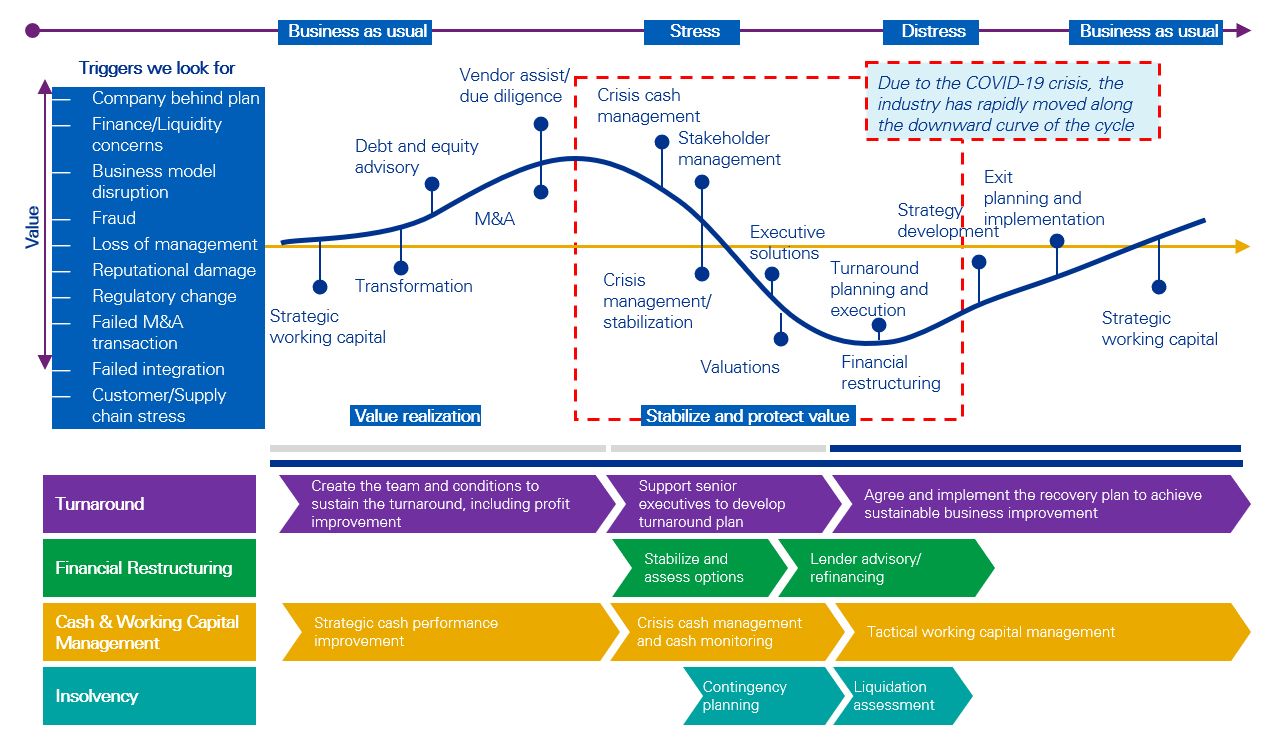

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach bring valuable insights and guidance to help you to stabilize, protect value, and then ready the business to emerge.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia