COVID-19 Relief Measures – Extension of tax filing deadlines and reduction of land and building tax, house transfer fee, mortgage fee including social security contributions

On 26 January 2021, the Cabinet approved several relief measures to aid those who are affected by COVID-19 pandemic. These relief measures include extension of tax filing deadlines and reduction of certain taxes, fees and social security contribution rates.

Details of the relief measures are summarized below.

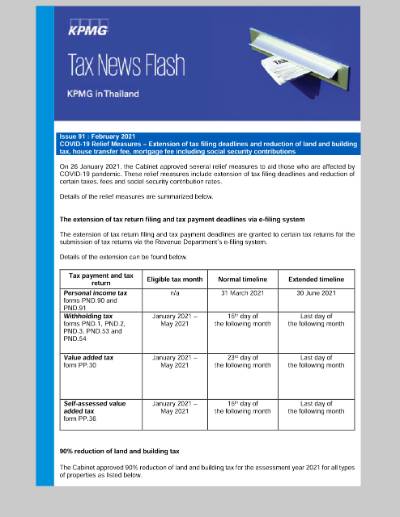

The extension of tax return filing and tax payment deadlines via e-filing system

The extension of tax return filing and tax payment deadlines are granted to certain tax returns for the submission of tax returns via the Revenue Department’s e-filing system.

Details of the extension can be found below.

Tax payment and tax return |

Eligible tax month |

Normal timeline |

Extended timeline |

Personal income tax forms PND.90 and PND.91 |

n/a |

31 March 2021 |

30 June 2021 |

Withholding tax forms PND.1, PND.2, PND.3, PND.53 and PND.54 |

January 2021 – May 2021 |

15th day of the following month |

Last day of the following month

|

Value added tax form PP.30 |

January 2021 – May 2021 |

23rd day of the following month |

Last day of the following month |

Self-assessed value added tax form PP.36 |

January 2021 – May 2021 |

15th day of the following month |

Last day of the following month

|

90% reduction of land and building tax

The Cabinet approved 90% reduction of land and building tax for the assessment year 2021 for all types of properties as listed below.

- Land or building used for agricultural purposes

- Land or building used for residential purposes

- Land or building used for purposes other than agricultural or residential purposes

- Undeveloped land or building

The reduction applies to any owners who own the property or possess the state property for their own benefits as of 1 January 2021.

The above reduction will not affect the following tax reliefs described in Section 96 and Section 97 of the Land and Building Tax.

- Land or building owned by individuals for agricultural purposes is exempt from land and building tax until 2022.

- In case the 90% reduced land and building tax is more than the amount of the house and land tax paid in the year before the year that the land and building tax is collected, the taxpayers shall pay tax as per the amount of the paid house and land tax and the excessive amount shall be entitled to 50% reduction.

In addition, the Ministry of Interior has extended the timeline for processes required under the Land and Building Tax Act for 2 months. Therefore, the deadline for land and building tax payment is extended from the end of April to 2 months from the date of receiving the tax assessment, which could potentially be the end of June 2021 at the latest.

Further details and new regulations relevant to these issues are expected to be announced soon.

Reduction of transfer and mortgage fees for residential properties

In order to support individuals who wish to purchase residential properties, the transfer fee will be reduced from 2% to 0.01% and mortgage fee will be reduced from 1% to 0.01% for the sales of the following properties.

- House with land, i.e. single house, semi-detached house, town house or commercial buildings

- Condominium

The fee reduction will apply to the purchases of the above house or condominium from the land developer or condominium developer in the price not exceeding THB 3 million only. The property transfer and mortgage must be registered at the respective office of the Department of Land concurrently.

The law relevant to this measure is expected to be announced soon. This measure will be enforced on the date after the relevant law is published in the Royal Gazette until 31 December 2021.

Reduction of social security contribution rates

The compulsory social security contribution rates of the employer and insured person under employment according to Section 33 of the Social Security Act B.E. 2533 (1990) are reduced for the two-month salary cycles from February 2021 to March 2021. The reduced rates will apply to the maximum salary of THB 15,000. The summary of the reduction are as follows:

Contributor |

Eligible month |

Normal rate |

Reduced rate |

Employer |

February and March 2021 |

3% |

Not reduced |

Insured person |

3% |

0.5% |

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia