On 19 January 2021, the Cabinet approved a draft amendment to Ministerial Regulation no. 186 issued under the Thai Revenue Code governing bad debt write-off from the debtor account. This amendment will revise the debt thresholds required for compliance with the conditions prescribed under Ministerial Regulation No. 186 in order to align with the amendment of the Bank of Thailand’s financial asset classification and to support businesses affected by the COVID-19 pandemic.

In addition, the amendment will add conditions for writing off bad debts from debtor accounts with respect to loans that are fully reserved at 100 percent, under the rules prescribed by the Bank of Thailand, and that adhere to the conditions that either (a) the principal or interest has been outstanding for a total of 360 days or 12 months, or (b) the debtor meets the criteria for writing off an account’s assets, as prescribed by the Bank of Thailand.

The amendment to Ministerial Regulation no. 186 applies to bad debts that are written off in the accounting period commencing on or after 1 January 2020 onwards.

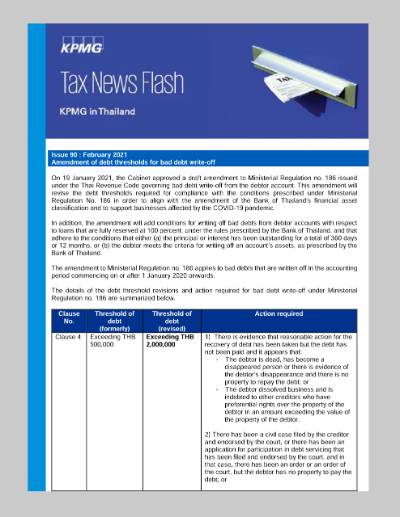

The details of the debt threshold revisions and action required for bad debt write-off under Ministerial Regulation no. 186 are summarized below.

Clause No. |

Threshold of debt |

Threshold of debt (revised) |

Action required |

Clause 4

|

Exceeding THB 500,000 |

Exceeding THB 2,000,000 |

1) There is evidence that reasonable action for the recovery of debt has been taken but the debt has not been paid and it appears that: - The debtor is dead, has become a disappeared person or there is evidence of the debtor’s disappearance and there is no property to repay the debt; or - The debtor dissolved business and is indebted to other creditors who have preferential rights over the property of the debtor in an amount exceeding the value of the property of the debtor. 2) There has been a civil case filed by the creditor and endorsed by the court, or there has been an application for participation in debt servicing that has been filed and endorsed by the court, and in that case, there has been an order or an order of the court, but the debtor has no property to pay the debt; or 3) There has been a bankruptcy action taken against the debtor and endorsed by the court, or an application for participation in debt servicing has been filed in case where the debtor is being sued by other creditors for a bankruptcy action, and in such case a composition has been made with the debtor with the approval of the court or the debtor has been adjudicated as bankrupt and there has already been the first distribution of the debtor’s property. |

Clause 5 |

Not exceeding THB 500,000 |

Not exceeding THB 2,000,000 |

1) There is evidence that reasonable action for the recovery of debt has been taken but the debt has not been paid and it appears that: - The debtor is dead, has become a disappeared person or there is evidence of the debtor’s disappearance and there is no property to repay the debt; or - The debtor dissolved business and is indebted to other creditors who have preferential rights over the property of the debtor in an amount exceeding the value of the property of the debtor. 2) Action has been taken against the debtor in a civil case and endorsed by the court, or an application for participation in debt servicing has been filed in cases where the debtor has been sued by other creditors for civil action, and such an application has already been endorsed by the court; or 3) There has been a bankruptcy action taken against the debtor and endorsed by the court,or an application for participation in debt servicing has been filed in case where the debtor is being sued by other creditors for a bankruptcy action and the application has been endorsed by the court.

For cases falling under 2) or 3), a director or the managing partner of the company or juristic partnership being the creditor should approve the writing off of debts within 30 days from the last day of the accounting period.

|

Clause 6 |

Not exceeding THB 100,000 |

Not exceeding THB 200,000 |

A reasonable action for the recovery of debt has been taken but the debt has not been paid and the expenses in taking out a lawsuit against the debtor would not be commensurate with the debt to be paid. |

Further details and new regulations relevant to these issues are expected to be announced soon.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia