Royal Decree No. 709, which came into effect from 13 July 2020, has been issued to provide tax benefits for debt restructuring.

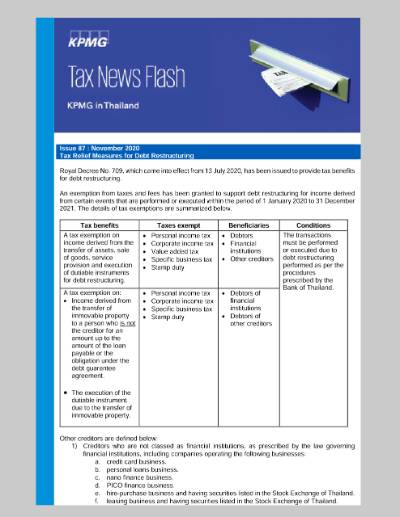

An exemption from taxes and fees has been granted to support debt restructuring for income derived from certain events that are performed or executed within the period of 1 January 2020 to 31 December 2021. The details of tax exemptions are summarized below.

Tax benefits |

Taxes exempt |

Beneficiaries |

Conditions |

A tax exemption on income derived from the transfer of assets, sale of goods, service provision and execution of dutiable instruments for debt restructuring. |

|

|

The transactions must be performed or executed due to debt restructuring performed as per the procedures prescribed by the Bank of Thailand. |

A tax exemption on:

|

|

|

Other creditors are defined below:

- Creditors who are not classed as financial institutions, as prescribed by the law governing financial institutions, including companies operating the following businesses:

a. credit card business.

b. personal loans business.

c. nano finance business.

d. PICO finance business.

e. hire-purchase business and having securities listed in the Stock Exchange of Thailand.

f. leasing business and having securities listed in the Stock Exchange of Thailand. - Creditors other than 1) who coordinate with a financial institution in debt restructuring and agree in writing with creditors who are financial institutions.

In addition, Royal Decree No. 709 and the pre-existing Royal Decree No. 623 together also provide tax benefits on debt forgiven in accordance with the criteria for debt restructuring as prescribed by the Bank of Thailand. The tax benefits are summarized as follows:

Tax benefits |

Taxes exempt |

Beneficiaries |

Conditions |

A tax exemption on income derived from debt forgiven by financial institutions (Royal Decree No. 623). |

Personal income tax or corporate income tax. |

Debtors of financial institutions. |

Debt restructuring must be performed as per the procedures prescribed by the Bank of Thailand. |

A tax exemption on income derived from debt forgiven by other creditors (Royal Decree No. 709). |

Personal income tax or corporate income tax. |

Debtors of other creditors. |

|

Following the issuance of Royal Decree No. 709, the Ministry of Finance issued Ministerial Regulation No. 367 on 20 August 2020 allowing other creditors to waive the procedures prescribed in Clauses 4, 5 and 6 of Ministerial Regulation No. 186 (“General Procedures”) in order to write off debts forgiven within the period from 1 January 2020 to 31 December 2021 as a result of the debt restructuring, as mentioned above.

General Procedures for bad debt write-off (under Ministerial Regulation No. 186) which can be exempted according to Ministerial Regulation No. 367 are as follows:

Threshold of debt |

Required conditions |

Not exceeding THB 100,000 |

A reasonable action for the recovery of debt has been taken but the debt has not been paid and the expenses in taking a lawsuit against the debtor would not be commensurate with the debt to be paid. |

Not exceeding THB 500,000 |

|

More than THB 500,000 |

|

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia