Although the Thai economy is in recession, the recovery from the impact of COVID-19 is currently better than many originally feared. Helped by government support measures and Thailand’s resilience in keeping the virus under control, The Bank of Thailand (BOT) has improved its projected 2020 GDP outlook to a contraction of 7.8% from 8.1% previously. However, impacts and recovery continue to vary across sectors, with tourism and exports expected to have a longer and slower recovery due to mobility restrictions and the weakened purchasing power of overseas businesses.

Since the end of the debt moratorium in October, the government and financial institutions continue to support businesses through the DR BIZ program and other debt relief measures, with repayment holidays and interest relief measures provided on a case-by-case basis. Many large corporates have raised additional liquidity in the capital markets, whilst SMEs have benefited from soft loans, as indicated by the increase in loans of less than THB 500 million.

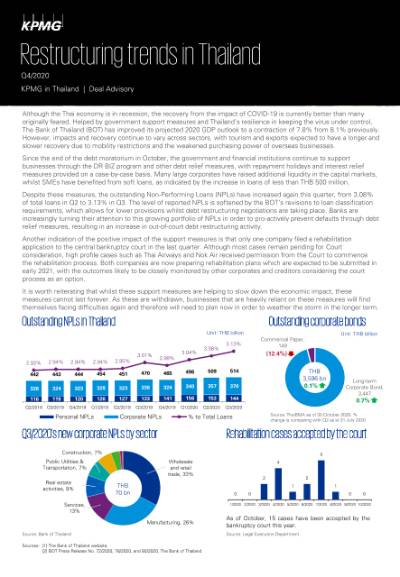

Despite these measures, the outstanding Non-Performing Loans (NPLs) have increased again this quarter, from 3.08% of total loans in Q2 to 3.13% in Q3. The level of reported NPLs is softened by the BOT’s revisions to loan classification requirements, which allows for lower provisions whilst debt restructuring negotiations are taking place. Banks are increasingly turning their attention to this growing portfolio of NPLs in order to pro-actively prevent defaults through debt relief measures, resulting in an increase in out-of-court debt restructuring activity.

Another indication of the positive impact of the support measures is that only one company filed a rehabilitation application to the central bankruptcy court in the last quarter. Although most cases remain pending for Court consideration, high profile cases such as Thai Airways and Nok Air received permission from the Court to commence the rehabilitation process. Both companies are now preparing rehabilitation plans which are expected to be submitted in early 2021, with the outcomes likely to be closely monitored by other corporates and creditors considering the court process as an option.

It is worth reiterating that whilst these support measures are helping to slow down the economic impact, these measures cannot last forever. As these are withdrawn, businesses that are heavily reliant on these measures will find themselves facing difficulties again and therefore will need to plan now in order to weather the storm in the longer term.

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represent the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumer. The percentage to total loans represent the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q3/2020 increase in corporate NPLs by sector’ represents the new and re-entered NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has accepted for consideration. The court may reject the application for rehabilitation.

KPMG Deal Advisory

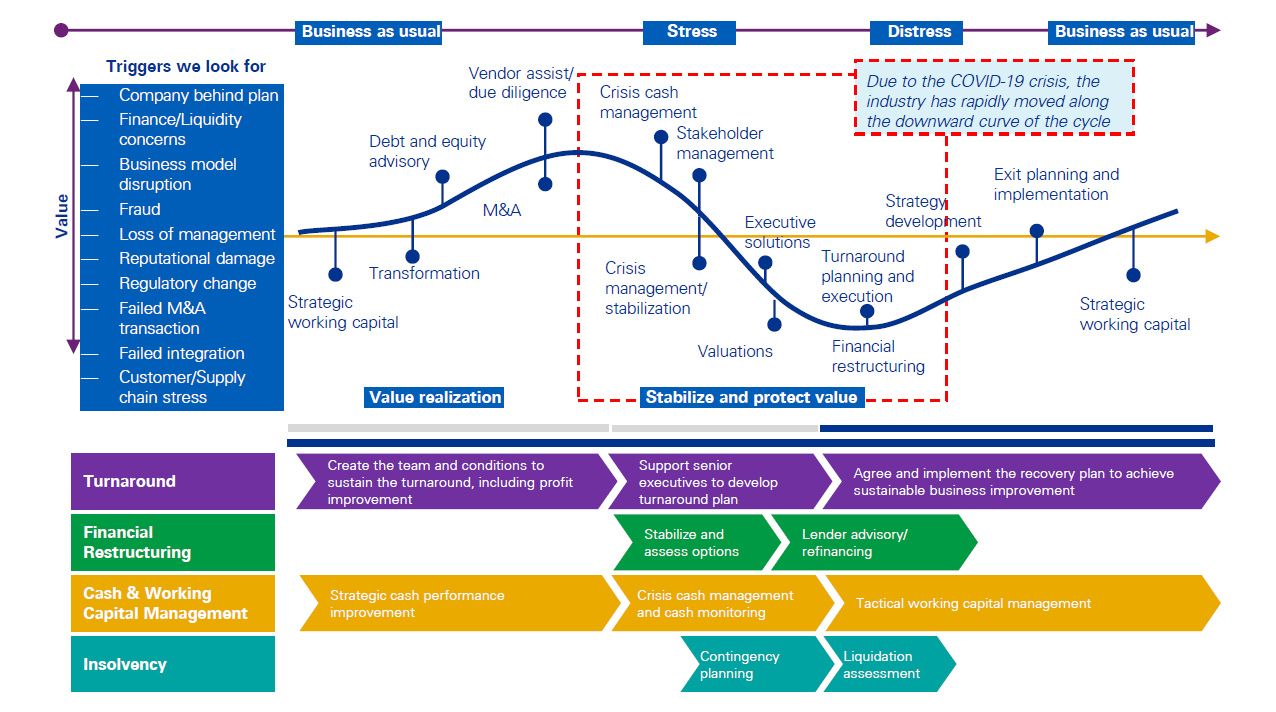

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach bring valuable insights and guidance to help you to stabilize, protect value, and then ready the business to emerge.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia