Following the outbreak of COVID-19, many businesses have been burning through cash reserves during the lockdown period, and while some have taken advantage of government relief measures, it must be remembered that at some point loans will still need to be repaid – a burden which comes on top of having to finance any ramp-up in production, repay tax deferrals and re-engage staff who have been furloughed or under reduced hours.

One of the key measures implemented by the Thai government is the debt moratorium program, which provided a principal and interest repayment holiday of six months for all SMEs with a credit line not exceeding 100 million baht. Although there are some calls for the moratorium to be extended in some form, it is currently due to end in October 2020. Whilst some financial institutions have extended the moratorium to the end of the year for borrowers who meet certain criteria, companies will have to resume payment on both principal and interest sooner rather than later. According to the BOT there are 1.2 million corporate accounts with outstanding loans totaling 3.36 trillion which have entered the debt restructuring program. The end of the repayment holiday will put pressure on many companies which have not fully recovered, or will never return to generating pre-COVID operating cash flows.

As a result, it is likely that the end of the debt moratorium will give rise to a wave of debt restructuring, as companies seek to amend repayment terms to align with forecast operating cash flows. To support this, the Bank of Thailand and Thai Bankers’ Association launched the second phase of measures, called the “DR BIZ Program”, with the aim of ensuring financial institutions are aligned on the level of action they will take, and assigns one financial institution to lead negotiations with the debtor. The lead institution is then encouraged to agree a suitable restructuring of the debt, using measures such as repayment period extension or reduced installments.

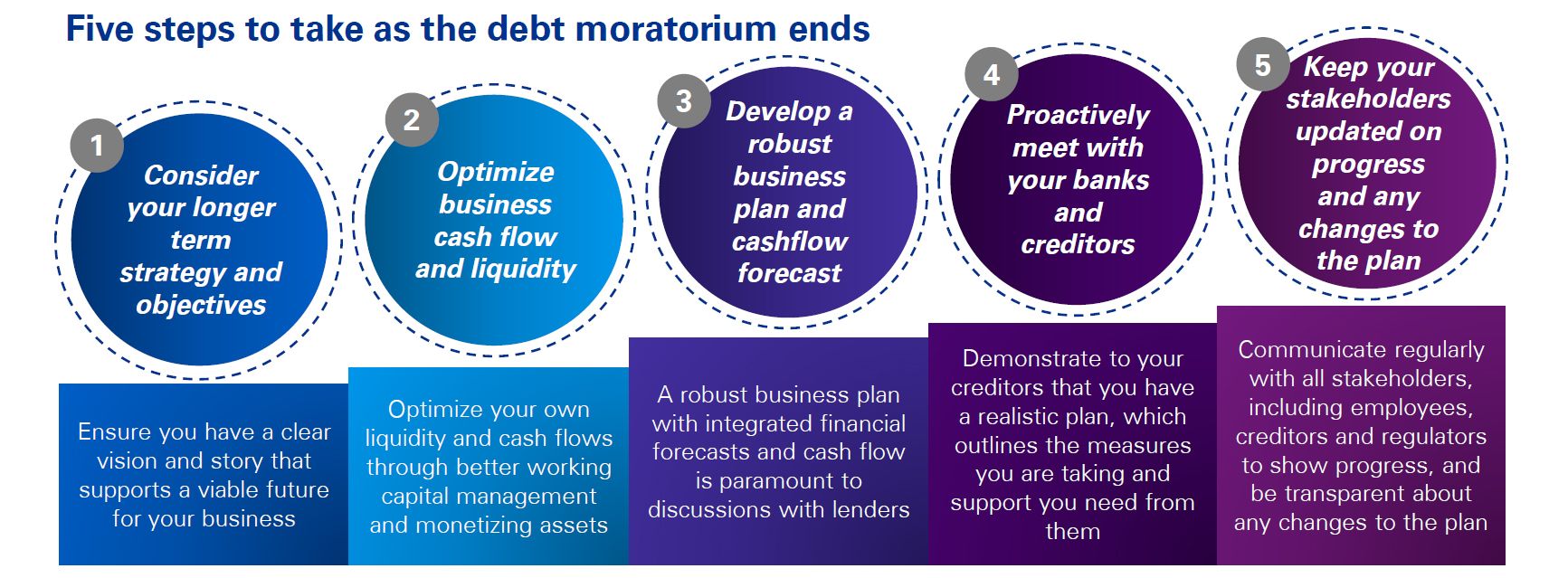

We outline below five key steps to consider if you are entering discussions with your lenders to restructure your debt:

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia