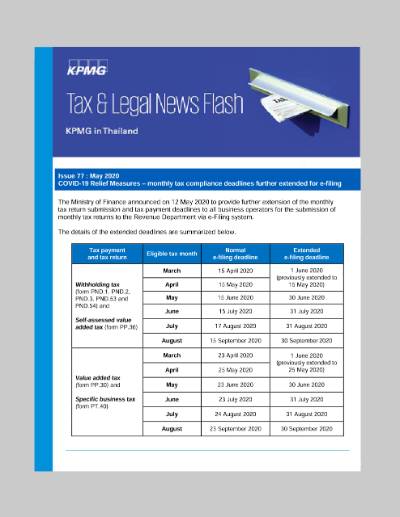

The Ministry of Finance announced on 12 May 2020 to provide further extension of the monthly tax return submission and tax payment deadlines to all business operators for the submission of monthly tax returns to the Revenue Department via e-Filing system.

The details of the extended deadlines are summarized below.

| Tax payment and tax return | Eligible tax month | Normal e-filing deadline | Extended e-filing deadline |

| Withholding tax (form PND.1, PND.2, PND.3, PND.53 and PND.54) and Self-assessed value added tax (form PP.36) | March | 15 April 2020 | 1 June 2020 (previously extended to 15 May 2020) |

| April | 15 May 2020 | ||

| May | 15 June 2020 | 30 June 2020 | |

| June | 15 July 2020 | 31 July 2020 | |

| July | 17 August 2020 | 31 August 2020 | |

| August | 15 September 2020 | 30 September 2020 | |

| Value added tax (form PP.30) and Specific business tax (form PT.40) | March | 23 April 2020 | 1 June 2020 (previously extended to 25 May 2020) |

| April | 25 May 2020 | ||

| May | 23 June 2020 | 30 June 2020 | |

| May | 23 July 2020 | 31 July 2020 | |

| July | 24 August 2020 | 31 August 2020 | |

| August | 23 September 2020 | 30 September 2020 |

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia