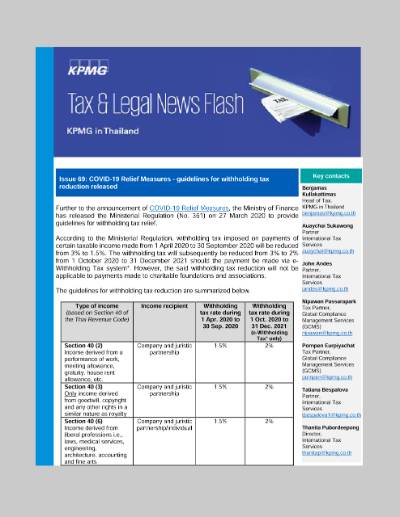

COVID-19 Relief Measures - guidelines for withholding tax reduction released

Tax & Legal News Flash Issue 69

Further to the announcement of COVID-19 Relief Measures, the Ministry of Finance has released the Ministerial Regulation (No. 361) on 27 March 2020 to provide guidelines for withholding tax relief.

According to the Ministerial Regulation, withholding tax imposed on payments of certain taxable income made from 1 April 2020 to 30 September 2020 will be reduced from 3% to 1.5%. The withholding tax will subsequently be reduced from 3% to 2% from 1 October 2020 to 31 December 2021 should the payment be made via e-Withholding Tax system*. However, the said withholding tax reduction will not be applicable to payments made to charitable foundations and associations.

The guidelines for withholding tax reduction are summarized below.

| Type of income (based on Section 40 of the Thai Revenue Code) |

Income recipient | Withholding tax rate during 1 Apr. 2020 to 30 Sep. 2020 | Withholding tax rate during 1 Oct. 2020 to 31 Dec. 2021 (e-Withholding Tax* only) |

Section 40 (2) Income derived from a performance of work, meeting allowance, gratuity, house rent allowance, etc. |

Company and juristic partnership |

1.5% | 2% |

Section 40 (3) Only income derived from goodwill, copyright and any other rights in a similar nature as royalty |

Company and juristic partnership |

1.5% | 2% |

Section 40 (6) Income derived from liberal professions i.e., laws, medical services, engineering, architecture, accounting and fine arts |

Company and juristic partnership/individual |

1.5% | 2% |

Section 40 (7) Income derived from a contract of work where the contractor has to provide essential materials besides tools e.g. turn-key contract |

Company and juristic partnership/individual |

1.5% | 2% |

Section 40(8) Only income derived from a hire of work, prizes, discount or any benefits in connection with the sale promotion, and certain other services, excluding service fees paid to hotels, restaurants and life insurance premium |

Company and juristic partnership/individual |

1.5% | 2% |

Note:

*E-Withholding tax system is the system used by the bank or other person who acts as a paying agent. Such agent will deduct withholding tax when making payment on behalf of the taxpayer and remit the tax withheld to the Revenue Department via the electronic channel. However, the law regarding e-withholding tax system is not yet officially released.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia