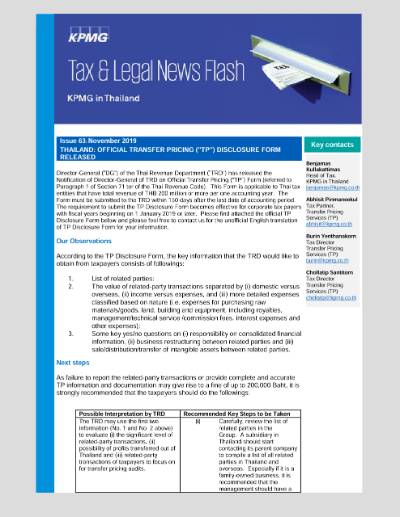

Thailand: Official Transfer Pricing ("TP") Disclosure form released

Tax & Legal News Flash Issue 63

Director-General (“DG”) of the Thai Revenue Department (“TRD”) has released the Notification of Director-General of TRD on Official Transfer Pricing (“TP”) Form (referred to Paragraph 1 of Section 71 ter of the Thai Revenue Code). This Form is applicable to Thai tax entities that have total revenue of THB 200 million or more per one accounting year. The Form must be submitted to the TRD within 150 days after the last date of accounting period. The requirement to submit the TP Disclosure Form becomes effective for corporate tax payers with fiscal years beginning on 1 January 2019 or later. Please click the link to go to the official TP Disclosure Form and please feel free to contact us for the unofficial English translation of TP Disclosure Form for your information.

Our Observations

According to the TP Disclosure Form, the key information that the TRD would like to obtain from taxpayers consists of followings:

- List of related parties;

- The value of related-party transactions separated by (i) domestic versus overseas, (ii) income versus expenses, and (iii) more detailed expenses classified based on nature (i.e. expenses for purchasing raw materials/goods, land, building and equipment, including royalties, management/technical service /commission fees, interest expenses and other expenses);

- Some key yes/no questions on (i) responsibility on consolidated financial information, (ii) business restructuring between related parties and (iii) sale/distribution/transfer of intangible assets between related parties.

Next steps

As failure to report the related-party transactions or provide complete and accurate TP information and documentation may give rise to a fine of up to 200,000 Baht, it is strongly recommended that the taxpayers should do the followings:

| Possible Interpretation by TRD | Recommended Key Steps to be Taken |

| The TRD may use the first two information (No. 1 and No. 2 above) to evaluate (i) the significant level of related-party transactions, (ii) possibility of profits transferred out of Thailand and (iii) related-party transactions of taxpayers to focus on for transfer pricing audits. | (i) Carefully, review the list of related parties in the Group. A subsidiary in Thailand should start contacting its parent company to compile a list of all related parties in Thailand and overseas. Especially if it is a family-owned business, it is recommended that the management should have a discussion with shareholders to obtain a full picture of all entities whose shares are held by them and then evaluate whether it meets the criteria of related parties as per Section 71 bis (2) of the Thai Revenue Code and should also check the other criteria of related parties under Section 71 bis of the Thai Revenue Code. (ii) Review all related-party transactions to be filled out in Page 2. It is strongly recommended that the taxpayers should carefully review whether the TP policy of each transaction is consistent with arm’s-length principle and the taxpayers have necessary intercompany agreements with supporting documents and local files to support those. |

For third information (No. 3 above), it will lead to more specific aspects of TP matters. If taxpayers who have responsibility to prepare consolidated financial information and if they meet threshold to be set, such taxpayers will need to prepare Master File as per BEPS Action 13. For any business restructuring and intangible property transfer, it may lead to special TP and tax review/investigation by the TRD. |

(i) For a taxpayer with a duty to prepare consolidated financial information, it is recommended that Master File should be discussed and/or prepared where necessary. (ii) It is recommended that the taxpayers should carefully review whether the business restructuring as well as sale/distribution/transfer of intangible properties have been made (i) with justifiable business and economic reasons, (ii) in accordance with arm’s-length principle and (iii) with supporting documents. |

How KPMG can help

Our TP team is prepared to provide TP risk review on your TP Disclosure Form as well as to assist you in preparing Local File with a gap analysis and recommendation to support your TP risk management in advance.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia