With the global roll out of COVID-19 vaccines, hope is on the horizon for nations and economies across the world. However, the route to recovery will be uneven and uncertain across sectors and geographies. We must move fast and Re-imagine what our businesses and enterprises will need so that they can fully seize the opportunities that lie ahead.

Business Support Measures

Creating platforms for nurturing creative ideas

To support businesses to innovate, the Government will invest in three key platforms:

1. New Corporate Venture Launchpad

- Provides co-funding for corporates to build new ventures through pre-qualified venture studios

2. Enhanced Open Innovation Platform

- Facilitates the matching of companies and public agencies with solution providers according to challenges faced, as well as co-funding prototyping and deployment

- Accelerates digital innovation through the inclusion of two new technology offerings:

- Discovery Engine that facilitates the search and matching of technology solutions to challenges

- Digital Bench that aids quicker Proof-of-Concept testing

3. Enhanced Global Innovation Alliance

- Expands cross-border collaboration between Singapore and other major innovation hubs globally, from 15 to more than 25 cities

- Includes the Co-Innovation Programme which supports up to 70% qualifying project costs

Our view

Innovate and collaborate to open up possibilities

The Corporate Venture Launchpad will be useful for larger businesses looking inward to generate innovative and creative ideas within their organisations.

The use of the new Discovery Engine and the Digital Bench under the Open Innovation Platform will enable better matching, which will in turn allow businesses to fasten development of prototypes and shorten time to market.

With the expansion of the coverage of the Global Innovation Alliance to more than 25 cities, businesses will be able to expand their outreach into more markets through partnerships in global hubs, tapping into expertise and insights of different markets.

The 3 key platforms will allow businesses to collaborate on a global scale and tap into a larger pool of resources and networks, to innovate, remain competitive and support vital areas of growth. Businesses should capitalise on these opportunities to embark on their next phase of innovation and growth.

Enhanced venture debt for high growth enterprises, including startups

The Venture Debt Programme under ESG’s Enterprise Financing Scheme (EFS) has been enhanced.

The Venture Debt Programme was introduced to:

- Help finance the growth of innovative enterprises using venture debt

- Provide up to 70% risk sharing by the Government on eligible loans with participating financial institutions; and

- Had raised annualised growth rate of 44% in the amount of early-stage funds for promising enterprises from 2016 to 2019

Our view

It’s time to innovate and scale up

The Venture Debt Programme, with the Government taking on a significant risk share of up to 70%, will provide funding for local companies to innovate, transform and fund new business initiatives, through venture debt.

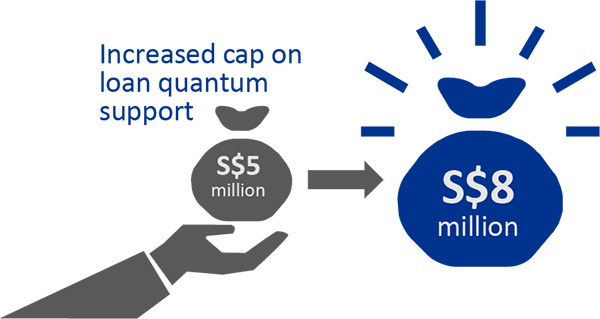

Increase in cap on loan quantum

With the increase in the cap on loan quantum support from S$5 million to S$8 million, companies will be able to access additional financial capital for business expansion without any additional requirements.

Take advantage to scale up

Companies which are high growth startups can now consider additional avenues of growth and should definitely take advantage of this Programme to scale up their businesses.

Supporting the transformation of mature enterprises

Emerging Technology Programme

- New programme to support commercialisation of innovations and diffusion of technology

- Co-fund the costs of trials and adoption of frontier technologies like 5G, artificial intelligence, and trust technologies

Chief-Technology-Officer-as-a-Service (CTOaaS)

- New programme to assist SMEs to uncover their digitalisation needs to transform their business

- Provide SMEs with access to professional IT consultancies

Digital Leaders Programme

- New programme to enable high potential local companies to become digital leaders through:

- Building technology leadership and expertise in the firm, including hiring of digital talent

- Supporting the development and implementation of Digital Transformation Roadmaps

Extending enhanced existing schemes

- Enhanced support levels of up to 80% for enterprise schemes, such as Scale-up SG, Productivity Solutions Grant, Market Readiness Assistance, and Enterprise Development Grant will be extended from end September 2021, to end March 2022

Our view

Surging ahead with transformation

Mature enterprises, which are essentially non-start-ups - from SMEs to Large Local Enterprises (LLEs) - recognise that digital transformation is critical to ensure that they not only survive but emerge stronger from the crisis caused by COVID-19.

However, the most significant challenges they face are finding the guidance, capabilities and funding they need to successfully complete their transformation journeys.

This comprehensive approach plays a critical role not only in giving these enterprises the knowledge and expertise they need, but also providing funding support as they expand their business into new areas, and grow regionally and globally.

In particular, CTOaaS is a superb initiative that pools together experienced technology leaders to plug the knowledge gap for many SMEs as they chart their digital transformation roadmap and drive change.

With not one, but three new programmes to leverage, SMEs and LLEs have all the tools they need engage and compete internationally, which also results in elevating Singapore’s profile in the global value chain.

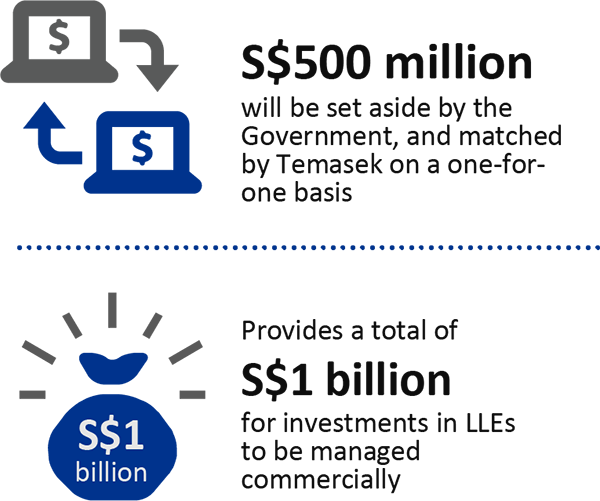

Providing growth capital for LLEs

- The Local Enterprises Funding Platform, co-invested by the Government and Temasek, provides LLEs with access to growth capital, so that they can transform and expand overseas

- The platform will invest in non-control equity and mezzanine debt of selected LLEs that are willing to work with fund managers to pursue further growth opportunities

Our view

Much-anticipated support for LLEs

LLEs have faced significant challenges in obtaining private funding as investors are more cautious and selective in investments in today’s uncertain and volatile climate. This is in addition to financial institutions being more risk-averse in providing credit to investors.

This funding platform is timely to help LLEs obtain financing, especially those that are hard-hit by the pandemic and yet in need of funding support to transform their business models, such as those in the aviation and aerospace sectors. LLEs supported under this platform will be able to have a head start and gain competitive advantage when the economy recovers.

The platform could perhaps be tweaked to require selected LLEs to bring along SMEs in complementary sectors in their expansion plans and thus help in the development of the entire ecosystem.