Facing and overcoming the challenges of COVID-19 has brought Singapore closer together as a nation and strengthened our determination and resolve. It has also presented us with an opportunity to Re-create our economy, our businesses, our people and our national vision to become a Global-Asia node for sustainability and green industries.

Sustainability Measures

Agri-Food Cluster Transformation Fund

The disruption to food supplies caused by COVID-19 has urged many countries including Singapore to take prompt action to secure present and future food supplies.

The new S$60 million Agri-Food Cluster Transformation Fund will contribute to achieving Singapore’s ambitious 30-by-30 food security plan by promoting and harnessing technology in local food production.

The new fund will replace the existing Agriculture Productivity Fund set up in 2014 to help farmers boost yields and increase production capabilities.

Our view

Food for thought about boosting urban farming

Food is the interface between people and nature. Climate change and the pandemic are certainly reminding us about the severe impacts we face and dependencies we have when this interface is disrupted.

The fund will not only invest in technologies and solutions addressing the food security aspect but also the nutrition aspect in terms of sustainable food for healthy living.

Whereas aquaculture is an area Singapore has already developed proven technologies and improved its resilience, farming represents an interesting business challenge. It is an opportunity to secure Singapore’s nutritional needs which takes into account the country’s limitation by promoting urban farming and stimulating more people to move into farming.

It would have been helpful if the Government had enhanced the Land Intensification Allowance to allow the cost of buildings incurred for urban farming to qualify for tax allowances, which would significantly lower the startup costs of urban farmers.

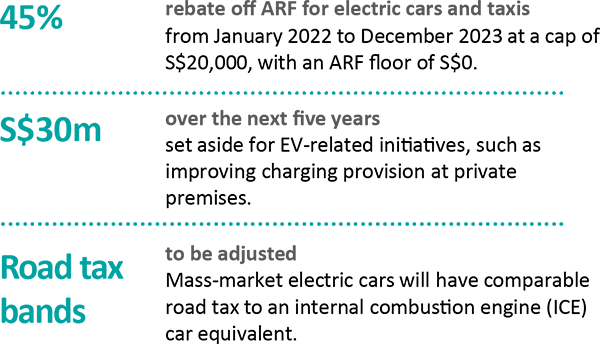

Encouraging the switch to cleaner-energy electric vehicles (EVs)

In tandem, the following measures were introduced to discourage the use of ICE vehicles:

- Raise petrol duty rates: 15 cents per litre for premium petrol,

10 cents per litre for intermediate petrol - Transitional offset measures for vehicles using petrol

- A one-year tax rebate of 60% for all motorcycles using petrol

- S$50 – S$80 in cash for individual owners of smaller motorcycles up to 400cc

- Petrol Duty Rebate of S$360 for active taxi and Private Hire Car drivers using petrol and petrol-hybrid vehicles, given out over four months. This is in addition to a one-year road tax rebate of 15% to all taxis and passenger cars using petrol.

- A one-year tax rebate of 100% for goods vehicles and buses using petrol

- A one-year road tax rebate of 15% for cars using petrol

Our view

Driving towards mass transition to EVs

These concrete steps form part of a well thought-out green roadmap to enable the achievement of large-scale emissions reduction in road transport vehicles.

The Budget makes the categorical choice in promoting EVs as the environmentally friendly option for Singapore drivers to switch to, while continuing to pursue a car-lite vision. The ambitious goal of 60,000 chargers by 2030 can only be achieved if the right investments are made in building up charging and supporting infrastructure. This will require careful monitoring and possibly further Government support and investment if the necessary private capital is not forthcoming.

The phased approach within a clearly defined Singapore 2030 Green Plan ensures we keep on track to achieve desired outcomes, while allowing time for infrastructure development and the mass transition to EVs. More importantly, it fosters a more environmentally conscious culture that is fundamental to sustainable development.

Issuing bonds for infrastructure projects

Under the proposed “Significant Infrastructure Government Loan Act” (SINGA), the Government intends to raise up to S$90 billion via issuance of new bonds.

The proceeds will be used to finance long-term infrastructure (including new MRT lines and coastal protection project), which will benefit current and future generations. The amount of borrowing is based on the expected pipeline of major, long-term infrastructure projects over the next 15 years.

The current low interest rate environment will facilitate the efficient issuance of these new bonds.

Necessary safeguards will be put in place in the legislation, which will be open to Parliamentary and public scrutiny.

More details will be provided when the Bill is presented in Parliament later this year.

The Government will take the lead by issuing green bonds on select public infrastructure projects.

The issuance of green bonds by the Government will build on these efforts by deepening market liquidity for green bonds, attracting green issuers, capital, and investors, and anchoring Singapore as a green finance hub.

The Government has identified up to S$19 billion of public sector green projects as a start, including Tuas Nexus.

Our view

Strengthening Singapore’s position as a regional debt market hub

The proposal to issue bonds should strengthen Singapore’s position as a regional debt market hub and enhance the vibrancy of our capital markets. The issuances will provide yield curves for different tenure and projects thereby attracting more players to tap on this source of capital.

br> The bond markets offer an alternate source of long-term financing at attractive terms. By spreading the infrastructure costs over the economic life of the project, the Government is being prudent in balancing short-term needs while ensuring long-term financial sustainability.

Given the regional infrastructure investment needs and the need to recycle bank debt from existing projects, a vibrant capital market in Singapore will provide a cost-effective option for regional projects debt issuances as well.

The income tax impact on these bonds would depend on the tax profile of the bondholders. However, to promote Singapore as a regional debt market hub and to make these bonds attractive to the bondholders, Singapore should consider giving tax incentives such as granting tax exemption to the bondholders on the related interest income and enhanced tax deduction for the issuers.