With ongoing conflicts and tensions around the world, the application and accurate implementation of sanctions have become increasingly relevant. In the spring of 2023, twenty financial institutions participated in KPMG Forensics’ survey about sanctions compliance. Topics in the survey stretched from governance and culture to current developments, filtering solutions and alert handling. The majority of responses came from banks. Additionally, insurance companies, trust offices and payment service providers participated in the survey. Almost all responses came from the second line of defence.

This blog is the second part of a trilogy and highlights the results of the survey that are related to (recent) developments.

Impact of Russia-related sanctions on financial institutions is high

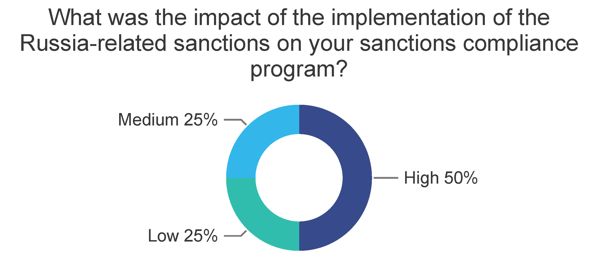

Since the start of the war in Ukraine, the European Union has adopted several sanctions packages targeting Russia, imposing financial restrictions on a long list of individuals and organizations. The implementation of Russia-related sanctions has had a varying impact on the sanctions compliance programs of the surveyed entities. According to the results as shown in Figure 1, half of the entities report a high impact, while a quarter indicate a medium impact, and the remaining quarter note a low impact. The impact of Russia-related sanctions on entities may depend on various factors, including the nature of their business, the size of their operations, and the countries in which they operate. Furthermore, the impact of these sanctions may not be limited to compliance issues, as they may also affect entities' financial performance, reputation, and business relationships. Therefore, entities need to carefully monitor and assess the impact of Russia-related sanctions on their operations and take appropriate actions to mitigate any associated risks.

Figure 1: responses of survey participants to the question What was the impact of the implementation of the Russia-related sanctions on your sanctions compliance program?

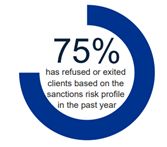

Three out of four surveyed entities indicate that they have refused or exited relationships with clients based on their sanctions risk profile in the past year.

Regulatory developments are the main driver of change in organizations

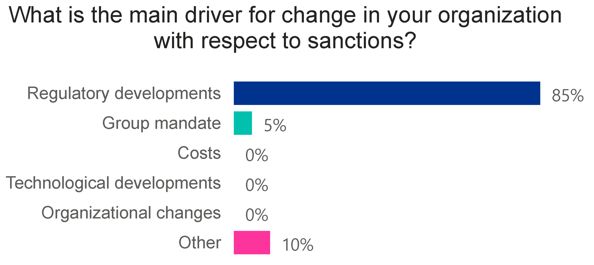

Regulatory bodies continuously update and refine sanctions as well as sanctions compliance requirements to address emerging risks. In line with these ongoing updates, regulatory developments are cited as the primary driver of change by 17 out of 20 financial institutions. Interestingly, as depicted in Figure 2, none of the surveyed entities cite technical developments as the main driver of change.

Figure 2: responses of survey participants to the question What is the main driver of change in your organization with respect to sanctions?

Artificial intelligence rarely leveraged in sanctions compliance

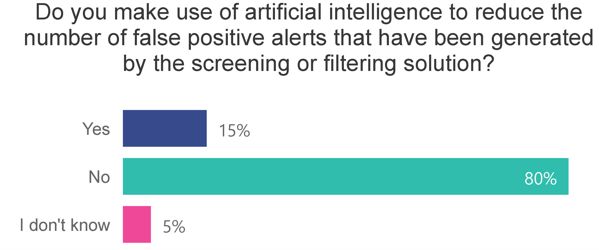

This result may also explain why only three of the twenty surveyed institutions currently make use of artificial intelligence (AI) in their customer screening and transaction filtering solutions. The same number of participants reduces the number of false positive alerts that have been generated by the screening or filtering solutions, as illustrated in Figure 3.

Figure 3: responses of survey participants to the question Does your filtering or screening solution make use of artificial intelligence to reduce the number of false positive alerts?.

Current sanctions screening systems generate a vast number of alerts, with over 95% of these alerts classified as ‘False Positive’1 . AI can help to reduce the number of false positive alerts. By applying advanced pattern recognition techniques, machine learning models or data analytics, organizations can better differentiate between genuine alerts and false positives, leading to more accurate and reliable results.

How KPMG can help

KPMG supports clients to (pro)actively design, implement and monitor sanction measures. Our team combines technical expertise with experience with financial institutions and compliance. KPMG has designed a global methodology used within the field of sanction model validations in accordance with the legal requirements, legal expectations of regulators and our experience within the sector. We can support institutions with our knowledge and expertise.

This blog is the second part of a sanctions blog trilogy. In the other blogs, the themes of Governance and the Complexity of Sanctions Compliance and Sanctions Screening and Filtering Solutions are further explored.

We will keep you informed by email.

Enter your preferences here.