Given the current rate of Real Estate-induced emissions in the European Union, it is projected that the industry will fully exhaust its carbon budget for 2050 by the year 2036.

The time to act is now

The time to act is now

In 2022, approximately 36% of greenhouse gas emissions in the European Union were directly or indirectly associated with the Real Estate sector. Organizations within this industry need to re-evaluate their strategies to align with industry-wide CO2 caps and the Netherlands’ goal of achieving a NetZero built environment by 2050. Societal demand for action is growing, with changes being driven by investor sentiment and regulatory pressure at national and EU levels.

The importance of sustainability regulation to your strategy and sustainability efforts

Regulatory pressure has been increasing in recent years, placing an additional burden on the reporting team of your real estate business. Yet, being able to transparently report on your sustainability efforts will help your business and the industry as a whole to better achieve the sustainability goals to which we are committed. The regulations imposed by ‘Europe’ should therefore be considered a strategic opportunity to show the world your efforts on Environmental, Social and Governance topics. The ability to transform sustainability reporting requirements into an opportunity to align business strategy, sustainability efforts, and reporting as a means of communication is an essential step for board-level executives.

Surprising initial insights into regulatory impact based on the SFDR

Recent regulatory pressure at EU level has resulted in the introduction of the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR), both of which are relevant to the Real Estate industry. The EU Taxonomy is a framework for classifying ‘green’ or ‘sustainable’ economic activities carried out in the EU, while the SFDR is a European regulation introduced to improve transparency in the market for sustainable investment products, to prevent greenwashing and to increase the transparency of sustainability claims made by financial market participants. The reporting standards of the SFDR are already proving effective in advancing transparency for sustainable investments, including real estate investment activities. Since the introduction of the SFDR Level II Technical Regulatory Standards (RTS) on 1 January 2023, Morningstar (January 2023) reported that only few fund managers (including non-real estate funds) have classified their funds as ‘dark green’ investment funds (so-called ‘Article 9 funds’), clearly demonstrating that there is both great room for improvement in sustainability efforts and a business opportunity to be ahead of the curve as a dark green company.

CSRD as successor to NFRD

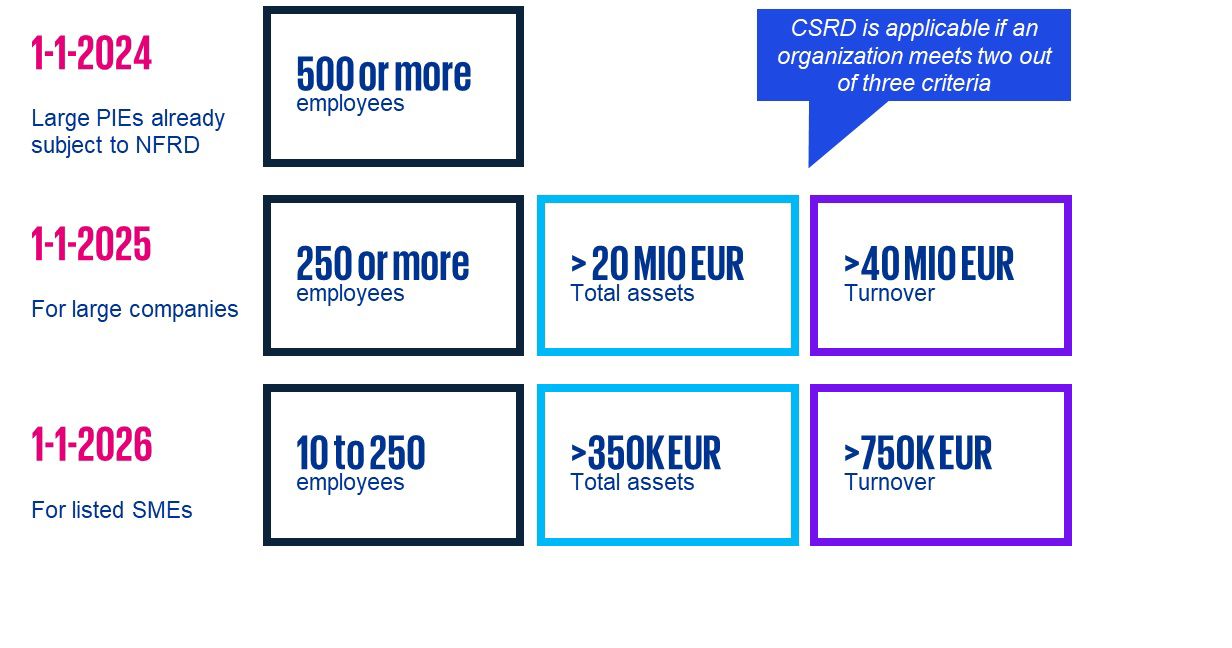

Starting in 2024, the Corporate Sustainability Reporting Directive (CSRD) will expand the scope of companies that are required to report on a wide range of Environmental, Social and Governance (ESG) topics. The CSRD is the successor to the NFRD, which already applies to public interest entities (such as large listed companies, banks and insurance companies).

Figure 1: The widening of the scope of the CSRD will impact a broad scope of real estate companies

Timeframe of the CSRD and implications for real estate businesses

The effective date for your real estate company to comply with the CSRD may vary (see figure above). In short, we expect many real estate companies to be part of the second wave as they are most likely to meet two of the three CSRD criteria: >EUR 20M in total assets, >EUR 40M in turnover, >250 employees. The second wave corresponds to an effective date of 1 January 2025, which means that companies must report on the financial year starting 1 January 2025.

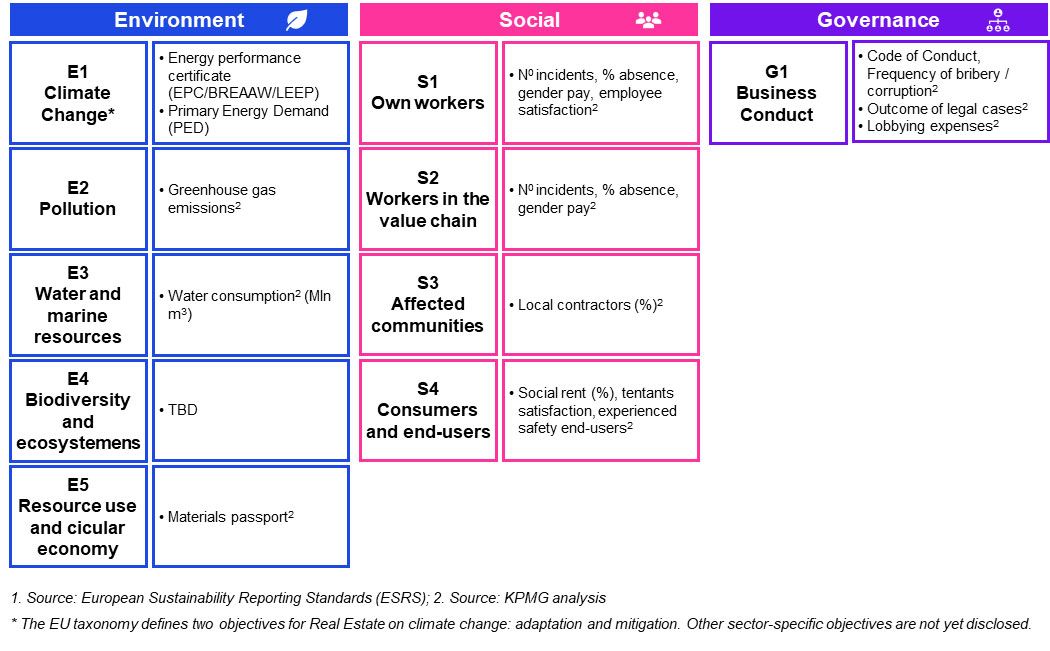

The main implication of this directive is that the industry must be fully compliant within two years. This means that companies should carry out a double materiality assessment and determine which CSRD topics are material to their activities. Then, for each of the European Sustainability Reporting Standards (ESRS), companies need to know if they are able to report. There are two cross-cutting standards, five Environmental standards, four Social standards and one Governance standard. Sector-specific standards are also to be expected.

Reporting according to these standards may involve (re)structuring internal processes and procedures, reassessing operational and technological infrastructure, and clarifying measures and means of reporting.

Figure 2: According to the ESRS, real estate organizations should report on several sector-specific and sector-agnostic KPIs

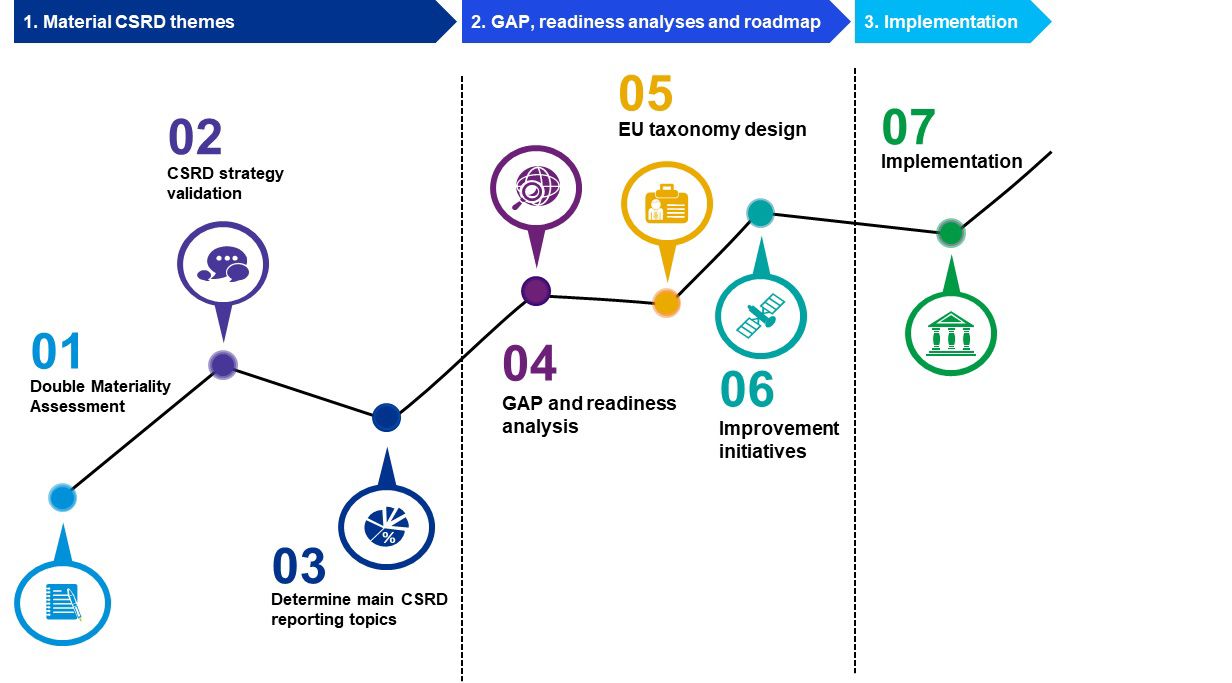

How to proceed?

Initiating a double materiality assessment to define material topics is a first and accessible step towards CSRD compliance.

CSRD reporting standards can then be established for each material topic.

Based on this, a gap analysis should be conducted to identify areas where your organization is not mature enough and needs to take action.

An action roadmap helps prioritize the work to be performed over the coming 1.5 years to 2025.

Figure 3: KPMG can assist in several domains, ranging from strategy and reporting to implementation

KPMG has the expertise to provide an integrated approach to help organizations prepare for CSRD sustainability reporting. Our real estate professionals, Sander Grunewald, Michiel Beijersbergen and Paul Oligschlager, together with our dedicated team on Sustainability (CSRD) Reporting, Thomas Ursem and Vera Moll, are ready to help you navigate the new sustainability landscape and ensure your organization is prepared to meet these challenges.

Discover more

Contacts

Partner, Operating Strategy - FS

KPMG in the Netherlands

Senior Manager, Sustainability Advisory

KPMG in the Netherlands

We will keep you informed by email.

Enter your preferences here.