Developers, builders, investors and financiers need to re-strategize now to meet ambitious building energy performance regulations in the near future

Authors: Paul Oligschläger (Senior Manager KPMG Real Estate Advisory) and Vincent Mahieu (Energy Efficient Mortgages NL Hub Expert).

The importance of the built environment in achieving EU climate goals

It is widely recognized that the built environment accounts for approximately half of all extracted materials, that the construction sector is responsible for approximately 1/3 of waste generation, and that approximately 36% of greenhouse gas emissions (and 40% of EU energy consumption) are directly related to the built environment within the EU. This underlines the importance of the built environment for achieving the EU climate goals in the near future, as well as for achieving net zero carbon emissions by 2050.

To make Europe’s economy more sustainable, the European Commission presented the EU Green Deal at the end of 2019. The Green Deal is enshrined in the EU Climate Law, which sets a legally binding target of net zero greenhouse gas emissions by 2050.

The EU institutions and member states are bound to take the necessary measures, both at EU and national level, to meet these targets. In the Netherlands, these plans are included in the National Climate and Energy Plan (NCEP) and the Climate Act (‘Klimaatwet’).

One of the most important European legislative instruments to achieve Europe’s green ambitions for 2050 is the Energy Performance of Buildings Directive (EPBD). EPBD III is currently in force and its latest updates have been incorporated into national regulations, mainly in building codes such as the Dutch Building Decree (‘Bouwbesluit’) and the corresponding EPC methodologies of all member states.

Now, the EU has made considerable progress in updating this directive to reflect Europe’s latest ambitions, which will be EPBD IV.

Figure 1: EU Green Deal. Source: European Commission, 2020

The aim of EPBD IV and key changes as compared to the current directive

The current directive, EBPD III, is a legislative framework that aims to achieve a highly energy-efficient building stock, create a stable environment for investment decisions and enable consumers and businesses to make more informed choices to save energy and investments. EPBD III introduced the concept of nearly-zero energy buildings (NZEB), which has been incorporated in the Netherlands into the NTA 8800 norm as of 2021.

EPBD IV aims to update existing EU-wide frameworks to reflect the greater ambition to reach EU Green Deal targets and achieve a zero-emission and fully decarbonized building stock by 2050.

While the final wording of the directive has not yet been published, it is already known that the latest version includes elements that update the energy performance methodology and proposes impactful tools and targets to reach the 2050 goals. The main proposed updates as compared to the current directive are:

- Zero-emission buildings (ZEB) will become the standard as of 2028, as opposed to the current nearly-zero energy buildings (NZEB) norm which is implemented by member states. EPBD IV prescribes the reduction of greenhouse gas emissions as an explicit goal.

- The introduction of minimum energy performance standards. These are aimed at creating a pathway, supported by financial mechanisms, for the progressive increase of energy performance, starting with the worst performing buildings. The standards are to be met as part of a wide renovation plan, at a trigger point on the market (sale or rent) or by a specific date.

- The introduction of building renovation passports with a step-by-step roadmap for buildings to achieve net zero carbon by 2050.

- A requirement for national governments to establish long-term renovation strategies to decarbonize the national building stock by 2050.

- An active and explicit role for the financial sector in financing the pathway to net zero carbon buildings.

- The validity of energy performance certificates (EPCs) will change. EPCs of class C and above will be valid for 10 years. EPCs of class D and below will be valid for 5 years.

- Member states must create national renovation plans, which include ways of financing and funding needed to improve the national building stock gradually over time.

Initial implications for the real estate development and construction industry

- The starting point for zero emissions is a three-step approach: 1) increase sustainability of real estate, reducing energy demand; 2) reduction of energy consumption by users, occupants, tenants; 3) use of renewable sources for the remaining energy demand, where technically feasible generated on-site.

- Article 9b dictates zero-emission buildings (ZEB), which is a more stringent standard than the nearly zero energy buildings or NZEB (‘bijna energieneutraal’, BENG) standard currently used. The main difference is the focus on zero emissions instead of energy usage.

- The current methodology for determining energy labels will remain in place until at least 2030. In terms of energy labels, ZEB will be translated into EPC A, with the remark that this means zero emissions. Currently, EPC A does not mean zero emissions in any EU member state. The newly introduced EPC A+ category will focus on emission-positive building stock.

- Global Warming Potential (GWP) is introduced to bring together greenhouse gas emissions embodied in construction products with direct and indirect emissions from the use stage. The requirement to calculate the life-cycle GWP of new buildings constitutes a first step towards increased consideration of the whole life-cycle performance of buildings and a circular economy.

- Part of the negotiations on the EU’s ambition for member states is to achieve at least energy label D by 2033. For reference, an earlier proposal was for an average of (not minimum) label D. The latest proposal is for a ‘minimum label D’, which could lead to significant renovation efforts in the Netherlands.

Initial implications for the investor, finance and mortgage sectors

- Financiers will have to take into account the lead time of newly constructed real estate. Financing ‘green’ assets in the current context does not necessarily mean that these assets will still be considered ‘green’ when they are completed, let alone when they have been in use for several years. Specifically, new constructions in the Netherlands are currently not compliant with ZEB standards by law, as NZEB is still applicable for new constructions. This means that renovation will be required between the completion of the building and 2050.

- The annual target for renovation of the building stock is set to almost double, from 0.8% to 1.5% per year. In concrete terms, this means that 9-14.5% energy reduction should be achieved by 2030 compared to what was projected for 2030 3 years ago. The question remains as to how the financial sector can play its part in driving sustainability efforts in the built environment.

- Mortgage Portfolio Standards have been introduced, which are mechanisms that require mortgage lenders and other relevant financial institutions to gradually improve the average energy performance of buildings over time. This is not yet specified, but the concept shows the great responsibility the EU places on financial institutions to facilitate the decarbonization of real estate, even when these institutions are not the owners.

- EPBD IV and the EU Taxonomy Climate Delegated Act are interdependent. The EU Taxonomy classifies environmentally sustainable economic activities across the economy, which includes the building sector. The EPBD IV explicitly refers to the EU Taxonomy for criteria related to building renovation activities. Alignment with the EU Taxonomy is therefore a crucial step to compliance with the future implementation of EPBD IV. By the time EPBD IV is embedded into national laws such as the Dutch Environment and Planning Act (Omgevingswet), the EU Taxonomy technical screening standards will likely be revised.

Timelines

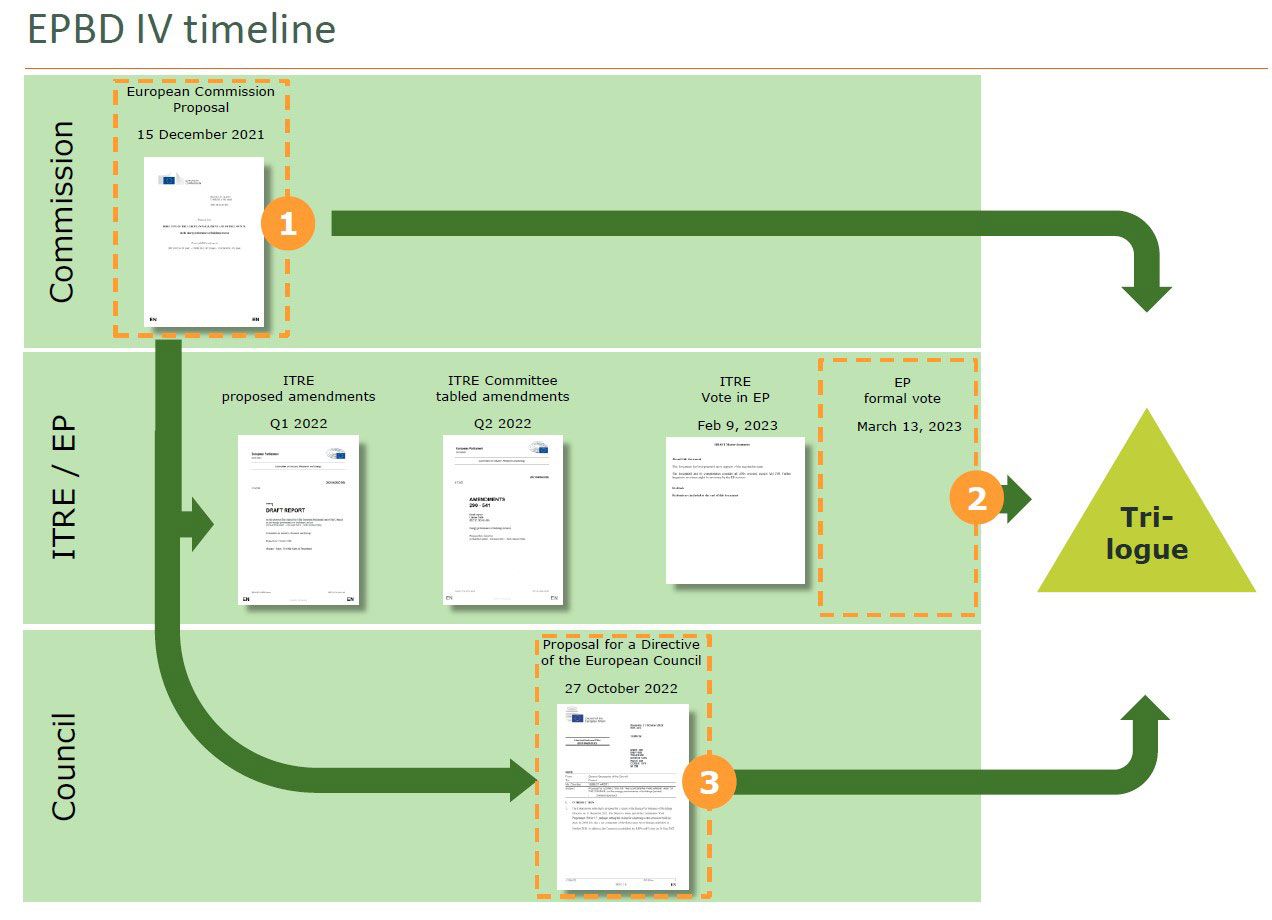

On 9 February 2023, the subcommittee on Industry, Research and Energy (ITRE) of the European Parliament voted on and approved the current EPBD IV proposal. This week, on 13 March 2023, the European Parliament will vote on whether to proceed with the proposal based on the latest consensus version, the ITRE version. Now the so-called trilogues between the European Parliament, the Council and the Commission will start, which are informal tripartite meetings on the EPBD proposal. The aim is to arrive at a final proposal for EPBD IV. We currently expect the final decision-making to take place in Q3 or Q4 of this year, depending on the final discussions and the approach taken by Spain, which will take over the EU Council presidency as of July 2023.

EPBD IV is a directive, which means that the EU legislative framework must be adopted into national law by each member state. In the Netherlands, for example, this means that amendments to current laws and regulations must be proposed and approved by both the Dutch Parliament (‘Tweede Kamer’) and the Senate (‘Eerste Kamer’). This is expected to take approximately 18 months.

In conclusion, EPBD IV might enter into force in early 2025.

Figure 2: EPBD IV timelines. Source: Energy Efficient Mortgages Hub, 2023

Topics that remain subject to discussion

There are several topics within EPBD IV that are still subject to discussion. The key topics affecting the scope and speed of implementation are listed below:

- It remains to be decided how the current regulations of NZEB norms and thresholds will be translated into ZEB and A/A+ classifications. It is likely that member states that have recently changed their EPC regime, such as the Netherlands, will wait to implement from 2030 onwards.

- It is expected that EPBD IV will be incorporated into existing regulations and no new regulations will be introduced. In the Netherlands, for example, the Building Decree primarily focuses on newly built stock and large-scale transformations. The question remains as to how the energy performance renovation of the existing building stock will be addressed in the legislation.

- If the energy mix of the remaining energy demand of buildings is 100% sustainable, the reduction of building energy usage may be based on a financial business case, leading to a scenario where a certain limited reduction of energy usage is sufficient to meet climate goals, as opposed to full renovation towards ZEB. This is highly dependent on the final interpretation of ZEB, energy labels and the nation-wide implementation of EPBD IV. For the Netherlands, this is also linked to the recent policy of the Heat Transition Vision (Transitievisie Warmte), which aims at natural gas-free neighborhoods.

- Skills and workforce provisions may be included in the final EPBD IV proposal. The lack of a skilled workforce to meet the ambitions of EPBD IV is a risk that is widely recognized, including by market stakeholders. This is especially relevant since most of the measures will be implemented within a relatively short timeframe between 2030 and 2050.

- For EPBD IV, the availability of data, for example on detailed energy performance metrics, is key. How EPBD IV aligns with current data protection regulations in the EU, such as the General Data Protection Regulation (GDPR), is still under review.

Call to action

For real estate developers and construction companies

EPBD IV revolves around zero-emission buildings. However, the current Building Decree revolves around nearly net zero energy, which is not in compliance with EPBD IV. Given that:

- current real estate development plans only take into account the current Decree; and

- it takes 5-10 years for developments to be completed.

This implies that newly delivered stock in 2030 will need to be renovated within 20 years if no additional measures are taken, to achieve net zero carbon in 2050. It is imperative to strategically assess the degree to which real estate currently under development meets net zero-emission targets to prevent avoidable renovation costs shortly after building completion. This presents a clear business opportunity for real estate developers to offer propositions and products that are future-proof, taking into account the EPBD IV criteria and alignment with the EU Taxonomy. This may directly impact a developer’s and builder’s strategy and operating model.

On this basis, we advise real estate developers and builders to: 1) assess their product strategy and portfolio; 2) assess the impact of their operating model; 3) align with the EU taxonomy; 4) perform a double materiality analysis of corporate sustainability; and 5) assess the embodied and operational carbon emissions of their developments.

Figure 3: actionable steps for real estate developers and construction companies. Source: KPMG, 2023

For investors and financiers

Discussions are still ongoing on the minimum energy label target for the near future (2030-2033). These initial targets are expected to be met, on average, in the Netherlands. However, these targets may change. This implies three important steps: 1) understanding the latest developments in energy label definitions and criteria, 2) gaining insight into the energy labels and emissions of all financed real estate, and 3) defining a feasible roadmap to the 2050 goals. Furthermore, given the explicit role of the financial sector, financiers and investors need to find innovative ways to help the built environment achieve the ambitious goals.

How KPMG can help

KPMG has in-depth knowledge of EU-mandated regulations, including EPBD IV and the EU Taxonomy, and extensive experience in helping real estate and financial sector clients assess the impact of regulations on their strategy and business model. Please contact us if you would like to learn more.

Latest IPRE version

The latest IPRE version voted on by the European Parliament can be found here:

REPORT on the proposal for a directive of the European Parliament and of the Council on the energy performance of buildings (recast) | A9-0033/2023 | European Parliament (europa.eu)

About the Energy Efficient Mortgages Netherlands Hub

The Energy Efficient Mortgages NL Hub is an initiative of a wide range of stakeholders active in the Dutch residential mortgage market. It brings together mortgage lenders, investors and various service providers and other institutions. The EEM NL Hub aims to develop and maintain a Dutch framework for energy -efficient mortgages that facilitates the translation and application of European regulations to the Dutch residential mortgage and real estate market. KPMG is one of the sponsors. https://energyefficientmortgages.nl/

We will keep you informed by email.

Enter your preferences here.