Merchants operating globally or working with multiple payment partners, such as PSPs, payment methods and banks, are facing an increase in complexity in various payments-related processes. This complexity includes, for example, handling multiple PSPs and ensuring smooth reconciliation processes. In addition, PSPs often do not provide all functionality required to provide customers with the optimal journey to pay for goods and services. For example, they might not be able to provide the desired level of integration with the merchant’s ERP system of choice, the desired level of merchant branding on the checkout page, or the highest rate of conversion for a particular payment method the merchant wishes to offer.

Payments orchestration is a term that recently has become popular to describe the layer between merchants and payment partners, enabling merchants to unify their payment experience across PSPs and reach the highest possible conversion rates by combining various payment partners. Building such a payments orchestration layer (POL) in-house is possible, but an increasing number of merchants opt to engage with a third party that provides these services. This article describes the features of payments orchestration, as well as success factors for enabling this.

Background & problem: increasing volumes of e-commerce increase the rationale for payments orchestration

Payments orchestration is a phenomenon which is not really new, but which has taken a significant flight in view of the developments of the last years. Payments processing by merchants has seen a significant growth and differentiation, showing the following changing factors:

- Many (smaller) merchants started to offer their goods on the web, often with the help of existing merchant platforms.

- Merchants with existing online presence saw their share of e-commerce transactions expand.

- New payment methods have been introduced at a high pace (e.g. BNPL, crypto, mobile wallets)

As a consequence of these changes, each merchant should continually revise their payment strategy, including functionality provided by payments partners such as PSPs, potentially enriched with a payments orchestration layer. This payments orchestration layer becomes more relevant if a single PSP cannot support all requirements the merchant has defined in their payment strategy with regard to providing payment methods, geographies or functionalities (e.g. reconciliation integration with the merchant’s ERP system).

For example, if merchants were initially able to perform reconciliation (partially) manually, the increase in volume is making it significantly more attractive to use a fully automated reconciliation functionality provided by a payments orchestration layer. This also applies in the case of multiple PSPs, where reconciliation and settlement reporting are received for each individual PSP a merchant engages with.

Different PSPs are engaged because a single PSP might not support all the functionalities required, such as directly integrating with the supporting (ERP) system ledger, matching incoming and outgoing payments with invoices and bills, and covering all desired payment methods. Also, merchants are inclined to maintain a fallback PSP in case the primary PSP is unavailable. Merchants, supported by multiple PSPs in different geographic regions and providing a variety of payment methods, aim to offer a consistent customer experience across different PSPs. This has led to merchants having to work with a wide variety of PSPs and payment partners, complicating automation, system integration and internal processes.

Payments orchestration is ideally positioned to address these issues originating from engaging with various parties in the payment value chain.

Definition of payment orchestration & features

Payments orchestration manages the entire omnichannel, end-to-end payment process by enabling a merchant to integrate their legacy application landscape with one or multiple payment partners through a single interface with the payments orchestration layer. This facilitates the coordination of multiple functional components involved in a single payment, such as transaction routing, management of personal data, consolidation and reconciliation. An example of what this could enable is that merchants can consolidate reconciliation reports from their accounts at multiple PSPs at a single location, as opposed to needing to reconcile them individually using the potentially unsupported or mismatching formats PSPs provide them in.

The resulting benefits of payments orchestration are multifold by providing additional functionality on top of existing integration between merchants and PSPs. Not all PSPs allow direct integration with the merchant’s ERP system and matching of incoming and outgoing payments with invoices and bills. In this situation, payments orchestration solutions greatly simplify and help to save time on the reconciliation process. Payments orchestration can unify the user experience and provide an integrated checkout page that ensures brand consistency and user familiarity across PSPs. In addition, payments orchestration allows for efficient rerouting of payments when a primary PSP is unavailable and a fallback PSP needs to be engaged.

Connected Enterprise: Enabling payments orchestration functionality

Although payments orchestration can provide these benefits, enabling these optimizations is not a straightforward ‘plug- and- play’ exercise as it requires going through a digital transformation. To leverage the full potential of the solution, the implementation needs to cover all capabilities required to meet customer expectations and drive business value regarding payments processes.

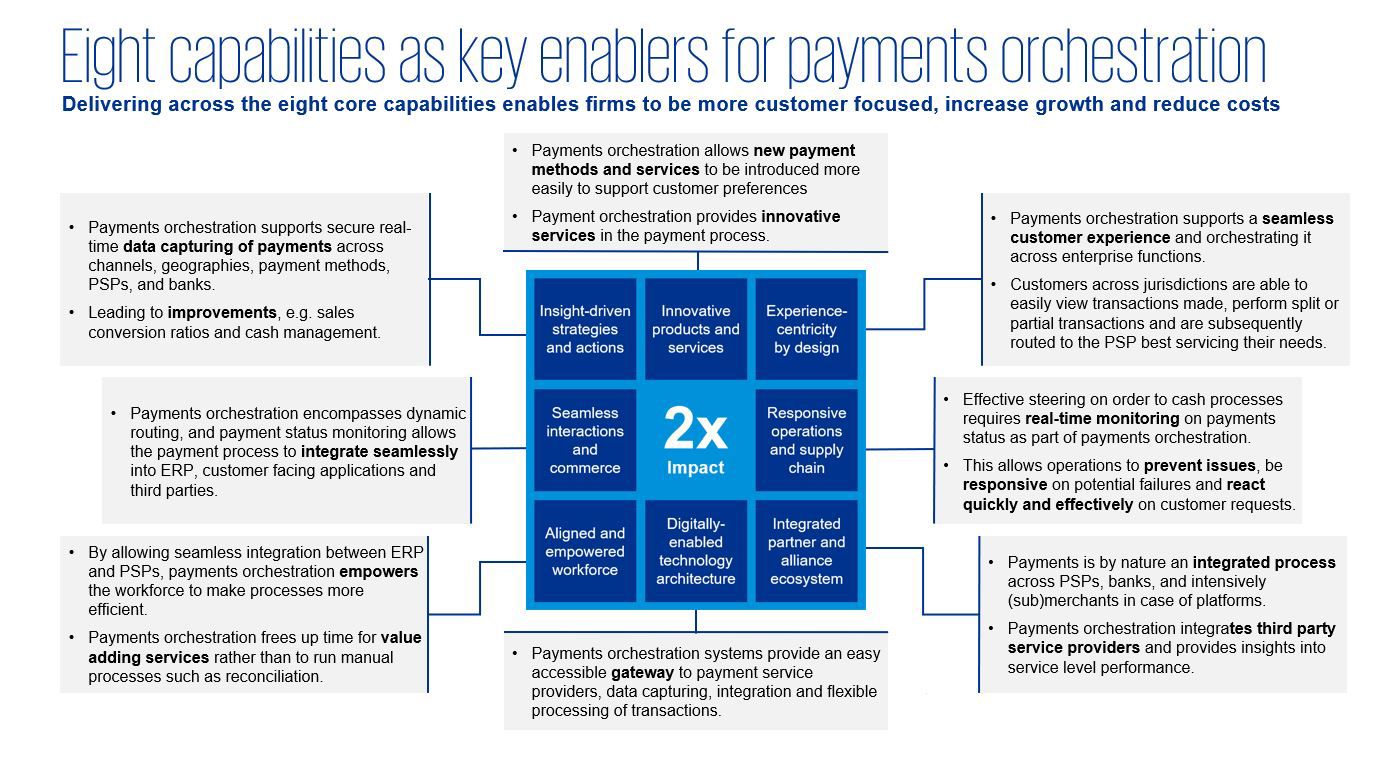

KPMG leverages the Connected Enterprise model in digital transformation implementations to identify and meet these capabilities. The model distinguishes eight capabilities that facilitate organizations in meeting their customer-centric objectives, which can also be applied to payments orchestration (see visual)[1] given its customer-centric nature as it aims to provide an improved and more consistent customer journey across different payment partners. As a result, merchants looking to include a payments orchestration layer in their payment process should place special focus on the areas of the Connected Enterprise’s eight capabilities, as can be seen in the visual below.

What do merchants need to drive success in payments orchestration?

Summing up, merchants could ask themselves the following three questions when dealing with payments orchestration:

- Which functionality do I need in addition to the ones that are currently offered by my payment partners (such as reconciliation of multiple payment partners)?

- Which payment partners do support the need for this functionality?

- How do I implement the payments orchestration layer successfully?

[1] According to the Connected Enterprise model, based on extensive research performed by Forrester, leading organizations make two times more impact than other organizations if they are able to understand what customers need and value, and are delivering on those expectations accordinglyprofitably. They are responsive and resilient enough to evolve with the changing market landscape, if they build these eight capabilities of the connected enterprise framework.

If merchants experience difficulties in answering theseose questions addressed, KPMG can help to support merchants in determining answers that align with the organizational (digital) strategy.

We will keep you informed by email.

Enter your preferences here.