The stark contrast in key performance indicators (KPIs) of insurers in present day compared to those of insurers a mere ten years ago, is undoubtedly one of interest. The development in KPIs over time reflects changes in business priorities and the factors that are deemed crucial to an insurer’s success. KPIs are also significantly affected by the senior management of the company, regulatory requirements and the economic and social environment, amongst others. KPIs are used by companies globally as a quantifiable measure of the company’s performance against its strategic targets and goals for all relevant stakeholders.

Tracking and reporting of KPIs can be used to drive decisions, steer strategy and provide important messages to all stakeholders. The group of stakeholders is diverse, ranging from internal stakeholders (management, employees,…) external stakeholders (clients, investors), and society (community, regulator, government). The relative importance of the different stakeholders being unique to each company.

In recent years, we have observed numerous developments that have affected the insurance sector in the Netherlands in several distinct ways. For example, in 2018, the European Commission published its action plan on sustainable finance, which led to three major related regulations being implemented in 2019. Subsequently, KPIs over the years 2019 to 2021, have shown significant changes that reflect not only compliance with the regulation, but also a greater prioritisation of ESG performance metrics.

From a more financially focused perspective, the upcoming implementation of the new accounting standard IFRS 17, as well as developments observed within the Solvency II risk framework, have resulted in changes in financially related performance measures. Given the exciting developments in KPIs, KPMG has developed a study on how the published KPIs of 28 insurance companies operating in the Netherlands have evolved and transformed within the 3 years of 2019 to 2021. This period was particularly fascinating as we were able to observe the responses of insurers to the COVID-19 pandemic and the resulting lockdown restrictions that crippled the global economy.

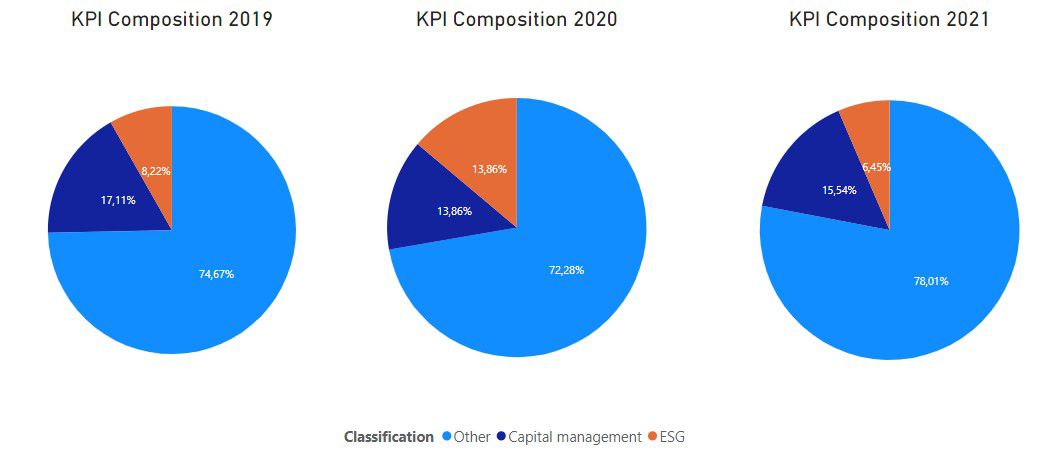

One element of the KPI Benchmark Report aims to understand how Dutch insurers’ priorities have changed over time. This is done by classifying KPIs into 12 main categories and evaluating the proportion of total KPIs that have been included in the annual reports of insurers. A simplified version of these results are illustrated in the graphs below.

We can see that capital management KPIs have remained a priority for companies over the years of the study. This is in line with our expectation given the all-important Solvency II prudential regime that was implemented in 2016, which governs the capital requirements for European insurers. It is also apparent that in 2020, ESG becomes of significantly greater importance, which is to be expected given the developments mentioned above regarding the European Commission. However, the decrease in the number of ESG-related KPIs included in annual reports in 2021 was certainly not intuitive. It is developments such as these that have been investigated and the findings detailed in the KPI Benchmark Report.

The KPMG KPI Benchmark Report analyses and investigates the evolution of KPIs included in the annual reports of Dutch insurers. The report gives invaluable insight into the Dutch insurance industry, and will be published soon! We trust that you are as excited as we are, and will keep an eye out for the publication. To receive a direct link to the publication, please message one of the KPMG contacts listed below.

Discover more

Contacts

We will keep you informed by email.

Enter your preferences here.