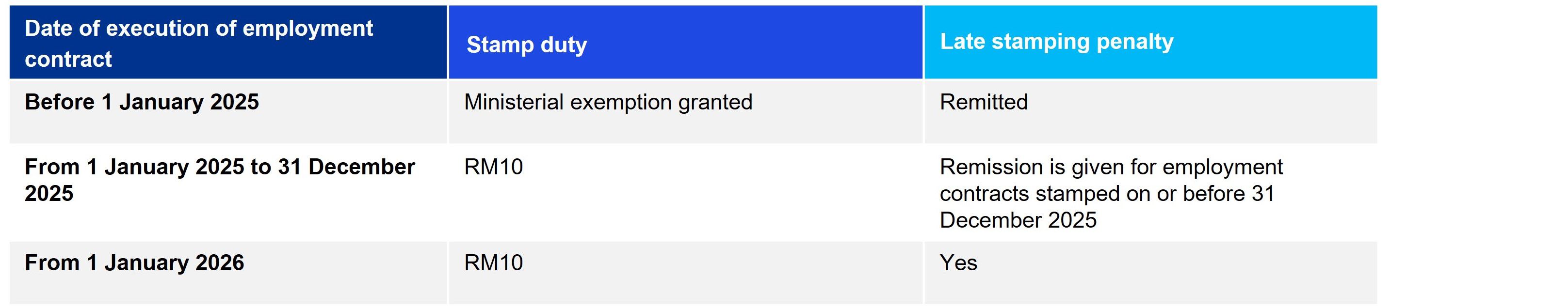

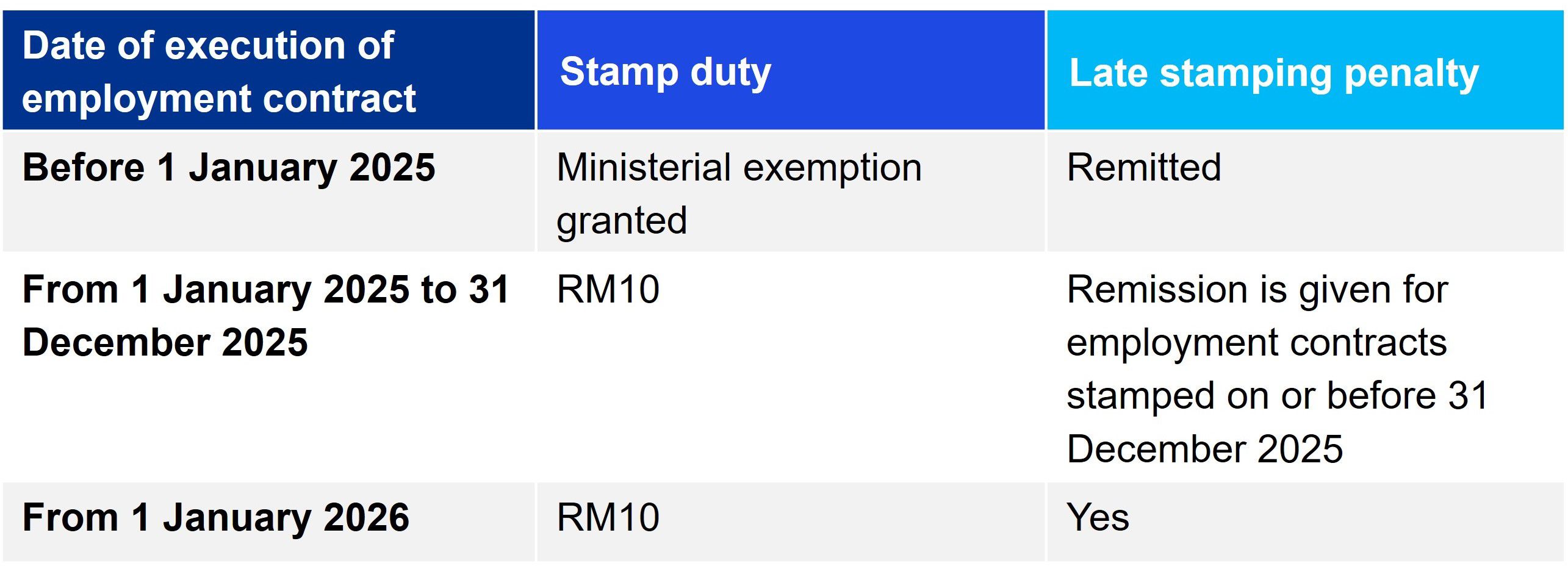

Stamp Duty Exemption for Employment Contracts Executed Before 1 January 2025

Employment contracts are instruments chargeable with stamp duty at RM10 per instrument pursuant to Item 4, First Schedule of the Stamp Act 1949. Recent stamp duty audit and compliance operations by the Malaysian Inland Revenue Board revealed that one of the major non-compliance revolves around unstamped employment contracts.

In view of the above, the Ministry of Finance has made the following decision to alleviate the compliance burden on employers:

Petaling Jaya Office

Soh Lian Seng

Partner - Head of Tax and Tax Dispute Resolution

lsoh@kpmg.com.my

+ 603 7721 7019

Ng Sue Lynn

Partner - Head of Indirect Tax

suelynnng@kpmg.com.my

+ 603 7721 7271

Tai Lai Kok

Partner - Head of Corporate Tax

ltai1@kpmg.com.my

+ 603 7721 7020

Bob Kee

Partner - Head of Transfer Pricing

bkee@kpmg.com.my

+ 603 7721 7029

Long Yen Ping

Partner - Head of Global Mobility Services yenpinglong@kpmg.com.my

+ 603 7721 7018

Outstation Offices

Penang

Evelyn Lee

Partner

evewflee@kpmg.com.my

+603 7721 2399

Ipoh

Crystal Chuah Yoke Chin

Associate Director

ycchuah@kpmg.com.my

+603 7721 2714

Kuching & Miri

Regina Lau

Partner

reglau@kpmg.com.my

+603 7721 2188

Kota Kinabalu

Titus Tseu

Executive Director

titustseu@kpmg.com.my

+603 7721 2822

Johor

Ng Fie Lih

Partner

flng@kpmg.com.my

+603 7721 2514