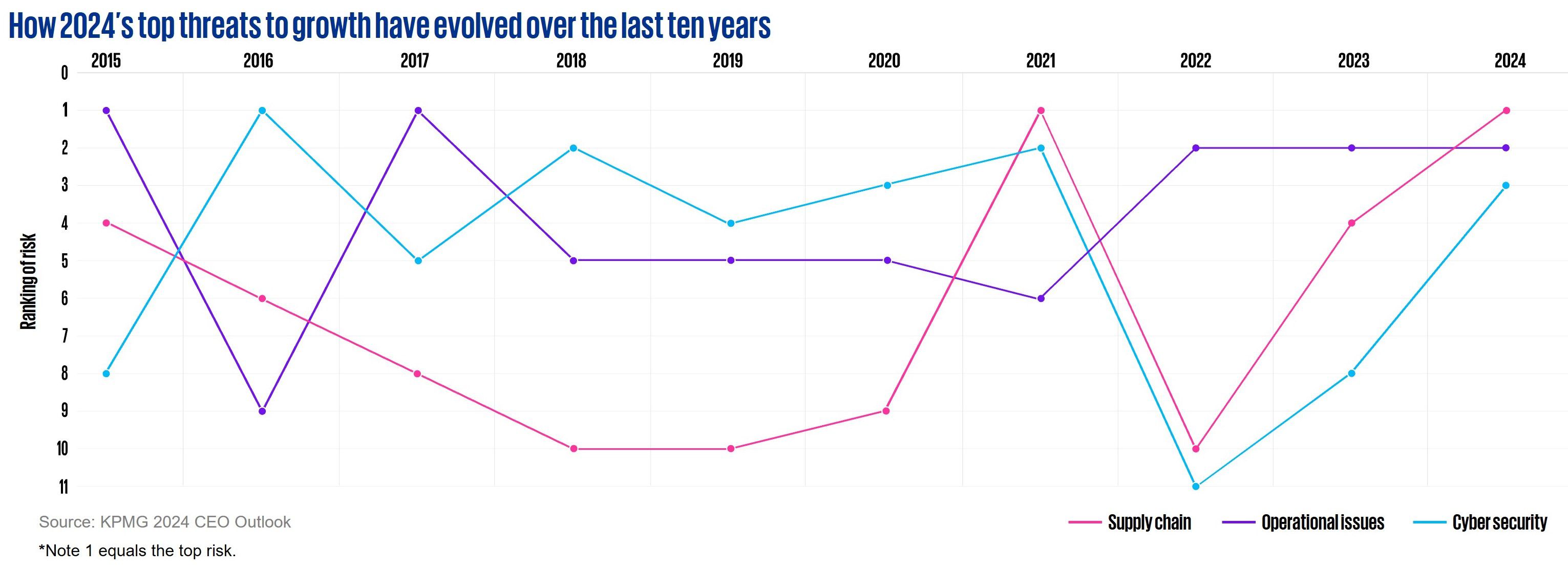

The economic landscape has evolved significantly over the past decade. In 2021, supply chain disruptions, largely driven by the COVID-19 pandemic, were viewed as a major threat to business growth. Remarkably, three years later, supply chain challenges remain at the forefront of CEOs’ concerns. This year's CEO Outlook survey shows a shift in perceived threats to growth, with supply chain challenges and operational issues now coming in above cybersecurity and even last year’s top concern—geopolitics and political uncertainty.

Despite these evolving challenges, nearly three-quarters (72 percent) of CEOs remain confident in the economy’s growth prospects over the next three years. This optimism is reflected in future hiring plans, with 92 percent of CEOs intending to increase employee headcount—the highest level recorded since 2020.

Data over the past decade highlights how CEOs are investing for the future of their businesses. Key focus areas include advancing digitization and connectivity (18 percent), enhancing their employee value proposition (EVP) to attract and retain talent (15 percent), understanding and implementing generative AI across the business and upskilling their workforce (13 percent), and execution of ESG initiatives (13 percent). This strategic approach ensures the long-term growth of their organizations, underscoring CEOs’ commitment to fostering growth and adaptability in an ever-changing business environment.