Indian automobile industry saw a great impact owing to the policy leapfrogging (BSIV to BSVI), abrupt diesel bans and thrust towards electric vehicles. The Automotive Mission Plan 2016-26 targets 3X growth for automotive industry and establishes India as a manufacturing base and an export hub. The plan also seeks to outline the trajectory of advancement of the auto-ancillary ecosystem in India. Further, due to the economic slowdown, auto industry sales in FY20 declined and a recovery to a pre-COVID-19 scenario is expected only around FY22-23. To add to this the tech-led disruptions from cab aggregators, fluctuations in interest rates and reduced liquidity in NBFCs led to a substantial slowdown in the industry.

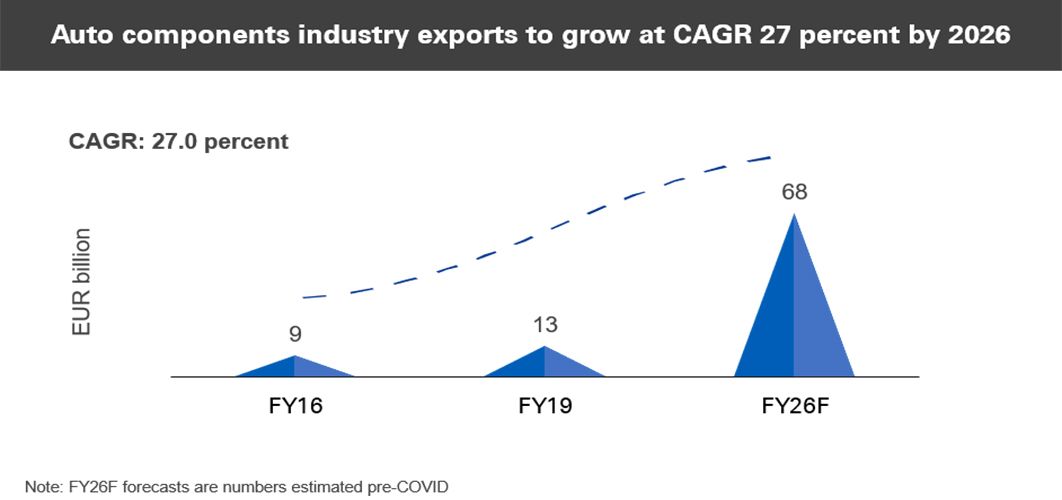

Auto-components segment in India is estimated at USD48 bn industry and expected to grow at a CAGR of 27 per cent1 in years to come.

Source: Invest India website accessed on 27 August 2020

Central and state governments have introduced multiple policies and financial incentives to drive the growth of the auto-component industry. India is well positioned to be an alternative source of supply to the global auto-component industry with 100 per cent FDI permitted, cost advantages and incentives.

Key growth drivers

Global sourcing hub

- At least 90 of the top 100 auto-component suppliers have presence in India

- India has reduced dependence on imports with high levels of localisation

Cost advantage

- Cost in India is 10-25 per cent lower than that of Europe and Latin America2

Role in global value chain

- 100 per cent FDI allowed through the automatic route

- Presence of auto design centres, automotive training institutes, special auto parks and virtual SEZs for auto components give India an edge

Geographic proximity

- Geographic proximity of key automotive manufacturing countries, including ASEAN countries and South Korea are create significant opportunities for Indian auto ancillary players

Rise of the east

- Asia emerging as a growing market backed by its cost competitiveness, rising incomes, rapid urbanisation, improved infrastructure and scope for greater vehicle penetration

Trade policy

- Trade policy in India is favourable with nominal restrictions on import-export.

How can KPMG in India help?

Dedicated team of professionals

- Extensive experience of executing strategy, cost reduction, market assessment, supply chain optimisation and feasibility studies in the automotive sector to articulate nuances of the market and accurately identify future trends through a tested methodology

- Dedicated team of professionals having in-depth experience and expertise to support throughout the project lifecycle

Sources:

- Invest India website accessed on 20 August 2020

- Make in India website accessed on 26 August 2020

Guidance note to readers: We have relied on secondary sources which are considered reliable but have not independently verified the data. KPMG shall not be liable and/ or responsible for any reliance placed on the content of the website.