Strategic opportunity for specialists

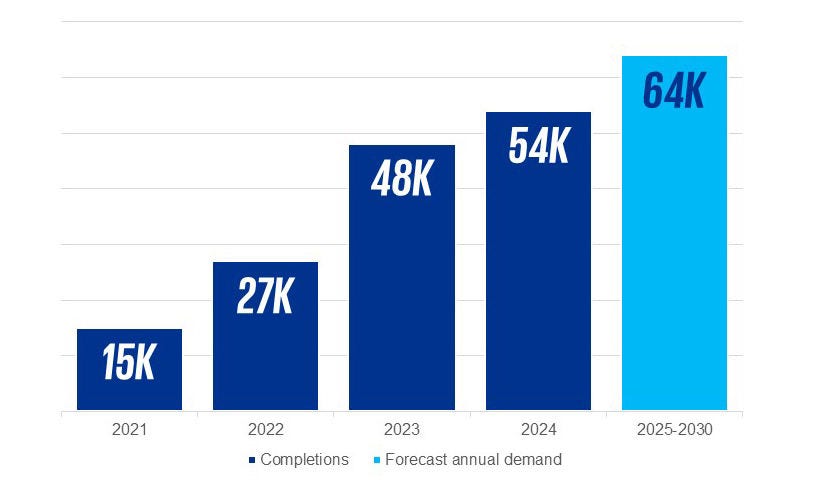

This supply-demand imbalance is placing upward pressure on pricing and extending delivery pipelines, creating opportunities for well-positioned safety-critical providers with the capabilities required to scale.

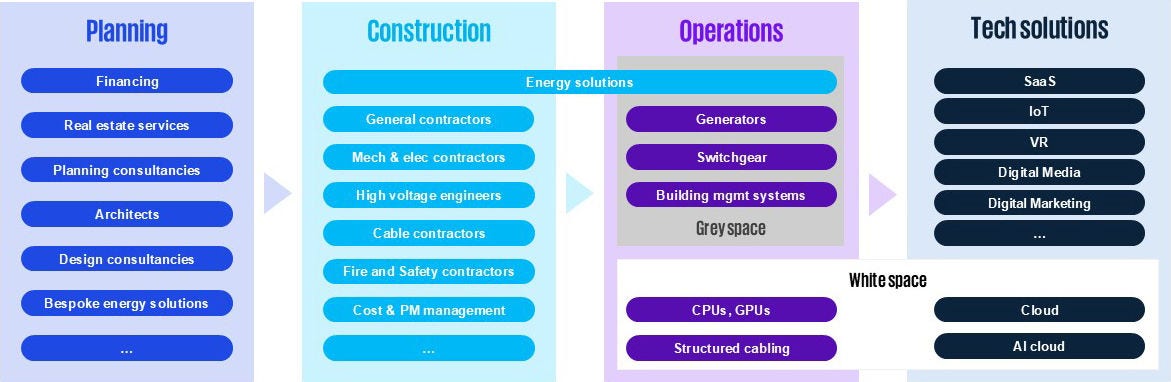

Fire and lightning protection spend scales directly with investment in hyperscale, pharma and grid assets, which are among the most resilient growth segments in the built environment. Unlike conventional construction projects, revenues are typically programme-based with repeat client engagement rather than project-by-project tendering.

Higher electrical loads, increased redundancy standards and more prescriptive safety regulations drive system complexity, benefitting specialists capable of integrated design-install-commission delivery, supporting superior margins relative to commoditised subcontracting.

On the positioning side, safety-critical specialists increasingly engage directly with developers, insurers and engineering majors, embedding them earlier in project decision-making and strengthening high-value, resilient client relationships.

With sustained data centre, life sciences and grid investment across Ireland and the UK, demand for safety-critical systems looks resilient. Capacity constraints in commissioning expertise are likely to persist, preserving favourable market conditions for scalable specialist firms.

For operators and investors alike, safety-critical platforms represent a resilient and increasingly strategic corner of the mission-critical ecosystem.