Consumers are becoming more informed, health conscious and digitally driven, with technological innovations reshaping retail experiences. Considering Ireland’s changing demographics, the central question is how the grocery landscape will evolve over the next decade.

As the next era promises to bring a personalised and evolved grocery experience, retailers need to prepare today – with a proactive, insight-led approach and a deep understanding of what’s next.

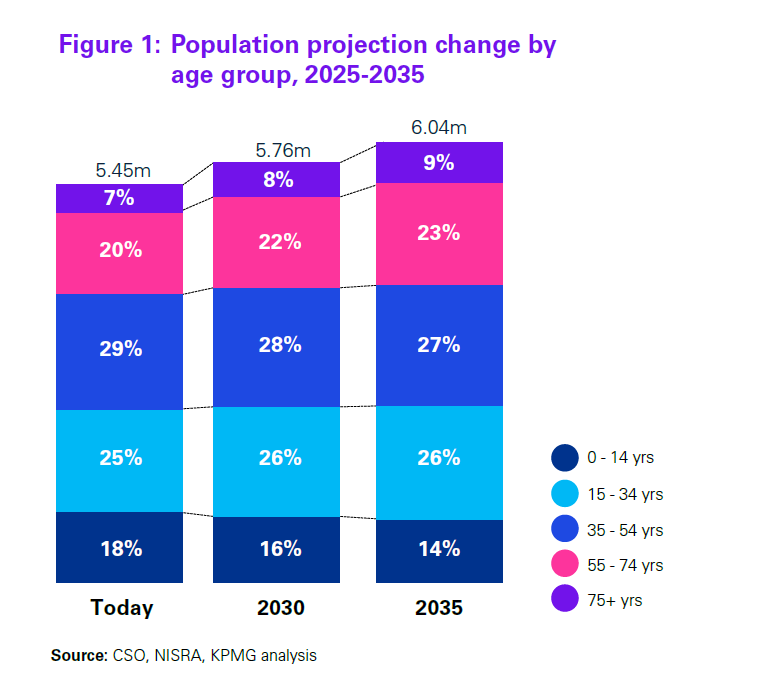

We led extensive research to uncover what lies ahead for the Irish grocery sector, combining a nationwide survey of 2,000 consumers across counties and demographics. This was layered with macro trends, demographic insights, and behavioural projection analysis to uncover what will shape Irish society by 2035. Together, these insights offer a lens into the future of the Irish grocery landscape – its consumers, challenges, and opportunities.