The built environment: strong growth, robust M&A and PE interest

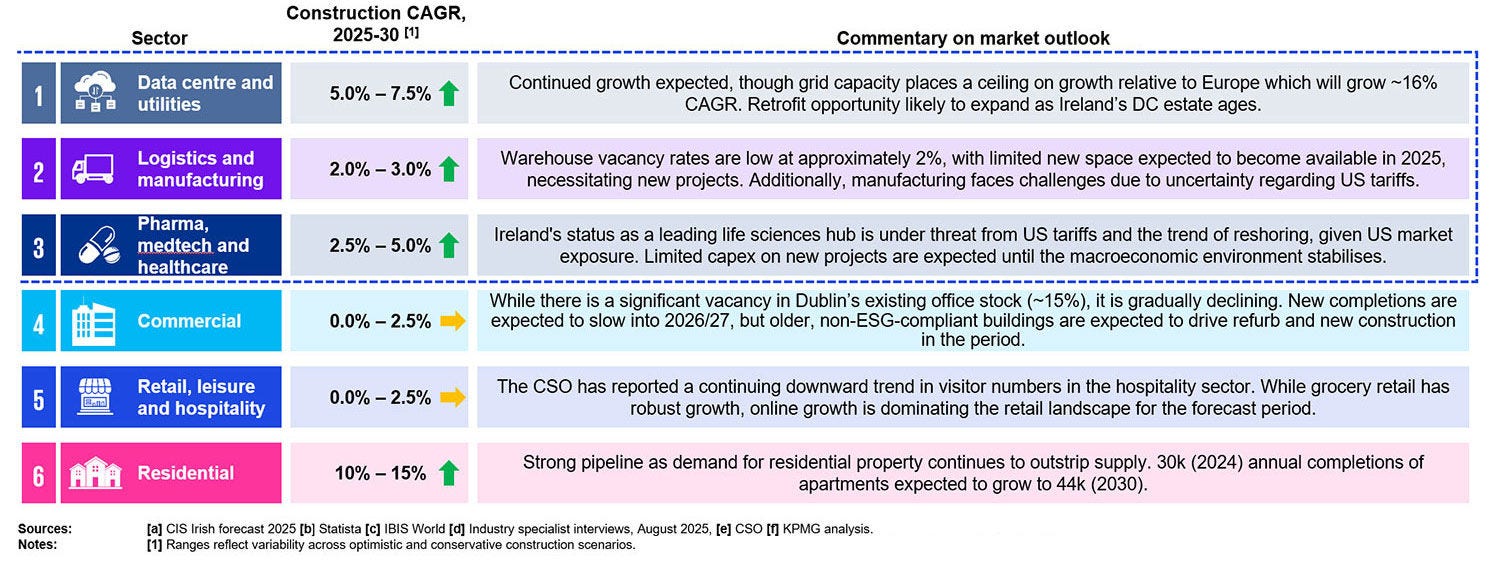

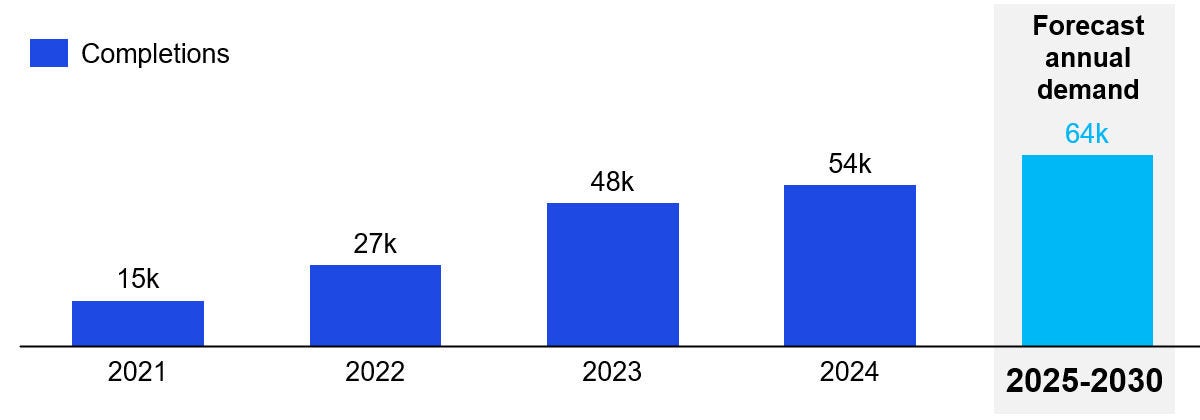

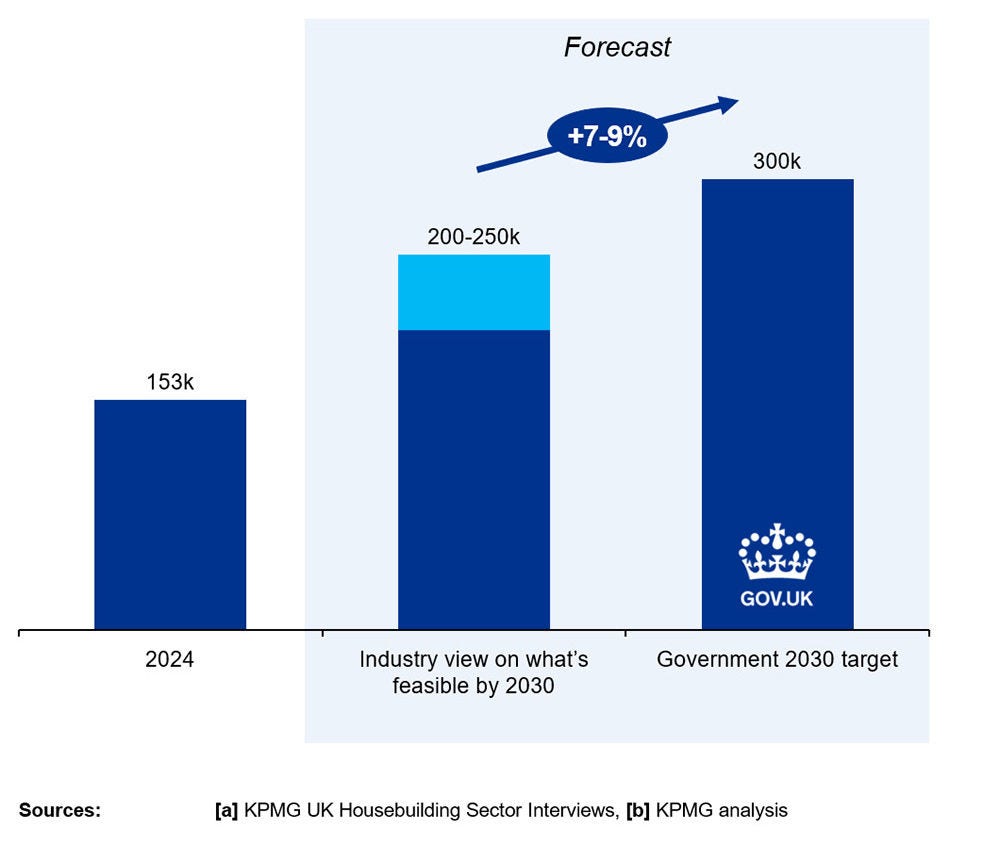

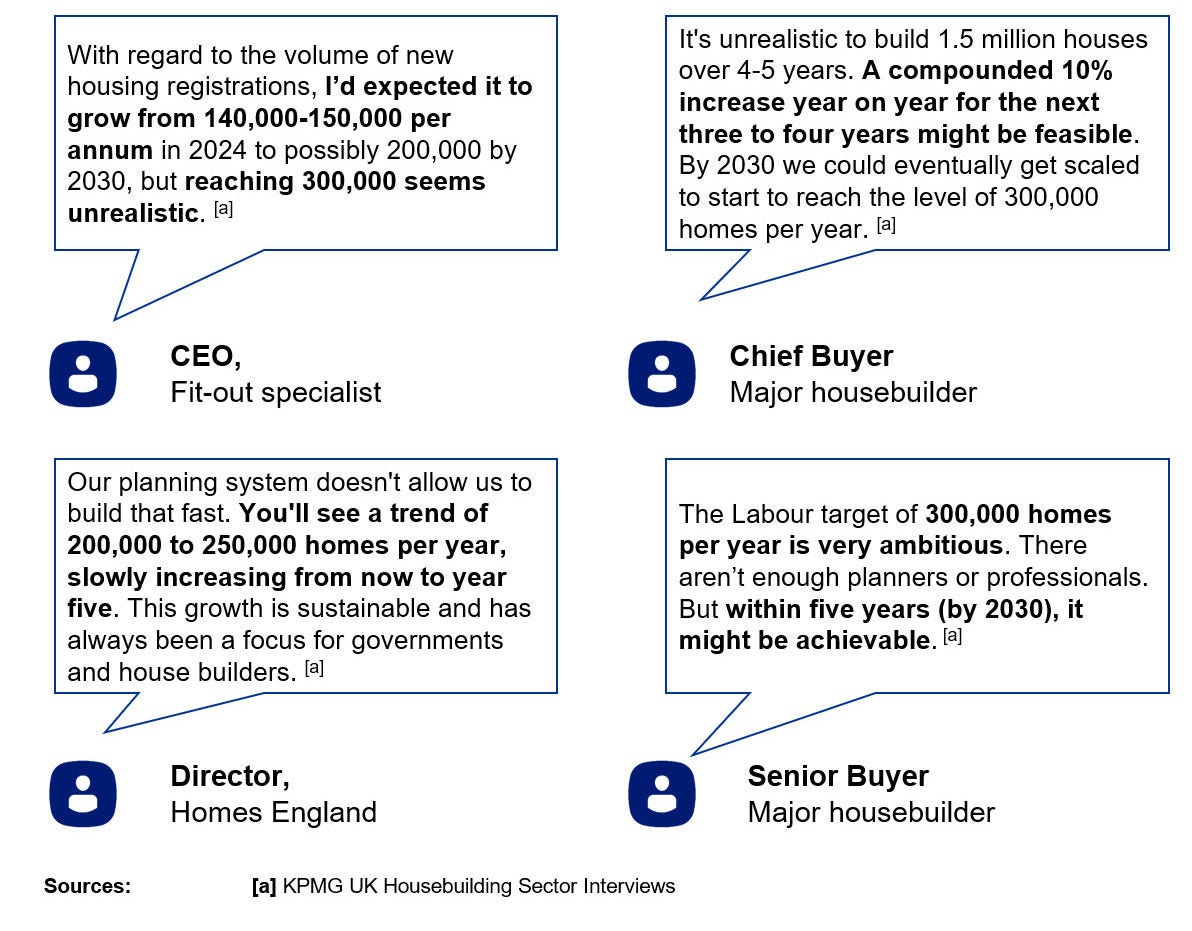

The built environment sector is experiencing a purple patch of strong growth, renewed M&A activity, and private equity interest. Strong public investment flows, decarbonisation, the exponential growth in digital, and the huge demand for mission-critical assets like data centres and energy infrastructure, are all conspiring to create the foundations for a mini boom for builders, engineers, and the rest of the built sector ecosystem.

At the same time, changing social priorities, regulator expectations, and technology are redefining how built assets are designed, financed, and operated.

These shifts are creating growth opportunities across a wide value chain – from construction and engineering to facilities management and proptech. Increasingly, however, the strongest momentum is being shaped by where major technology and digital-infrastructure investment flows, particularly in data centres and high-specification industrial facilities.

As a result, strategic investors and private equity funds are increasing their exposure to the sector, attracted by its solid fundamentals and its alignment with long-term digital growth, decarbonisation and national infrastructure trends.