IFRS 18 Presentation and Disclosure in Financial Statements (“IFRS 18”) marks a significant shift in how companies present, disclose and communicate financial performance.

Now is the time for companies to review their systems, make critical judgments and prepare for a more connected and insightful future in financial statement presentation and disclosure.

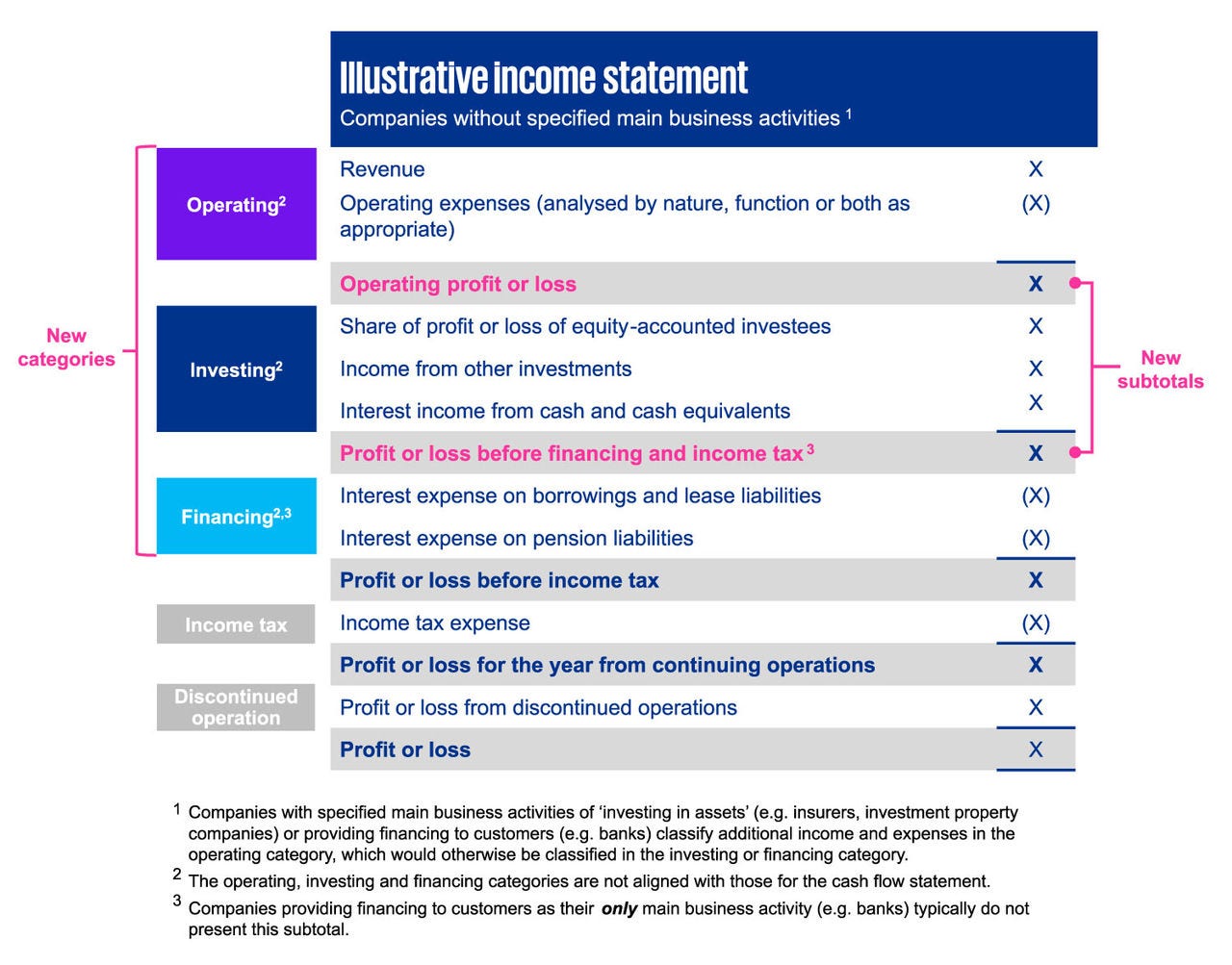

Developed in response to growing investor demand for more relevant and comparable data, IFRS 18 aims to provide consistency in presentation of the income statement alongside more disaggregated information.

Further, key non-GAAP measures that meet the definition of management performance measures (“MPMs”), will now be integrated into audited financial statements, fostering greater transparency and consistency.