Introduction

In an era of unprecedented public and regulatory scrutiny, the need to address how financial services organisations provide financial advice is as pressing as ever and, in many ways, now faces a period of even more heightened challenge.

Globally, there is a recognition that more can be done within the wealth management industry in this regard, and this has been exacerbated by evolving regulation, tech-driven changes in how financial advice is sought and delivered, and heightened risks related to data, fraud and vulnerable customers.

Today, organisations are operating in a climate of volatility and uncertainty. Every day that goes by without an organisation properly addressing conduct failings or weaknesses, the risk of mis-selling increases.

Therefore, exposure to conduct risk has never been higher and the consequences of mis-selling and associated conduct breaches have never been more severe. In such an environment, cultivating a strong corporate culture and focus on good conduct from the top level all the way down through the organisation is key. However, organisations don’t always know how to tackle such a complex problem in a cost-effective way.

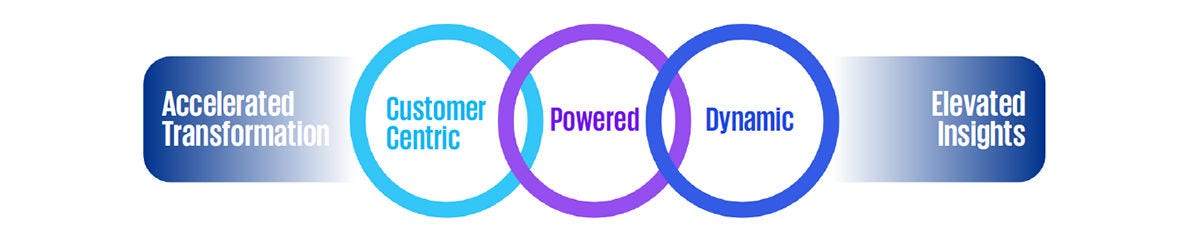

Our solution will help organisations implement change, which will not only minimise their conduct risk and ensure they comply with evolving regulation and standards, but will also give them a competitive advantage and drive better and more sustainable outcomes for their customers.