Newsletter – April 2025

The 2023 banking turmoil underscored several key lessons in liquidity risk management with particular focus on intraday liquidity risk. This newsletter examines the challenges banks face in forecasting intraday and daily fluctuations in deposit volumes, cash inflows and outflows, which are crucial for effective liquidity management. Innovations in the Euro Zone like instant payments with 10-second execution (24/7/365) and shortened T+1 settlement times have significantly increased the speed and complexity of intraday liquidity management. Advanced models help banks estimate these movements by capturing recurring patterns such as payday deposits, weekend effects, and seasonal promotions. Effective management of intraday liquidity risk is essential not only for regulatory compliance but also for the effective utilization of liquidity reserves. The ECB's newly published sound practices for managing intraday liquidity risk, that relies on the BCBS 144 on liquidity risk and BCBS 248 on intraday liquidity management outline seven principles, clarifying regulatory expectations based on BCBS 248, ILAAP, CRD, and SREP, with a holistic approach that distinguishes fundamental requirements from aspirational best practices.

For additional information on the topic, we also recommend our previous newsletters on liquidity management:

What is intraday liquidity risk?

Intraday liquidity risk arises when the bank cannot meet payment obligations on time, negatively impacting its own and others’ liquidity positions. It stems from timing mismatches between outgoing and incoming payments within or across currencies, even when daily net liquidity needs appear balanced. Since incoming payments are unpredictable, banks manage this risk by using liquidity reserves, delaying payments – when possible - for better inflow-outflow matching, or relying on counterparty credit lines. It primarily occurs in real-time gross settlement systems, correspondent banking, securities settlement, FX transactions and central counterparty or Client’s clearing activities.

Taking a step back, these (and all other non-intraday liquidity) contingencies are monitored for different time horizons and their behaviour under stress scenarios are simulated or predicted using historical data in the internal liquidity stress testing models in the US. There the liquidity risk management has been developed – similarly to market risk management – after the 2007-8 Crisis with stringent regulatory requirements for bank holding companies (with total consolidated assets larger than USD 100 billion). The complexity of the ILST models is further increased by the underlying scenario, e.g., if ring fencing between different legal entities is allowed or not.

Minimum operating liquidity (also known as intraday liquidity) is a key element of the ILST. Many subject matter experts and journalists contemplated how it could have been possible to avoid the 2023 US crisis (given that protagonists were sufficiently capitalized), but it was visible in 2021 regulators (one can e.g., search for letters made public by the Federal Reserve Bank of San Francisco) that liquidity risk management practices were below supervisory expectations: (i) the ILST did not address both market and idiosyncratic risks, (ii) liquidity limits did not address post stress situation, they were not reviewed and updated frequently (iii) and the contingency funding plan were neither up to date nor linked to the liquidity risk framework in the impacted institutions.

Zooming out of the US, recent crises, including COVID-19, the 2022 UK gilt turmoil, and the energy crisis, have highlighted the strain of unexpected payment delays, margin calls, and volatile collateral needs on intraday liquidity. The failure of Credit Suisse in 2023 underscored the dangers of intraday liquidity stress, as delayed incoming payments and efforts to maintain normal outflows contributed to its liquidity strain.

With technological advancements like instant payments and AI-driven trading accelerating transaction speeds, the risk of liquidity shortfalls is increasing. These challenges highlight the need for stronger supervisory frameworks to ensure banks can manage intraday liquidity shocks effectively.

How should a prudent Intraday Liquidity Risk management work?

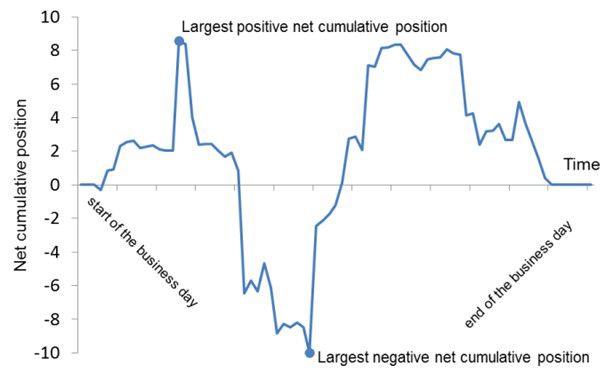

Intraday liquidity stress testing is essential to assess how liquidity needs shift under adverse conditions. The Basel Committee has outlined four stress scenarios in BCBS 248: own financial stress, customer stress, counterparty stress, and market-wide credit or liquidity stress. The Figure 1 shows an example on how the intraday liquidity can evolve over the day.

Figure 1 Daily maximum intraday liquidity usage (Source: Figure 1 from BCBS 248)

Banks also incorporate additional stress tests, such as operational stress (e.g., payment system failures), downgrading stress, counterparty stress and foreign exchange stress to evaluate their resilience and implement strategies to mitigate potential liquidity shortfalls.

The ECB has identified a lack of forward-looking perspective in intraday liquidity stress testing, highlighting the need for proactive measures beyond those outlined in BCBS 248. In daily cash management, banks rarely calculate ex-ante forecasted intraday liquidity gaps or assess ex-post forecasting accuracy, limiting their ability to anticipate liquidity shortfalls. However, larger banks are increasingly using forecasted intraday balances under stressed scenarios to improve risk preparedness.

Summary of ECB’s sound practices

To comply with new expectations of the ECB, several key areas need improvement compared to current market standards. First, the limit framework for intraday liquidity (IL) risk must be comprehensive, with formalized exchanges between risk, treasury and business units. Regular reporting, including BCBS 248 metrics, should incorporate ad-hoc capabilities, and ILM must be integrated into internal audit processes to ensure consistency across the group.

Additionally, real-time monitoring should extend to non-material currencies and sub-accounts, with thorough risk assessments. Buffer allocation on accounts and monitoring of counterparty payment patterns need enhancement. Projections should include intraday needs, and explicit outflow ladders must be defined. A systematic liquidity guideline is essential for steering and optimizing intraday liquidity, with prioritized and updated liquidity sources. Finally, stress tests, particularly for non-GSIBs, must be more comprehensive and conservative, and separate intraday liquidity buffers for all material currencies should be established.

Complying with the full scope of the key practices will be a big challenge for many banks, especially regarding separate BAU and stress buffers for all currencies, a real intraday forecast or a uniform application within the group. The Table 1 provides additional details on the key elements and good practices.

|

Fundamental key practices |

Good practices |

1 |

Risk Management Framework

|

|

2 |

Governance

|

|

3 |

Forecasting

|

|

4 |

Monitoring

|

|

5 |

Managing outflows

|

|

6 |

Sourcing of liquidity

|

|

7 |

Stress Testing

|

|

Table 1 Summary of ECB expectations toward intraday liquidity management

Modelling Approach – Machine Learning

A possible solution to ECB’s regulation changes is the application of machine learning (ML) techniques for forecasting. It can enhance intraday liquidity forecasting by identifying historical patterns in transaction timestamps and estimating remaining cash flows as the difference between the timestamp prediction and the actual balances using historical data.

The process begins with data preparation, where actual external transaction times are merged with expected cash flows from internal systems, irrelevant transactions are removed, and a materiality threshold is set for payments that significantly impact intraday balances. In algorithm development, models like random forests are trained to predict execution times based on historical data and available features. The predicted timestamps are then simulated against expected cash flows, with accuracy and robustness assessed through parameter adjustments. This ML-driven approach improves liquidity prediction, enabling more precise and proactive intraday risk management.

How can we help?

KPMG Hungary can help by interpreting regulatory requirements and best industry practices through tailored workshops and market benchmarking. We also offer health checks on your intraday liquidity management and support improvements in it by enhancing policies, governance, and monitoring functionalities based on your needs.

The newsletter was prepared by: József Soltész, György Székely, Zoltán Kádár