Building a Tax function fit for the futute

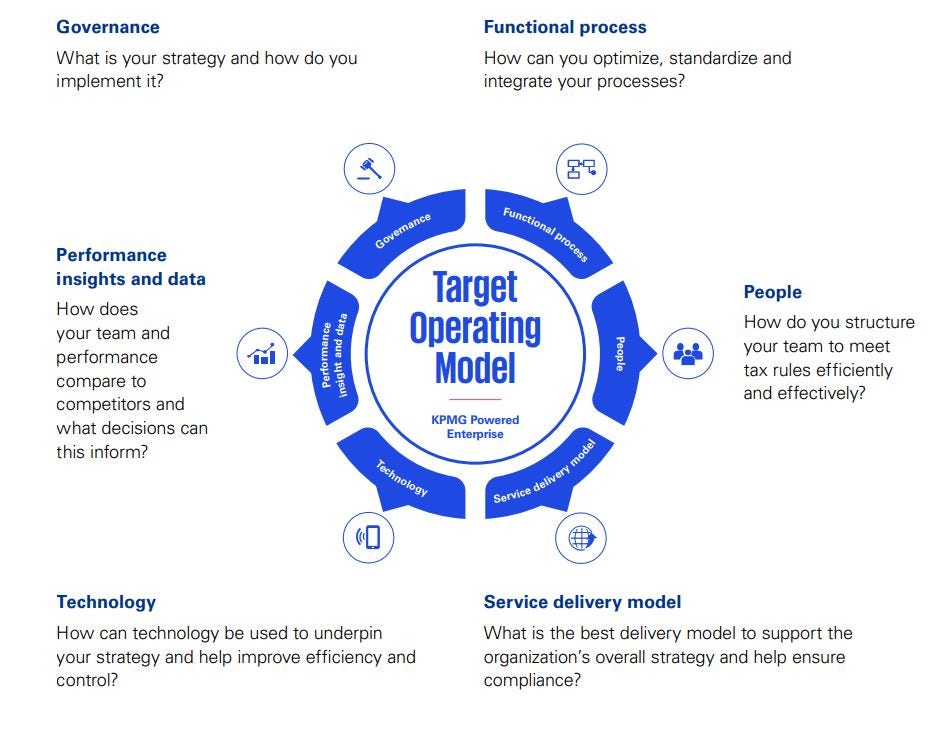

Tax Transformation starts with a clear tax vision and strategy aligned to the business objectives of the wider organization.

Organizations that transform their tax functions are not afraid to ask the hard questions such as:

- Are we ready to comply with new regulations?

- Is our current technology and data structure a barrier?

- Is tax delivering value to the wider business?

Our Tax Transformation team helps organizations actively contribute to finance transformation projects helping to ensure that tax requirements are integrated and tax is positioned as an enabler. We can streamline processes and help design a sourcing model which best suits business objectives and wider organizational goals across the whole spectrum of outsourcing, in-sourcing, and co-sourcing.