Germany remains a primary investment location in Europe for Chinese companies with existing business in Germany. This is a key finding of our German-Chinese Business Confidence Survey 2025, which we conducted for the first time together with the Chinese Chamber of Commerce in Germany (CHKD). The survey analysed the business expectations of 104 Chinese companies based in Germany. The survey results paint a multi-layered picture of sentiment between the strategic importance of the location and structural hurdles - and they demonstrate new dynamics in times of geopolitical upheaval.

German-Chinese Business Confidence Survey 2025

US realignment and the German government's infrastructure package lead to an increased focus on Germany.

Download nowAndreas Glunz

Managing Partner International Business

KPMG AG Wirtschaftsprüfungsgesellschaft

Five remarkable facts at a glance

Digitalisation (51%) and the energy sector, including battery technologies (48%), are the fields that are considered particularly promising for future cooperation according to the respondents. For 55% of respondents, proximity to their customers and business partners is the decisive factor for their presence in Germany. Strengthening the reputation and visibility of the corporate brand followed in second place (44%).

It is essential for Germany to act strategically in its cooperation with Chinese companies. Not isolationism, but an industrial policy guided by interests and targeted corporate cooperation will ensure competitiveness and strengthen the resilience of the location and the German economy.

Europe is increasingly moving into China's focus

The survey results also show that the attractiveness of the European market for Chinese companies is growing in the face of geopolitical tensions. 30% of the companies surveyed are therefore looking for new business opportunities in Germany and the EU. More than one in five Chinese companies (22%) are deliberately shifting their focus from the USA to the EU as an alternative sales market.

Chinese companies see opportunities in the German infrastructure package

Chinese companies are also attracted by the funds that the German government is making available from the special fund (500 billion euros by 2037) for the modernisation of transport, energy supply, digitalisation, education and science infrastructure as well as for more climate protection. However, concrete investments are still the exception. 15% are aiming to cooperate with German partners; 10% want to participate in public tenders.

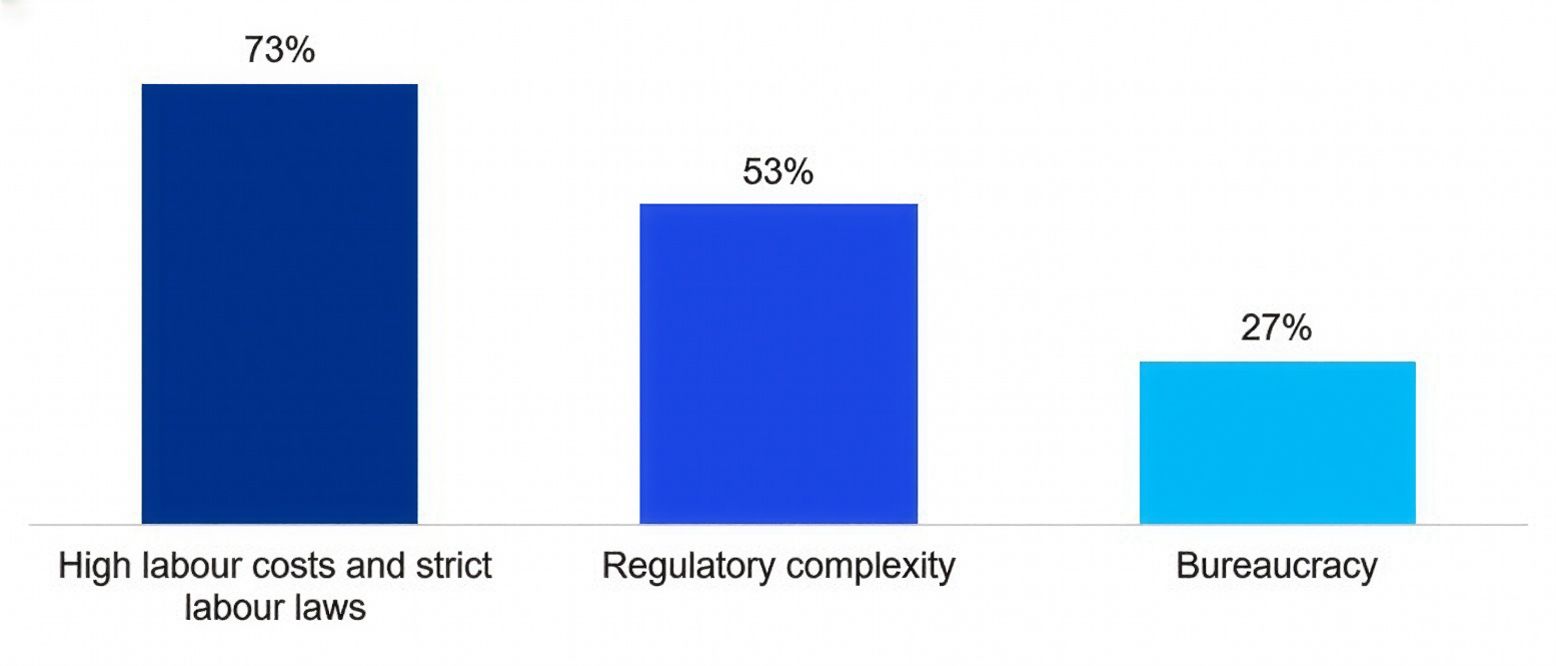

What is slowing down the commitment of Chinese companies in Germany

We asked Chinese companies what they consider to be the greatest challenges to business success in Germany:

In addition, almost half of the respondents (46%) complain that they are disadvantaged when it comes to accessing funding: Only 5% feel that they are on an equal footing with EU companies. Simpler and faster administrative procedures, clearer and more reliable review processes for Chinese direct investments and improved visa and work permit procedures are also important for future investments.