Overview

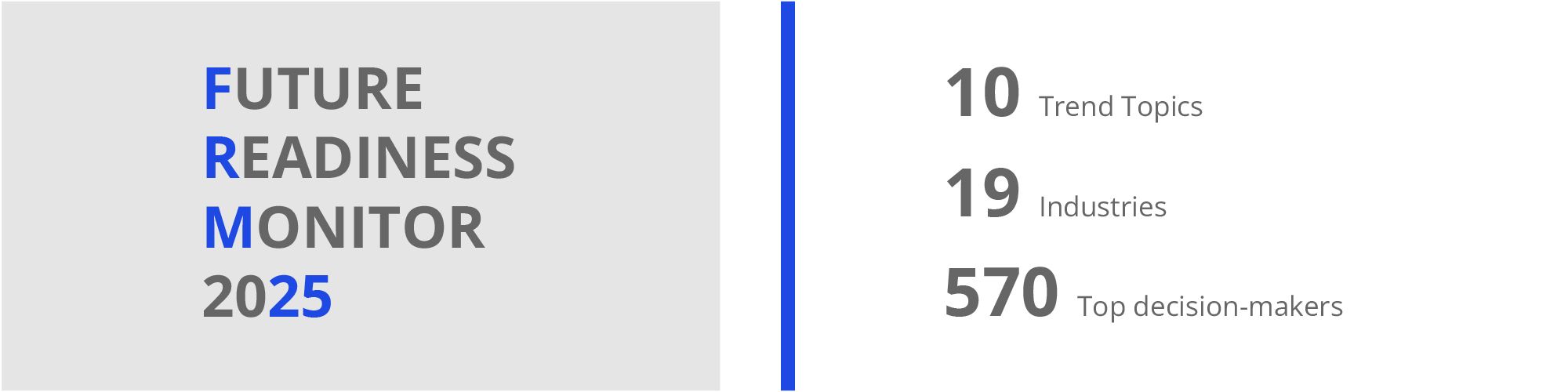

In light of new opportunities and complex challenges, how are German companies assessing their future viability In which areas should they invest? Which investments are being prioritized by partners and competitors? What trends will shape the next three years? Find out in the Future Readiness Monitor 2025, which features insights from CEOs, board members, and strategic managers across 19 key industries.

To assess the preparedness of German companies for upcoming challenges, we surveyed 570 top decision-makers. They were asked to assess their company’s situation in terms of economic sentiment (optimism), current positioning regarding business-critical factors (maturity), current activities and investment priorities (investment priority), and the perceived importance of future challenges (relevance).

The results provide key indicators of the extent to which companies in Germany already meet the prerequisites for future success.

Dr. Ladislava Klein

Member of the Managing Board, CMO, Head of Family Businesses

KPMG AG Wirtschaftsprüfungsgesellschaft

The most important findings

Optimism

71 per cent of all respondents were optimistic about the future prospects of their company over the next three years - almost half of them very optimistic. Only four per cent are very pessimistic about the future.

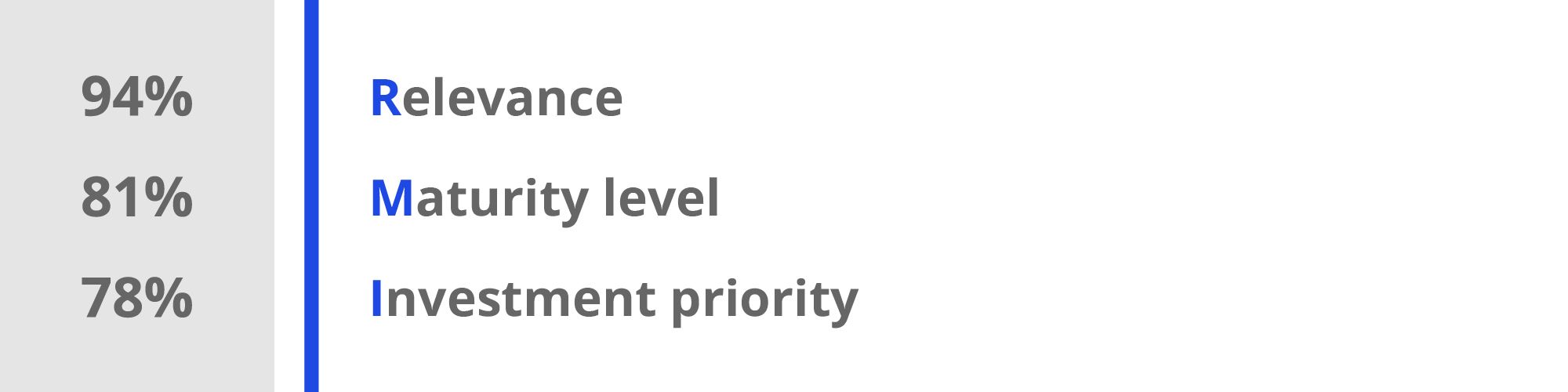

Relevance

The topics of combating cybercrime and workforce transformation were rated as highly relevant for their company by 94 per cent of respondents.

The use of AI, both for automation and for innovation, is of great importance to nine out of ten respondents. For one in four companies, the consideration of climate risks and consequential damage from climate change currently plays no or only a minor role in corporate strategy and planning, although the requirements for climate protection are increasing.

Investment priority

More than 70 per cent of respondents prioritise workforce transformation and the use of AI solutions for innovation and automation in their investments over the next three years.

Despite the highest level of maturity, coping with cybercrime remains a high priority for planned investments at around eight out of ten companies. A low investment priority was given to the topics of regulation and governance (33 per cent) and realignment and business model transformation through M&A, cooperation or joint ventures (31 per cent).

Maturity level

In the Future Readiness Monitor, 66 per cent of the companies surveyed believe they are well or very well positioned to meet the current challenges. An increase of four percentage points compared to 2024.

When it comes to coping with cybercrime, 81 per cent of all respondents indicated a high level of maturity. The use of AI solutions for innovation and automation showed a low level of maturity. Here, only 44 per cent of companies feel they are sufficiently well positioned.

The trends in detail

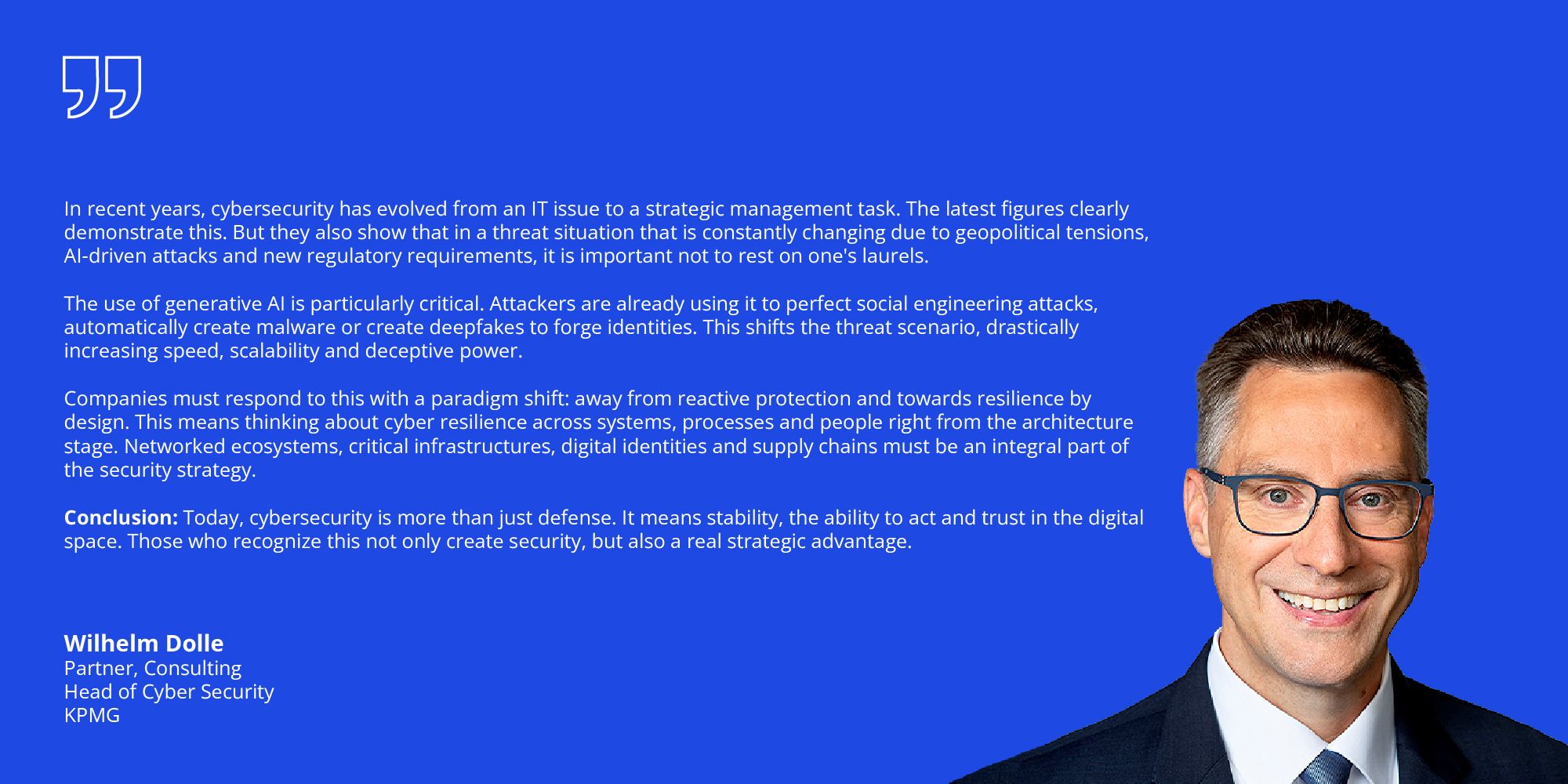

Holistic strategies for dealing with cybercrime

Increasing digitalisation, the geopolitical situation, and the use of AI in cyber-attacks are amplifying risks for companies. An effective cyber strategy includes risk assessment, prevention, and rapid response mechanisms. In addition to technical protective measures, targeted training and regulatory requirements, such as the AI Act, NIS2, DORA, or the GDPR, are essential for effectively countering cyber threats.

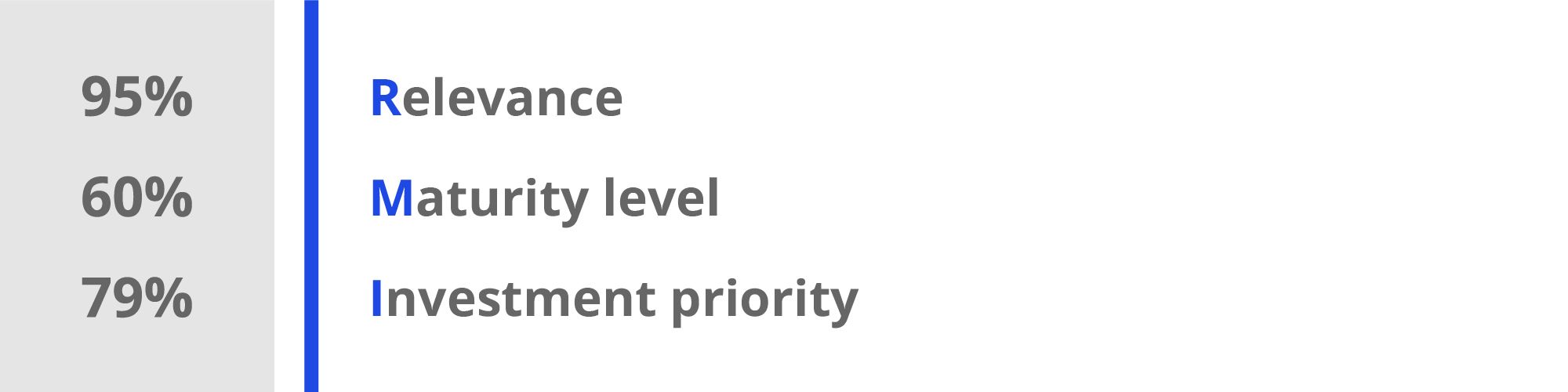

Relevance

Once again, the management of cyber and white-collar crime is the top agenda item for German companies this year, ranking first across all three dimensions. Its relevance has increased again compared to the previous year: Overall, 94 per cent of respondents consider the topic to be of high importance, with 81 per cent rating it as very high. In view of geopolitical tensions, increasing attacks on state and economic infrastructures, and advancing digitalisation, the threat landscape has become even more acute. The focus remains on critical infrastructure, including energy, transport, healthcare, administration, and the media. At the same time, SMEs and public institutions are also increasingly being targeted, often through complex ransomware attacks. The close networking of German companies means that attacks on supply chains and IT service providers are particularly effective, increasing the urgency of holistic security strategies.

Maturity level

This topic also once again leads in terms of maturity. A total of 81 per cent of companies rate their cyber defence as high, which is an increase on the previous year (77 per cent). Many companies have strengthened their security structures as a result of digital transformation, expanding the relevant skills in the process. As attackers become increasingly professional and increasingly operate in well-organised groups with financial resources, ongoing development is of crucial importance.

Investment priority

The willingness to invest in combating cybercrime remains high, with 78 per cent of companies are planning to invest heavily in this area. This demonstrates that companies are increasingly recognising cybercrime as a strategic risk, not just an IT issue.

According to the KPMG study "e-Crime in the German Economy 2024", more than one in three German companies has been the victim of cyber-attacks in the past two years, with 57 per cent of these companies experiencing an increase in damage. Furthermore, 65 per cent expect the threat to increase over the next two years. Given these figures, it is logical that investments are increasingly being channelled into areas such as vulnerability management, identity and access management, and security monitoring – important levers for reducing attack surfaces and strengthening resilience.

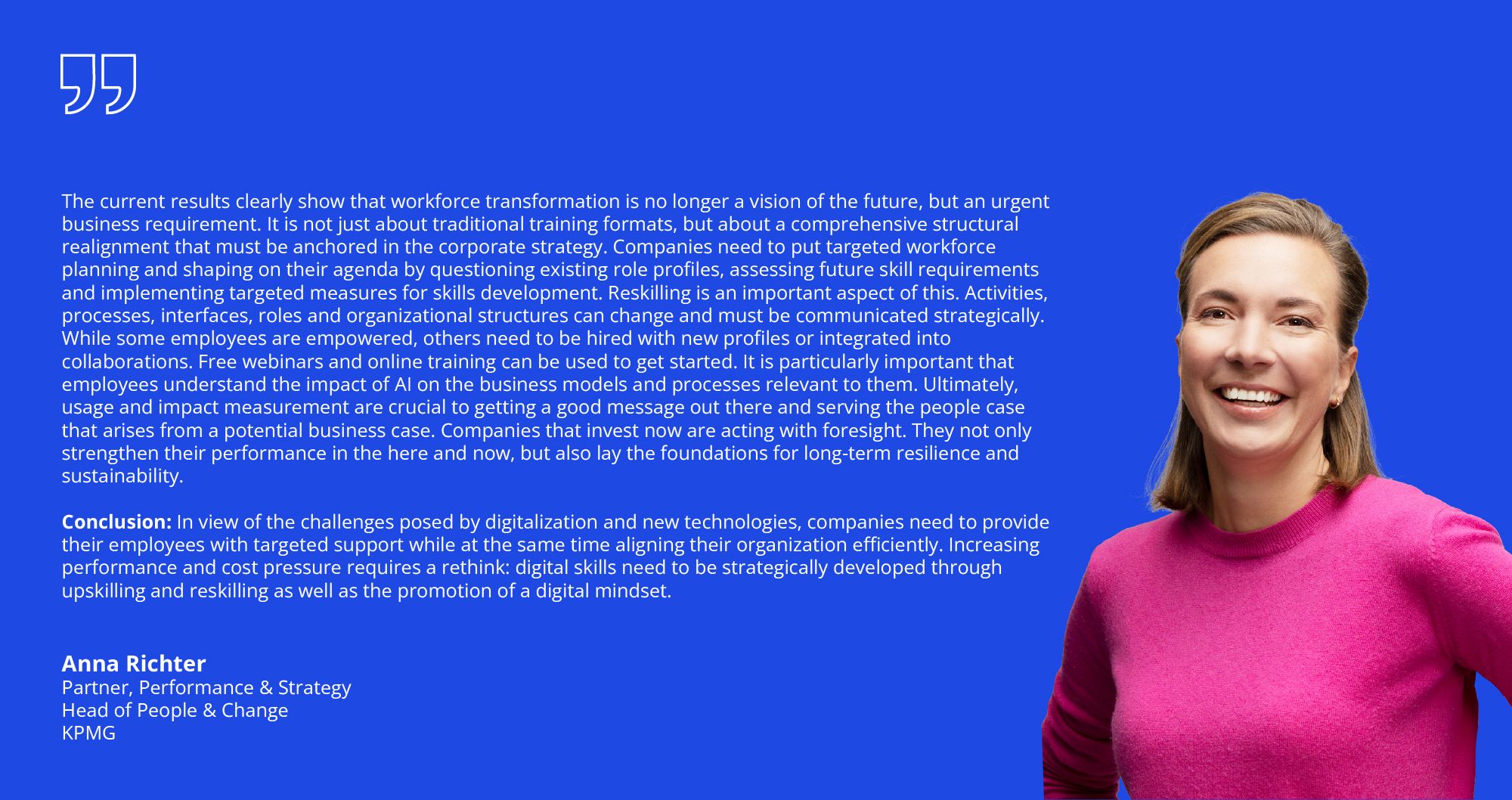

Strengthening digital skills and preparing teams for the future

In view of the challenges posed by digitalisation and new technologies, companies must provide their employees with targeted training an align their organisations efficiently. The increasing pressure to perform and control costs demands a shift in mindset: digital skills must be developed strategically through upskilling and reskilling, and a digital mindset must be promoted, while also striking the right balance in team structures.

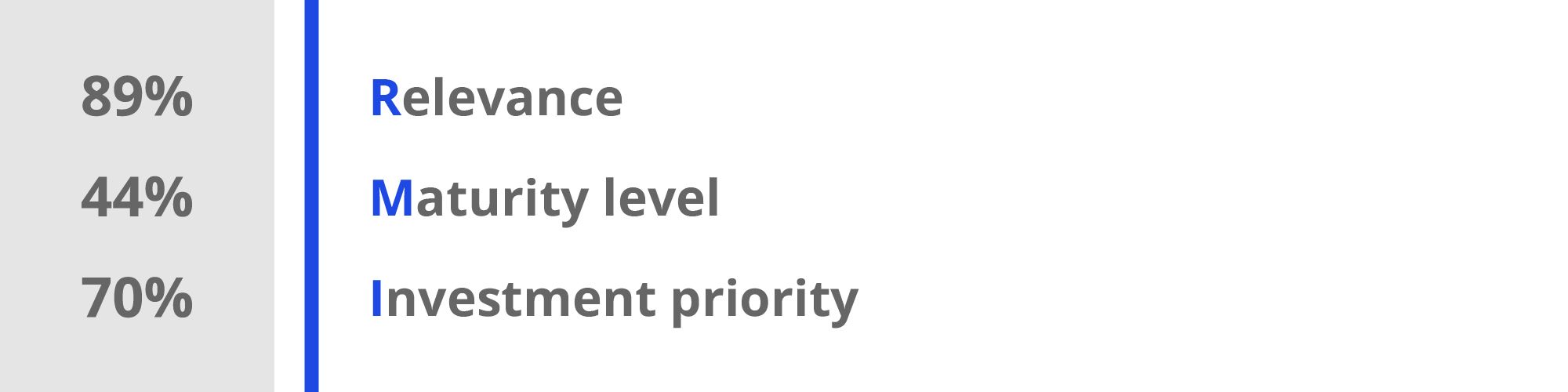

Relevance

Our study shows: Workforce transformation is one of the top issues for German companies. In order to meet digital requirements, they are specifically promoting the digital skills of their employees and the adaptability of their organisations. In doing so, they are establishing sustainable working models.

In order to remain competitive, the focus is shifting towards the effective use of AI and automation. One of the biggest hurdles is the lack of transparency regarding existing and future skills requirements. Systematic skills mapping is therefore becoming a key element in targeted reskilling and upskilling, and thus in creating a future-proof workforce.

Maturity level

The maturity level of companies lags well behind the relevance assessment. This indicates that, while many companies have recognised the need, few have embedded implementation. Changes in corporate strategy require adjustments to the operating model, role profiles and skill sets, and call for a comprehensive analysis of the existing organisation and targeted realignment. In particular, the use of new technologies presents many companies with challenges, as digital tools need to be meaningfully integrated and made accessible to all.

Investment priority

Workforce transformation is currently one of the areas that companies are prioritising. Over the next three years, eight out of ten companies are planning to invest more in this area. This is a direct response to the existing implementation backlog: many companies recognise the need for structural changes, new technologies and employee training, but lack a suitable, comprehensive implementation strategy. This includes assessing future skill requirements, introducing suitable tools, planning change strategically and communicating it clearly, and providing targeted training measures to close skills gaps.

Automation of business processes through artificial intelligence and other technologies

Automating business processes with AI and other technologies boosts efficiency, improves quality and frees up employees to focus on more valuable tasks. This improves decision-making and makes work more attractive, which is an important factor in addressing the shortage of skilled labour. These technologies also offer new solutions. At the same time, it is crucial to promote digital skills to prepare employees to work with these new technologies and to enable them to continuously develop their skills.

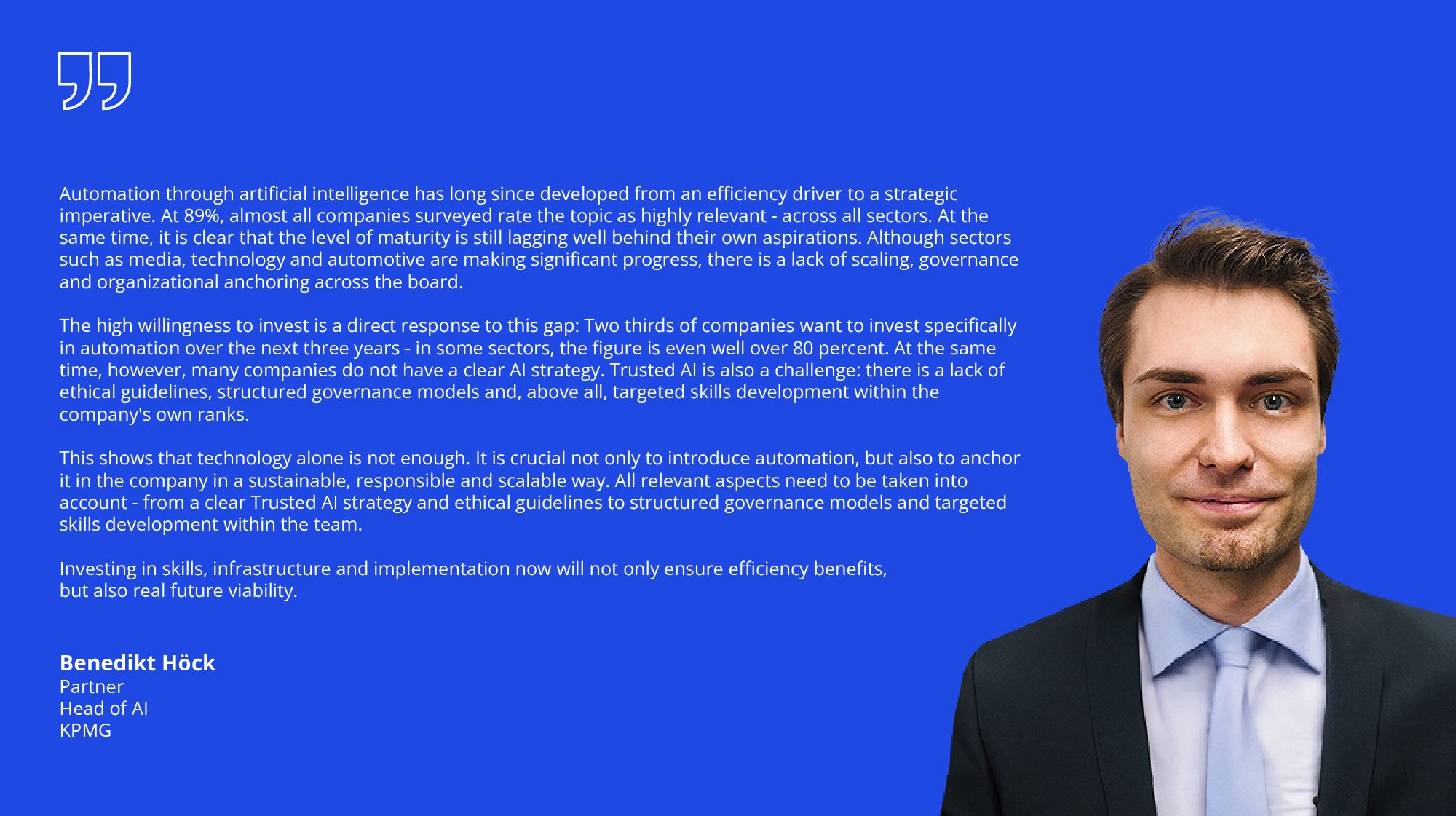

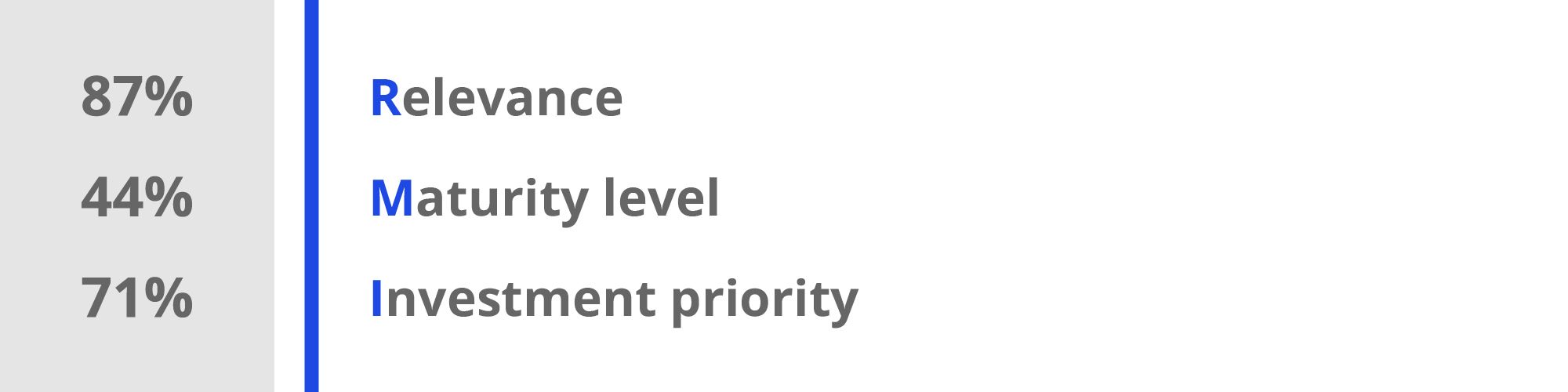

Relevance

The automation of business processes using AI and other technologies is highly relevant to German companies today. Overall, 89 per cent of respondents consider the topic to be highly relevant. This growing importance is reflected not only in technological progress, but also in the increasing strategic integration of automation in many companies. Automation is increasingly seen as the answer to rising complexity, costs, efficiency pressures and the shortage of skilled labour.

Maturity level

Despite the high level of relevance, there is still a clear discrepancy between aspiration and reality in terms of maturity. Only around 44 per cent of companies rate themselves as highly developed, which is a slight increase on the 38 per cent recorded the previous year.

This discrepancy is particularly evident in AI applications. While 97 per cent of companies now have an AI strategy, many are lacking concrete implementation in terms of trustworthiness and governance.

According to the KPMG study "Generative AI in the German Economy 2025", 74 per cent of companies have not yet established a company-wide strategy for trusted AI. Furthermore, two out of three companies lack clear ethical guidelines and governance structures for AI usage.

Investment priority

A total of 70 per cent of companies state that they will prioritise this topic in their investments over the next three years, an increase of five percentage points on the previous year.

There is momentum in the area of generative AI: according to the KPMG study "Generative AI in the German Economy 2025", over 80 per cent of companies intend to increase their budgets, with around half planning to increase them by at least 40 per cent.

More than one in four companies already has the necessary expertise, often within their data analytics teams.

*KPMG study: Generative AI in the German economy 2025

Artificial intelligence for innovation

Using AI in targeted ways drives innovation, enables new business models, accelerates development processes and optimises data-driven decision-making. Market potential can be identified earlier, products can be developed more efficiently, and individual customer solutions can be created. Generative AI enables creative approaches in design and research. Furthermore, the use of AI is accelerating the development of adjacent key technologies such as digital twins, quantum computing, Web3, and blockchain as part of rapid technological convergence. Patent analyses show that cross-technology innovation processes are significantly faster. To ensure successful deployment, employees must develop the necessary competencies and comply with regulatory requirements such as the EU AI Act. Rather than speaking generally about 'AI', it is essential to identify distinct technologies, ranging from classical machine learning (ML) and deep learning to natural language processing (NLP) and computer vision, as well as physical AI approaches such as robotics, smart materials and the metaverse, and 'living intelligence', which includes biological systems, sensor technology, and bio-inspired technologies.

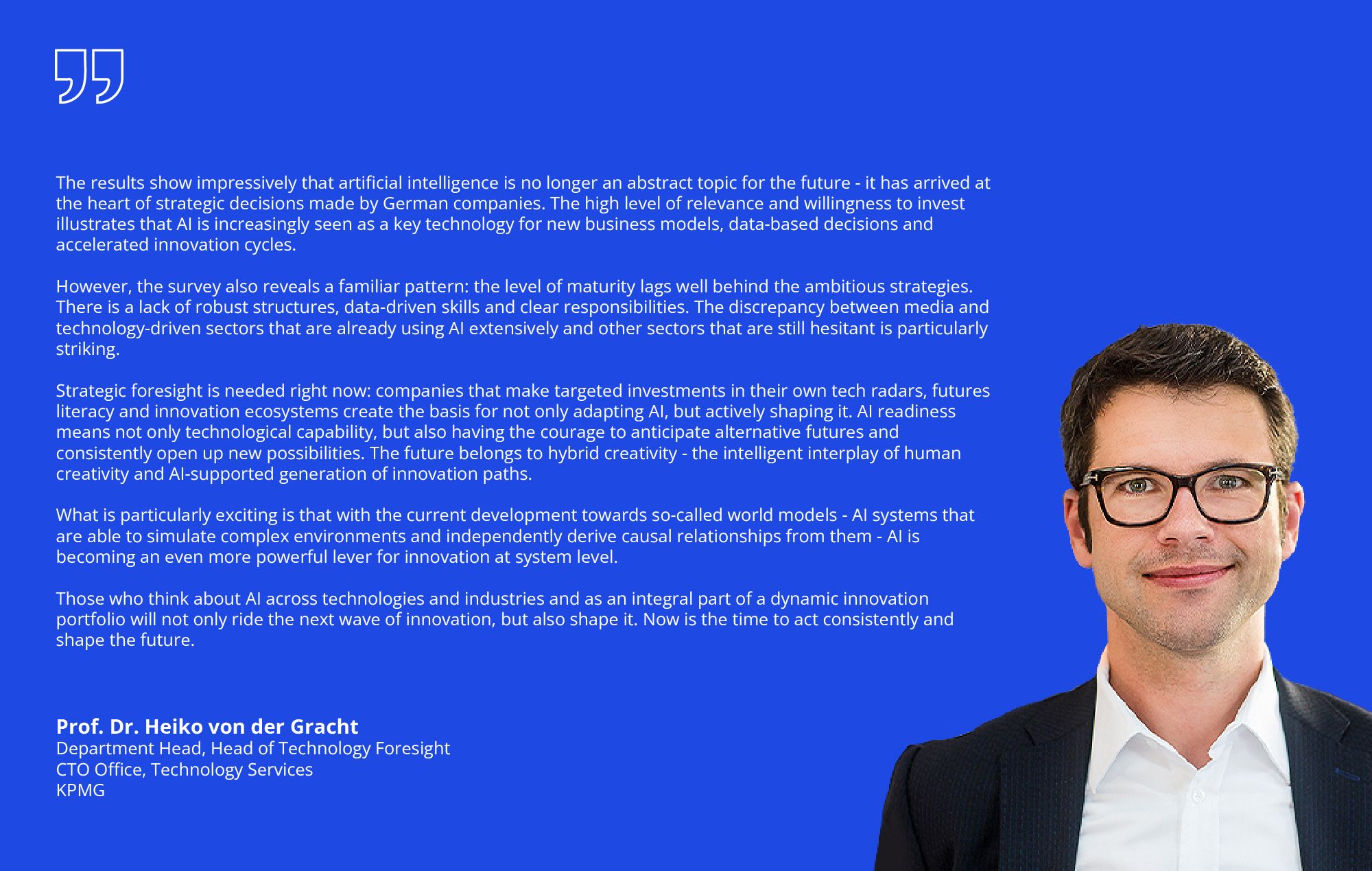

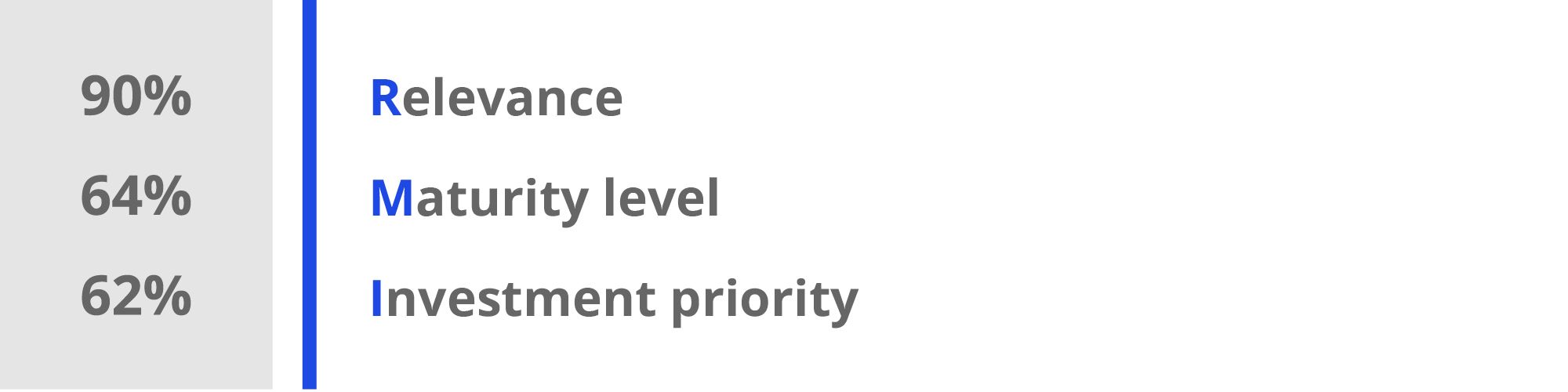

Relevance

Almost nine out of ten companies consider the topic to be highly relevant.

This assessment highlights the growing urgency of using AI, particularly in the context of innovation. Companies recognise that AI is much more than a technological gimmick; it accelerates holistic innovation management, for example by facilitating new business models, efficient processes, data-driven decision-making, the early identification of market potential and better, more personalised customer solutions. A key driver is the fear of missing the crucial moment to get started, often described as FOMO (fear of missing out). At the same time, AI is shifting the understanding of innovation from individual, isolated initiatives to dynamic ecosystems spanning technologies and industries. Future-proof companies no longer consider innovation solely within their own sector but are developing cross-technology and cross-industry strategies to identify and capitalise on new market opportunities early on.

Maturity level

The assessment of maturity is significantly lower. More than one in three companies rate their level of maturity as low. The results of the KPMG Global Tech Report 2024 also confirm this: only 31 per cent of companies have successfully scaled and integrated their AI applications into daily operations. Many companies remain stuck in the testing phase or have not progressed beyond initial proofs of concept. Organisations often follow a familiar pattern, described as the 'hype cycle': initially, there is a phase of inflated expectations, during which pilot projects and proofs of concept are launched quickly. However, without a viable scaling strategy, the 'trough of disillusionment' often follows, as the transition from prototype feasibility to productive, value-generating use fails due to technological complexity, poor data quality, inadequate IT infrastructure or a lack of internal expertise.

Investment priority

Investment planning is also increasingly focusing on the use of AI for innovation. According to 71 per cent of companies surveyed, it is a high investment priority. The focus is on achieving tangible economic benefits, such as more efficient processes, shorter innovation cycles, data-driven decision-making and enhanced product development. This shows that AI is increasingly being seen as a strategic value driver rather than just an area for experimentation.

Agility – the growing need to adapt quickly and flexibly to rapidly changing conditions

In times of poly-crises and dynamic markets, agility is crucial. Flexible organisational structures, scalable processes, and an adaptable technological infrastructure enable companies to remain efficient and resilient.

Relevance

For 90 per cent of respondents, the company’s agility remains highly relevant, maintaining the same high level as in the previous year. This consistently strong rating shows that agility is not a short-term trend but is firmly embedded in corporate strategy. Sectors facing high levels of dynamism, due to increasing trade barriers in the international environment, high innovation pressure, or accelerated consumer change, rate the topic above average.

Maturity level

Almost two thirds of companies rate their level of maturity as high, suggesting that agile principles and structures are already well established in many organisations.

Nevertheless, just under a quarter of companies still rate their level of maturity as low. This group is taking a considerable risk, particularly in an environment characterised by uncertainty, speed and external change. In such an environment, agility is not just a matter of efficiency, but an increasingly important prerequisite for responding to unforeseeable developments.

Investment priority

As with the maturity level, around two thirds of companies prioritise the topic highly, while around a quarter give agility low priority in their investment plans. Given the high level of importance and self-assessed maturity, it is expected that agility will become an even greater investment focus in future. This development is not yet clearly reflected in the results.

Translating regulatory and governance requirements into added value

Companies must comply with new legal regulations, such as the EU Taxonomy and the Supply Chain Duty of Care Act and convert them into business value. This can be achieved through transparent reporting or sustainable investments, for example. Governance is becoming increasingly complex, as operational, strategic, legal, IT, geopolitical and environmental, social and governance (ESG) issues all need to be coordinated. Close cooperation between the legal, compliance, IT and finance departments is required to achieve this.

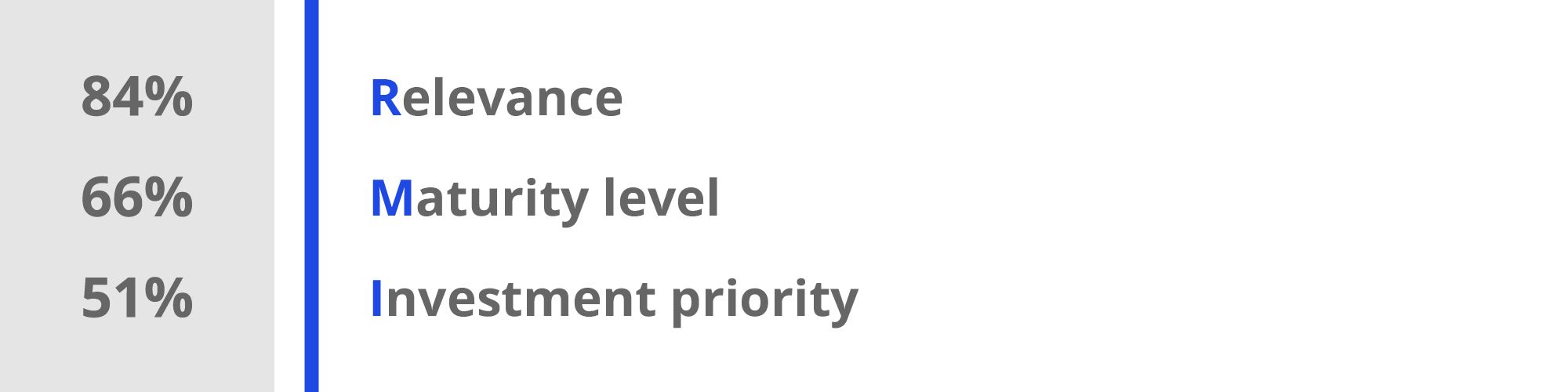

Relevance

The importance of regulation and governance has risen significantly since last year. The topic is now considered highly relevant by 84 per cent of respondents. This is a substantial increase compared to last year, when the figure was 65 per cent. Growing pressure to act due to new regulatory frameworks, such as the Corporate Sustainability Reporting Directive (CSRD), Environmental, Social and Governance (ESG) reporting obligations, and the Supply Chain Duty of Care Act, is contributing significantly to the importance of this topic. Companies are increasingly recognising that governance is not just a compliance issue but must be closely aligned with strategic leadership and sustainable corporate management.

Maturity level

There has been a noticeable development in the level of maturity. A total of 66 per cent of respondents rated their company's level of maturity in the areas of regulation and governance as high. This represents a significant increase, given that only 48 per cent held this view in the previous year. This means that regulation and governance is now one of the areas in which companies consider themselves to be strongest. This indicates that many companies have made structural and procedural progress, for example through clearer responsibilities and greater collaboration between legal, compliance and IT departments, as well as the digital monitoring of regulatory requirements.

Investment priority

The investment priority has hardly changed. Just under half of those surveyed rated it as high for the next three years, which is almost the same as the previous year. At the same time, around a third of companies (33 per cent) state that it is currently a low priority. Despite growing relevance and an increased level of maturity, therefore, the willingness to invest remains restrained. This may be a sign that many organisations have already incorporated the topic into their structures or are making selective investments.

Increasing geopolitical tensions and trade conflicts are putting pressure on businesses to minimise risk in their models, global footprints and value creation networks.

The rise in geopolitical tensions and trade conflicts presents companies with the challenge of adapting to a volatile global economy. Suitable strategies must be developed to minimise the associated negative effects. This includes diversifying supply chains and sales markets, regionalising activities, creating more flexible structures, and expanding into new markets.

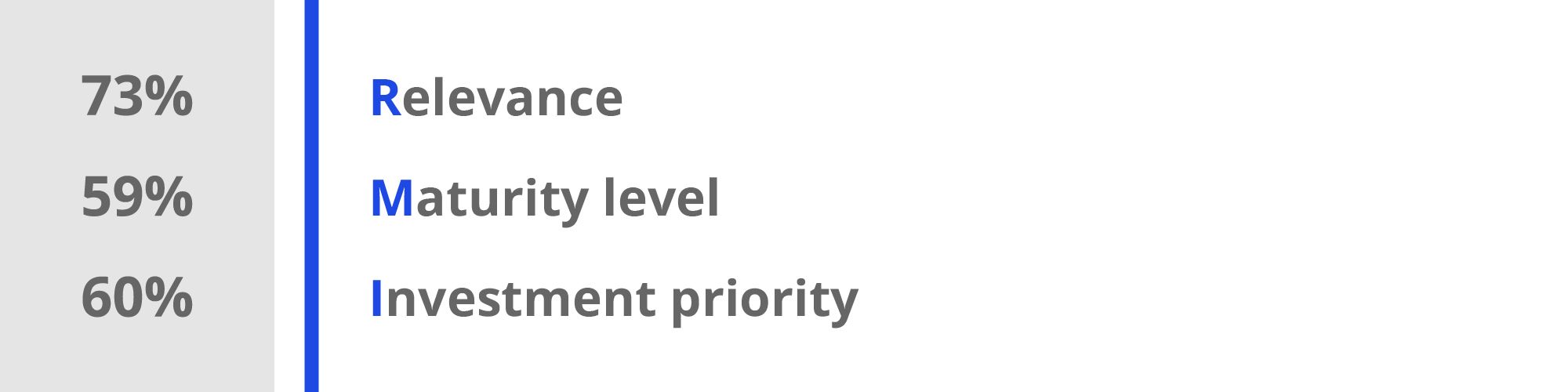

Relevance

73 per cent of respondents considered the topic to be highly relevant, which is a significant increase compared to 63 per cent last year. Conversely, the proportion of respondents who rated the topic as having low relevance fell by six percentage points to 19 per cent.

This stronger position in a comparison of topics highlights the growing importance of geopolitical tensions and trade conflicts for strategic decision-making, particularly in the context of cross-border transactions. Geopolitical uncertainties, volatile financing conditions and protectionist trade measures are making security planning considerably more challenging. Accordingly, tectonic shifts in the global balance of power, economic regions and trade relations are among the key risks identified by KPMG for 2025. The assessments clearly reflect this: Geopolitical dynamics are already having a far-reaching impact on global supply chains, market strategies, and location decisions. They are perceived as a highly relevant topic across industries.

Maturity level

A total of 59 per cent of respondents continue to rate their company's maturity level as high. Compared to 2024, the proportion of respondents rating their maturity as low has fallen by seven percentage points to 20 per cent. This indicates that many companies have taken targeted measures to strengthen their organisational and operational resilience in response to recent crises.

Investment priority

There is a clear upward trend in willingness to invest. A total of 60 per cent of companies intend to prioritise investments to address geopolitical risks and trade conflicts over the next three years. This represents a ten-percentage-point increase compared to 2024. However, at the same time, 28 per cent still rate the investment priority as low, which is a surprisingly high figure and points to continued reluctance to invest in parts of the economy.

Consideration of ESG issues when investing

Sustainability is a key driver of investment. Financial institutions, investors and customers are increasingly expecting ESG criteria to be integrated into business models. Companies that use ESG criteria strategically can enhance their resilience, minimise risks and secure their long-term company value.

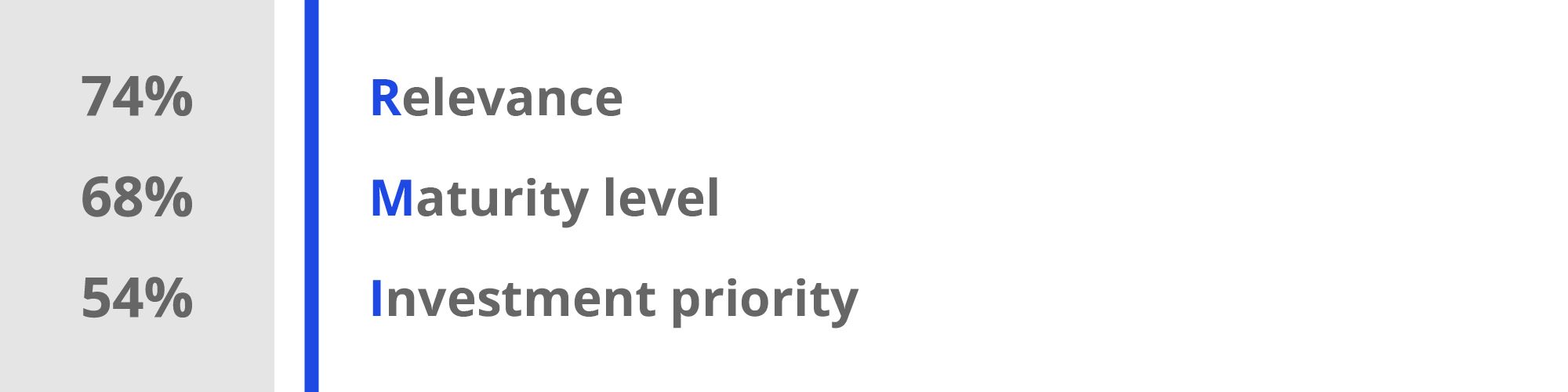

Relevance

74 per cent of the companies surveyed considered the topic to be highly relevant. This is a significant increase compared to the previous year (65 per cent). Although ESG is not yet regarded as a priority area for action, perceptions have improved. The increased relevance can also be explained by the fact that ESG requirements affect the entire value chain and are increasingly influencing companies and individual business models. Furthermore, customers, investors and talent are forming their expectations of companies.

Maturity level

The level of maturity in integrating ESG into corporate processes has improved significantly. A total of 68 per cent of companies consider themselves to be at a high level in this area, which is an increase of eleven percentage points compared to the previous year (57 per cent). This indicates that an increasing number of companies are implementing concrete measures to anchor ESG in their structures, for example through uniform governance or standardised reporting.

Investment priority

In contrast to the areas of relevance and maturity, the assessment of investment priority has weakened. While 63 per cent of respondents gave ESG a high investment priority in 2024, this figure has fallen to 54 per cent this year. This nine-percentage-point decline may suggest a certain level of 'investment saturation'. Many companies have implemented initial ESG measures and are now shifting their focus to consolidation, internal anchoring and efficiency. Additionally, macroeconomic challenges, such as potential changes to customs regulations, the implementation of trade restrictions, and other protectionist measures, necessitate the reassessment and adjustment of investment priorities in the short term. Nevertheless, ESG remains a long-term investment theme, particularly in light of transparency requirements, digital ESG solutions, and safeguarding global supply chain standards.

Realignment and business model transformation through strategic transactions

Strategic transactions, such as mergers and acquisitions (M&As), collaborations, and joint ventures, enable companies to optimise their portfolios, access new markets, and exploit synergies. A strong strategic fit and the clear integration of new business areas are key to success.

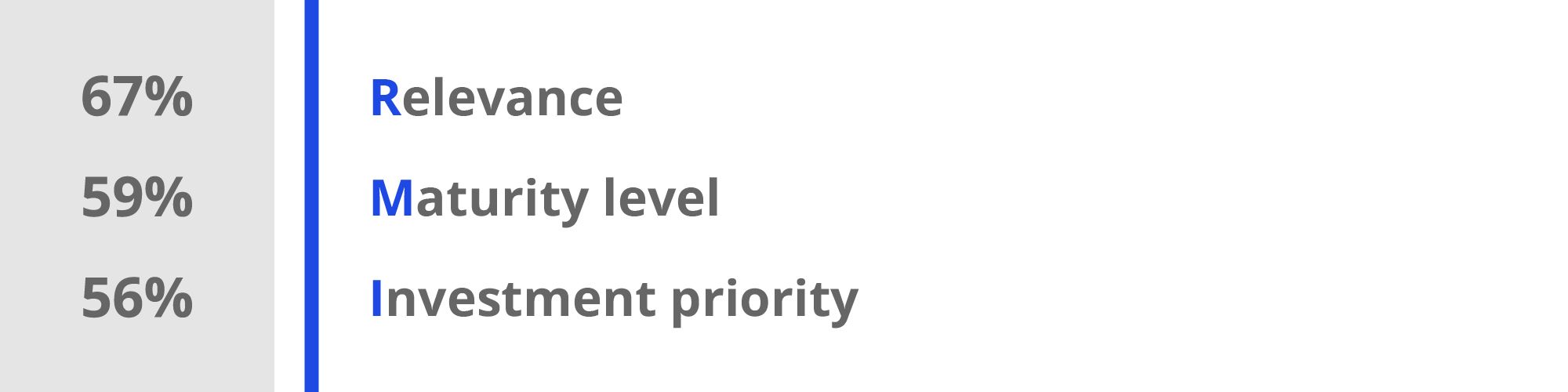

Relevance

Compared to other topics in the survey, the topic is currently of lower priority to many companies. Nevertheless, 67 per cent of respondents rate its relevance as high. However, uncertainty in the global economic and trade order, as well as volatile market conditions, are dampening M&A activities. Many companies are currently adopting a more cautious approach to cross-border transactions, as geopolitical tensions, volatile financing conditions and rising trade barriers resulting from protectionist customs policies are making conditions unpredictable. Shifts in global supply chains and political intervention in international trade flows also make it more difficult to plan and evaluate potential transactions.

Maturity level

When it comes to maturity, the picture is mixed: In this area, 59 per cent of companies rate themselves as highly mature. At the same time, one in four companies classifies itself as having a low level of maturity. Medium-sized companies often lack structured processes, dedicated M&A teams and reliable transaction experience. Cooperations and joint ventures also demonstrate that strategic objectives and operational integration are frequently underdeveloped.

The KPMG M&A Outlook 2025 confirms this trend. Most companies surveyed identified integration, valuation and due diligence as the biggest hurdles in the transaction process.

In particular, corporates struggle with a lack of integration between strategy, implementation and post-merger integration. Almost 90 per cent of respondents report significant challenges during the closing process.

Investment priority

Over the next three years, around 56 per cent of companies plan to actively promote the topic of M&A. However, 25 per cent consider it to be a low priority. This reluctance is understandable, given the current tense market environment. According to the KPMG M&A Outlook 2025, the main hurdles cited by companies are high valuation expectations, a volatile interest rate environment and general market uncertainty.

Consideration of climate risks and consequential damage from climate change in corporate strategy and planning

Companies play a central role in the transition to a climate-neutral economy. In addition to reducing emissions, they must also integrate climate risks and consequential damage, such as extreme weather events or supply chain disruptions, into their strategy. The importance of reporting on climate risks for climate protection is growing, and new opportunities are emerging. It is therefore important for companies to align their planning and strategy accordingly.

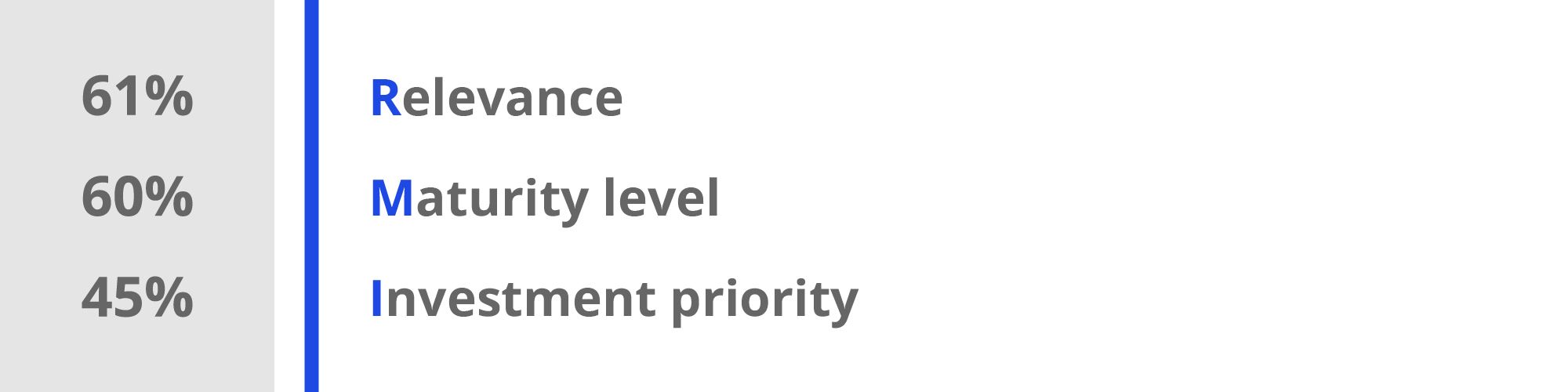

Relevance

A total of 61 per cent of the companies surveyed considered the topic to be highly relevant. Compared to the previous year (67 per cent), this represents a slight decline. This suggests that, despite their fundamental importance, climate risks are currently being overshadowed by other pressing challenges. At the same time, particularly affected sectors, such as energy, raw materials and insurance, assign significantly higher relevance than less exposed industries. However, this contrasts with the 25 per cent who rate the topic as having low relevance.

Maturity level

60 per cent of respondents rated their company’s maturity level as high. This suggests that many companies have established initial structures or measures to systematically record and evaluate climate risks, for example through climate risk assessments or scenario analyses as part of their ESG reporting obligations. Nevertheless, there is still a considerable need for action. A total of 21 per cent of companies rate their own level of maturity as low. This may indicate that comprehensive integration into business processes and strategic planning has not yet been achieved.

Investment priority

Despite increasing regulatory requirements, such as the EU Taxonomy and the Corporate Sustainability Reporting Directive (CSRD), and the growing threat of climate-related damage and natural disasters, investment in sustainability issues lags behind investment in other future-oriented fields. Only 45 per cent rate the investment priority as high for the next three years. This represents a significant decline compared to 62 per cent in the previous year. This may be related to short-term budget shifts in the context of economic uncertainty. At the same time, there is a risk that companies will not make the necessary adjustments in time, delaying precautionary measures and thus becoming more vulnerable to climate-related disruptions. Considering the increasing requirements and risks, this is likely to become particularly pertinent for the 37 per cent of companies that currently prioritise sustainability low.

Interactive dashboard

Discover the results of the trend study in detail. Which topics are at the top of the agenda in your industry? Where are the investment priorities?

Our interactive dashboard provides you with answers - customised, structured and at a glance. Filter the results of the study by sector and gain insights into the average ratings of respondents on a scale of 0 to 10.

Industry reports

How well prepared are German companies for the trends and requirements of the future? In which areas should they invest and where are others investing? What developments will characterise the coming years and what is the future viability of individual sectors?

The compact short reports summarise the key findings in a clear and sector-specific manner - for a quick, well-founded overview of relevant trends and developments.

Further insights

Here you will find the overall reports from previous years - for reading, comparing and categorising current developments. (In German only)

The results are based on a standardised survey on a scale of 0 to 10:

- 0 stands for non-existent (e.g. no relevance/investment priority, no degree of maturity, very pessimistic)

- 10 for a maximum value (e.g. extremely high relevance/investment priority, very high degree of maturity, extremely optimistic)

- 5 is a neutral value, with no clear tendency

The answers were clustered into scale ranges in order to visualise different levels of expression:

- 0-4: low level

- 5: neutral

- 6-10: high level

- 8-10: very high (if labelled accordingly)

This website only shows percentages within these scale ranges - in particular the proportion of respondents who categorised a topic in the 6 to 10 range. This allows a quick assessment of how many companies rate a topic as relevant, prioritised or decisive for the future.

The topics were not ranked. The percentage values serve to simplify understanding, but do not replace the differentiated evaluation using mean values, as used in the full study. The neutral value (5) is not included in the percentages and should be taken into account when interpreting the results.