In view of rising stakeholder expectations and increasing strategic relevance, it is important for companies to take a proactive approach to assessing and managing physical and transition risks. This allows climate risks to be minimised and potential opportunities to be exploited.

KPMG specialises in the identification and assessment of climate risks and opportunities and offers practical tools and solutions for companies to assess the impact of climate change on their business. Using these tools, organisations can mitigate risks and create new pathways for sustainable growth.

Our team of experts can help your company analyse the complex impacts of climate change and make informed decisions based on recommendations.

Why are KPMG and Zurich Resilience Solutions working together in this area?

KPMG and Zurich Resilience Solutions (ZRS, part of the Zurich Insurance Group) support companies in reducing climate risks. To effectively manage these risks and capitalise on the opportunities they present, companies need an integrated approach. By combining the expertise of KPMG and ZRS, we can provide a holistic and market-leading climate risk assessment that provides a solid foundation for strategic decision-making and action.

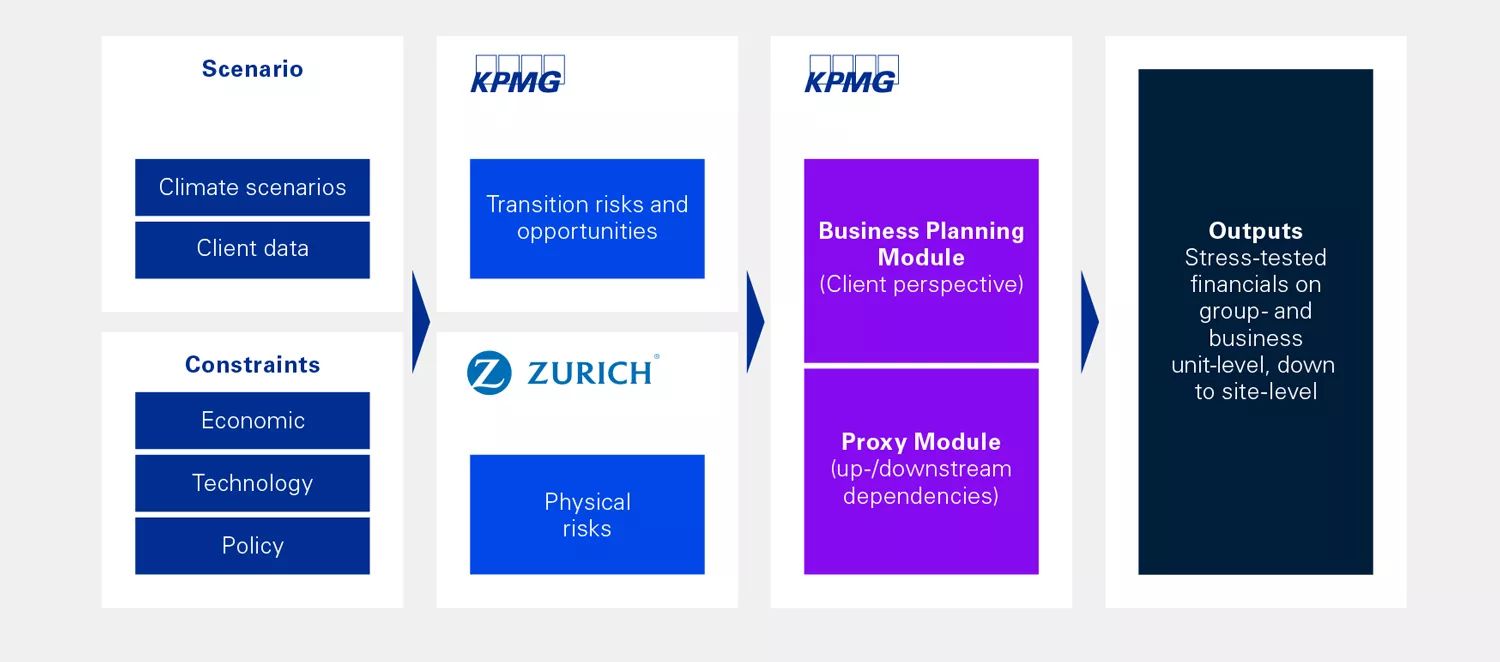

ZRS focuses on physical risks, i.e. the impact of climate change on property, plant and equipment and operations at Group and site level. This includes, for example, extreme weather events, rising sea levels and forest fires.

KPMG, on the other hand, deals with business-related risks, so-called transition risks, which arise from social and economic changes towards a low-carbon and more environmentally friendly future. These risks typically include political and regulatory risks, technological risks, market risks and reputational risks.

KPMG has advanced quantitative and modelling capabilities and many years of experience in modelling climate impacts for our clients.

KPMG's collaboration with ZRS leverages their extensive physical risk expertise, while ZRS benefits from KPMG's track record in assessing and strategically managing business-related risks and opportunities. Our offering helps to increase the resilience of organisations and ensure the achievement of sustainability goals.

The partnership with KPMG once again underpins our endeavour to accompany and support companies worldwide in overcoming the challenges of climate change. Various factors such as extreme weather events pose a threat to businesses and communities worldwide. But political and social climate requirements also pose ever greater challenges. Together with the experts at KPMG, this is precisely where we want to start and support companies in recognising and assessing climate risks at an early stage and taking holistic action.

Effective management of climate risks has become a priority for all companies. In order to strengthen corporate resilience sustainably and along the entire value chain, medium and long-term changes in the risk landscape must be taken into account now. By combining Zurich's strong capabilities in physical risks with KPMG's expertise in transitory risks, we enable companies to make informed, strategic decisions based on a comprehensive assessment of specific climate risks and consideration of the overall economic ecosystem.

What are we offering?

Regulatory changes, pressure from shareholders and the increasing reality of climate change have increased the importance of climate-related risk assessments. In the next 2-3 years, large companies from various sectors will have to carry out scenario-based climate risk assessments.

- Our offering enables us to identify, quantify and advise on both physical and transition risks. It is suitable for organisations in almost all industries.

- Specialised experts from our network provide detailed insights and methodological adjustments to meet the individual requirements of each client.

We offer a detailed climate risk and opportunity assessment that covers both physical and transition risks and supports companies in fulfilling the requirements of the CSRD in particular, but also other frameworks such as SBTi, TCFD, CDP, GRI and SASB.

Our services include analysing climate risks and opportunities along the entire value chain to identify material impacts. We create a heat map to assess the key drivers, summarise the qualitative results and evaluate the financial impact of physical transitory risks and opportunities in key areas of the business. We also seamlessly integrate the climate risk analysis into the company's risk management and develop strategies and measures to minimise risks. We also focus on the integration of individual transitory opportunities into the company's business development, whereby the changing supplier and sales markets caused by climate change play a special role.

Our climate risk services can include individual or all of the above-mentioned components. We prepare reports that comply with regulatory requirements and offer recommendations for integrating these processes into your permanent ERM framework.

In addition, we provide a reusable methodology that allows companies to recalculate the impact of climate risk under different scenarios, including balance sheet changes and various mitigation options. Our methodology also enables the seamless integration of the results into the risk management process.

Our solution: Comprehensive Climate Risk Management

Together with ZRS, we offer a collaborative and comprehensive approach to effectively manage the physical and transitional risks and opportunities caused by climate change.

Based on our expertise, we conduct thorough climate risk analyses along the entire value chain, from the corporate group and business units down to site level. This enables us to identify significant impacts and make proposals for feasible adaptation and mitigation measures.

Climate risk management should be an integral part of corporate risk management and business strategy. Therefore, we seamlessly integrate our climate risk analysis into existing frameworks, ensuring a robust and comprehensive approach to climate risk management. Our reporting process helps companies to align with international sustainability reporting frameworks and regulations, including TCFD.

Our collaborative advantage: strengthening your sustainability

At KPMG, we value the power of collaboration. Our collaboration with ZRS enables us to offer a holistic approach to climate risk management.

Our cooperation

The combination of our complementary expertise enables a holistic view of climate risks and supports companies in making strategic decisions.

Modelling of transition risks

We specialise in transition risks arising from social and economic changes towards a low-carbon and environmentally friendly future. These risks include regulatory and political risks, market and technology risks and reputational risks. We use our advanced Integrated Assessment Model (IAM) to develop detailed and coherent scenarios.

Customised for you

Our solution can be customised to meet the specific requirements of different industries and clients. KPMG and ZRS have extensive experience of working with a wide range of industries and sectors, allowing us to provide detailed insights and methodological customisation to meet our clients' needs.

Learn how Climate Risk Assessment can help you achieve your ESG goals

Your contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia