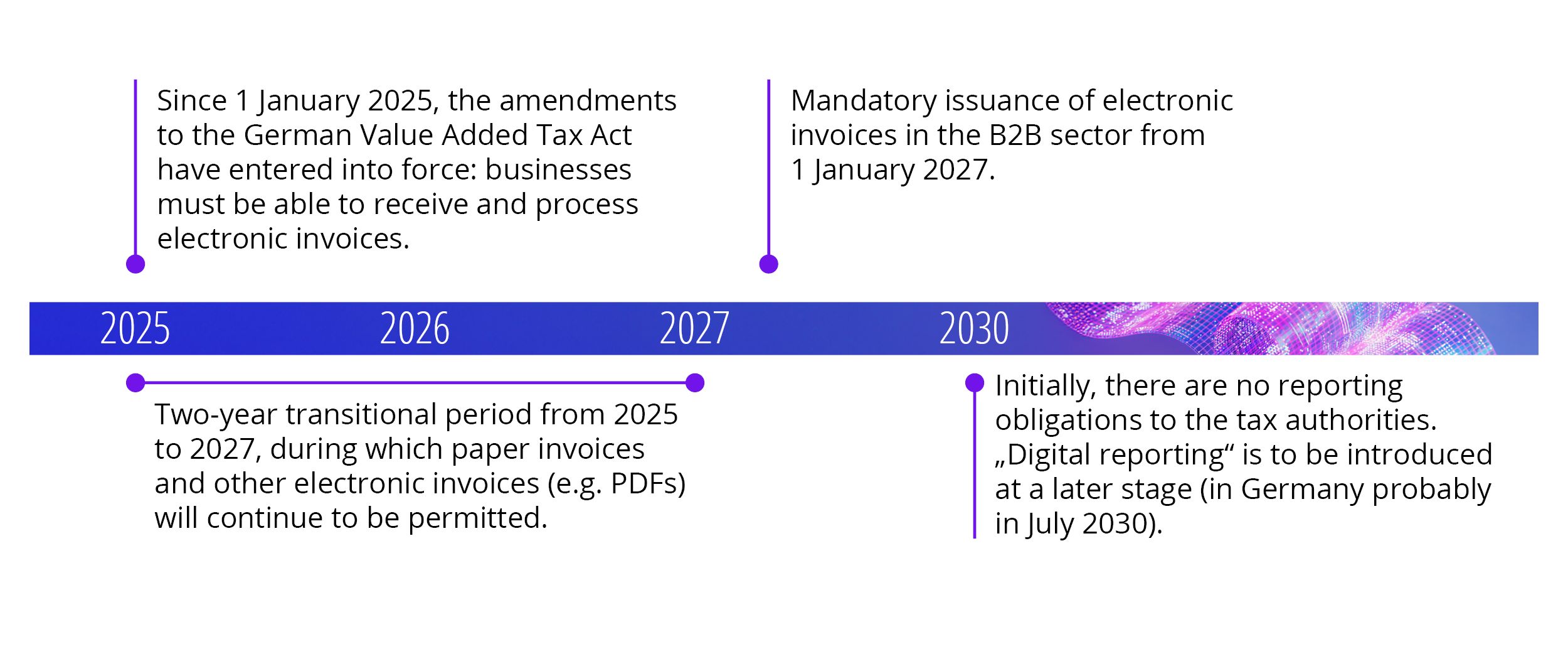

E-invoicing and digitalised invoicing processes are intended to ensure faster and more efficient processing of invoices, greater accuracy and a reduction in formal effort. However, the new requirements pose challenges for companies: With the announcement of the Growth Opportunities Act on 27 March 2024, it is now clear that the obligation to issue electronic invoices, which previously only applied to public clients and their invoice issuers in Germany, will be extended to the B2B sector from 1 January 2025. Application at EU level as part of the "VAT in the Digital Age" (VIDA) initiative is expected to follow from 2028/2030.

What is an e-bill?

An electronic invoice (e-invoice) is an invoice that is issued, transmitted and received in a structured electronic format and enables electronic processing. An invoice in PDF format does not fulfil this requirement.

Timetable

Transition phase until 2027

The key points of the e-bill at a glance

- Mandatory introduction of the EN16931 invoice format (European CEN standard from the B2G sector), i.e. the XRechnung and ZUGFeRD formats that already exist today will generally also be permitted for the B2B sector.

- The EDI procedure with other electronic formats remains permanently permissible if extraction into EN16931 or into a format interoperable with EN16931 is possible.

- There are also exceptions. There is no e-invoice obligation for:

- Small value invoices up to a maximum of EUR 250,

- Invoices for travel tickets,

- Tax-free transactions without the right to deduct input tax,

- B2C sales.

What companies should do now

Due to the rapidly evolving heterogeneous regulatory landscape, companies should develop a global strategy for e-invoicing and digital reporting.

In addition to strategy development, very concrete steps are required:

Analysing and adapting processes

Review existing ERP systems, analyse your invoicing processes, develop cross-border solutions (ERP-integrated and/or via the involvement of a service provider) and maintain your accounts payable and accounts receivable master data.

Development of a digitalisation strategy

Develop a digitalisation strategy, especially if your company has primarily used analogue invoice formats to date.

Communication with business partners

Inform suppliers and customers about the upcoming changes and the new requirements at an early stage.

How we support you

Our team of tax experts will be happy to help you prepare for e-billing, from identifying your requirements to selecting and implementing the right solution for you.

Our colleagues from Digital Process Compliance also provide support in the customisation and creation of digital processes and, as auditors, determine the robustness and conformity of your processes. Our experts will support you in converting to electronic invoice formats and adapting your processes and internal control system.

Get in touch with us.

Brochure

Implementing e-invoicing in a legally compliant, efficient and future-proof manner

Test your AP e-invoicing process using our practical test package and expert support

Further interesting Insights for you (partly in German)

Your contacts

Christopher-Ulrich Böcker

Partner, Tax, Indirect Tax Services

KPMG AG Wirtschaftsprüfungsgesellschaft

Astrid Ras

Director, Tax - Indirect Tax Services

KPMG AG Wirtschaftsprüfungsgesellschaft

Andreas Steffens

Director, Audit, Regulatory Advisory, Digital Process Compliance

KPMG AG Wirtschaftsprüfungsgesellschaft

Patrick Stadler

Senior Manager, Audit, Regulatory Advisory, Digital Process Compliance

KPMG AG Wirtschaftsprüfungsgesellschaft