Green hydrogen is an important component of the energy transition and the German government's goals are correspondingly ambitious: according to the coalition agreement, Germany is to become the lead market for hydrogen technologies by 2030. In reality, however, the sustainable hydrogen economy is still in its infancy in many areas. There are still many steps to be taken at all stages of the value chain - from production, import, transport and storage to application and utilisation - before the market is fully established. In our white paper "Hydrogen: a key to the energy transition?", we shed light on where Germany currently stands and which tasks are particularly pressing.

Executive Summary

Regulatory framework

For the hydrogen market ramp-up to succeed, investors need stable, long-term and attractive market conditions. So far, the regulatory framework for the expansion of the transport and distribution infrastructure has been lacking. The European Commission's delegated act, which clarifies the concrete definition of green hydrogen, is also important. This is currently being criticised from various directions, because: Under certain conditions, hydrogen produced from nuclear power could also be categorised as green. Another point of criticism relates to so-called additionality, as renewable energies are not yet sufficiently available to cover the high demand for green electricity for hydrogen production.

Financial support

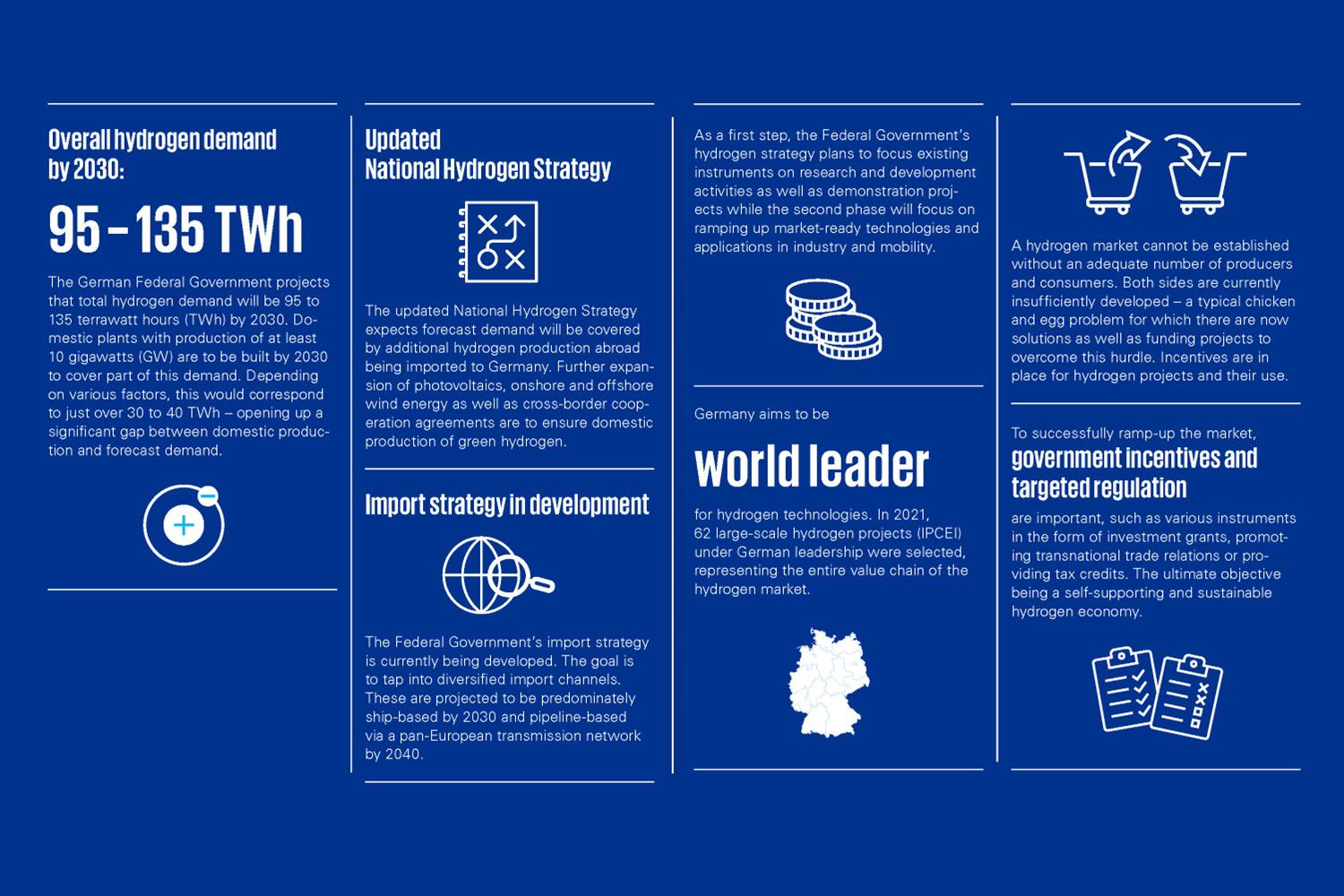

One building block for attractive framework conditions is the accompanying government funding - always with a view to an ultimately self-supporting and sustainable hydrogen market. According to the German government's updated hydrogen strategy, funding will initially focus on research and development activities and demonstrators. In a second phase starting this year, the focus will be on the ramp-up of market-ready technologies. The largest volume of funding is still being provided via the IPCEI programme launched by the European Commission. As part of this programme, 62 projects with an estimated investment volume of 33 billion euros have been selected in Germany alone, which will be co-financed by the federal and state governments. However, it would be advisable not to focus solely on investment grants. Rather, the variable costs of projects that have already been initiated should also be relieved. For example, the current inflation-related cost increases are jeopardising the economic viability of projects that have already been initiated.

Necessary hydrogen imports

Studies predict that the demand for hydrogen, including the resulting downstream products, will increase moderately until 2030 and then dynamically thereafter. The production plants planned in Germany with a total output of up to ten gigawatts will not be able to meet the forecast domestic demand. Instead, we will have to resort to imports. Global supply chains and international partnerships are therefore needed to secure the supply of hydrogen. Germany plans to invest more than 5 billion euros in international hydrogen procurement in the coming years. The first tenders for hydrogen imports have already been launched by H2Global.

With a view to future price developments, the majority of market observers currently assume that green hydrogen in particular can be offered more economically in the future. However, this will require the development of a global liquid hydrogen market with sufficient free quantities. Similar to the energy sources oil and gas, exchange-traded hydrogen products are needed to ensure global pricing and commercialisation of trade flows.

Comprehensive infrastructure

Currently, a large proportion of hydrogen consumption in refineries and the chemical industry is covered by production in the immediate geographical vicinity. Hydrogen refuelling stations are mostly supplied by lorries. In order to enable the use of hydrogen on a large scale, this currently isolated and inefficient infrastructure must be significantly expanded in the future. This is particularly true due to the geographical distance between the north-east German green electricity regions and the industrial areas in western and southern Germany.

To this end, the German hydrogen network is to be gradually expanded to around 13,300 kilometres by 2050 in accordance with FNB-Gas and provide the basis for a nationwide supply of hydrogen filling stations. Existing natural gas pipelines can also be used at least partially for hydrogen transport.

Competence profiles already available

With regard to the skilled labour required for this, Germany considers itself well equipped with its current vocational training. Many existing technical professions already have the broad skills profiles required in the hydrogen economy. Nevertheless, further education and training for new safety-relevant qualifications in dealing with the new hydrogen technologies remain necessary.

To summarise, it can be said that Hydrogen will become considerably more important in the coming years. However, if Germany wants to achieve its goal and become the lead market for hydrogen technologies, there are still some challenges to overcome.

Your contacts

Michael Salcher

Regional Head East, Head of Energy & Natural Resources

KPMG AG Wirtschaftsprüfungsgesellschaft

Keywan Ghane

Partner, Performance & Strategy

KPMG AG Wirtschaftsprüfungsgesellschaft

Robert Schwarz

Senior Manager, Performance & Strategy, Enterprise Performance

KPMG AG Wirtschaftsprüfungsgesellschaft

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia