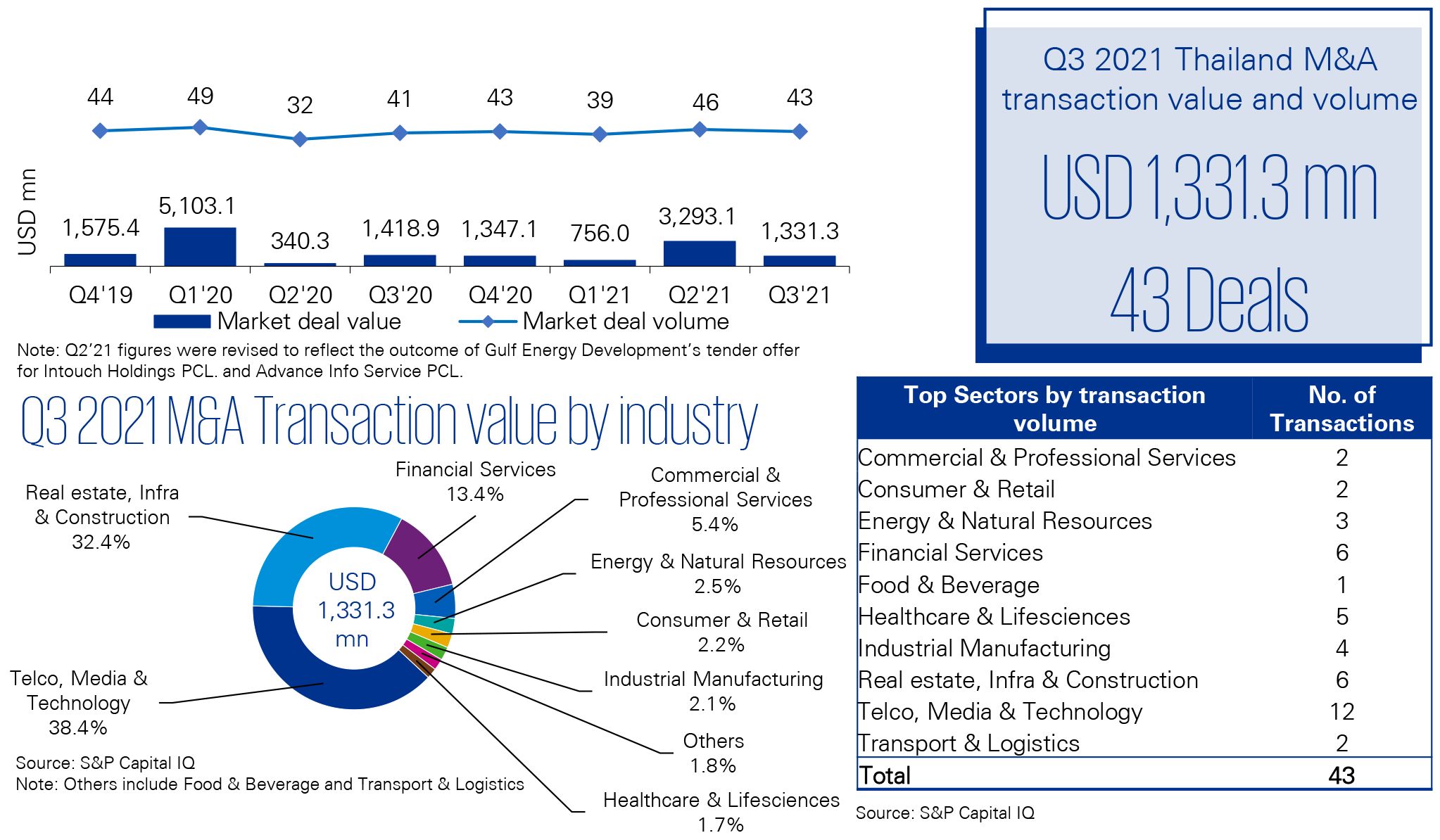

Thailand was heavily impacted by the pandemic in Q3 2021 with growth in daily cases, ongoing business restrictions and limited tourism levels contributing to a high level of household debt and weakened domestic demand. Despite these headwinds, M&A activities continued to remain at a stable level with 43 deals this quarter, as stakeholders seize the opportunity to take advantage of attractive deal opportunities and quick business growth.

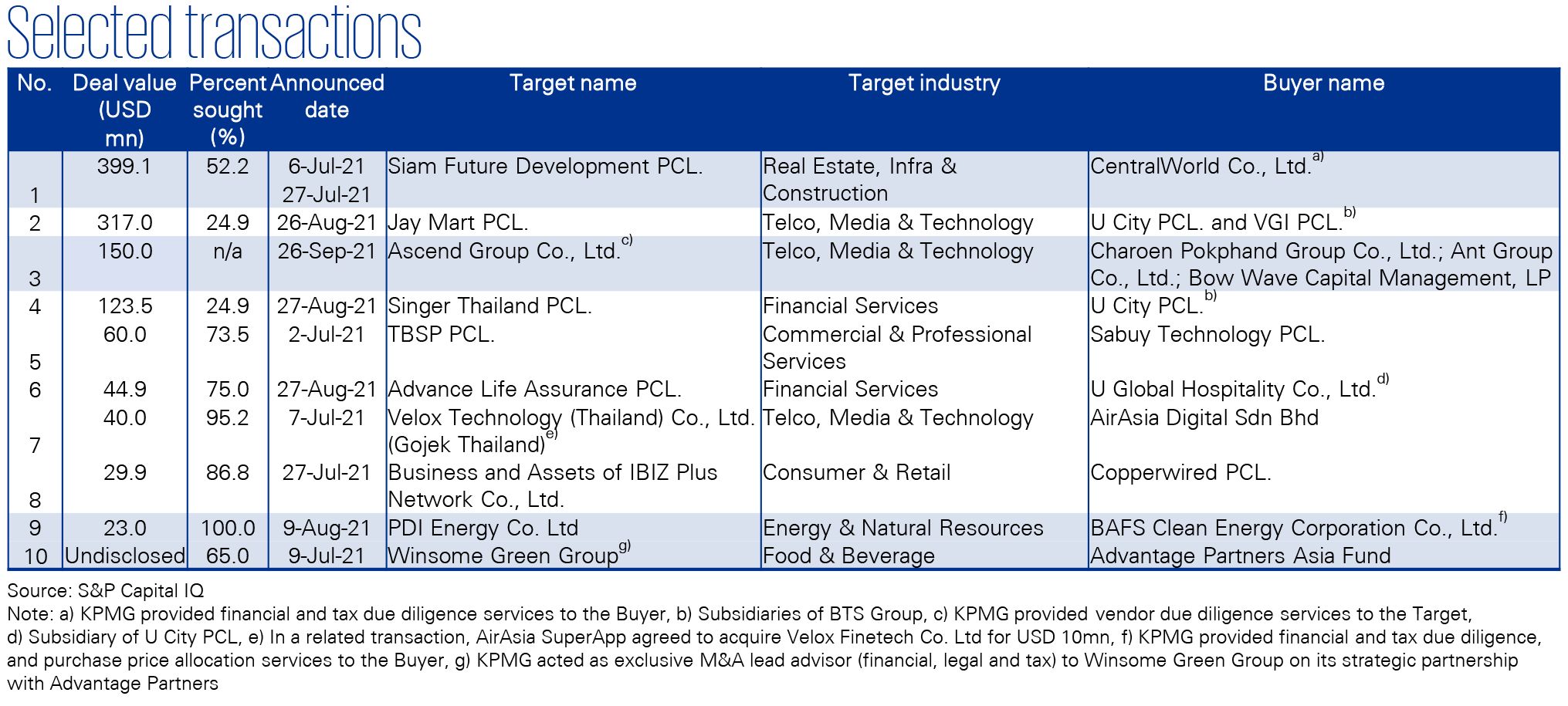

Despite a similar level of deal volume, the overall deal value reduced given the lack of mega deals we saw in Q2. The largest deals this quarter were CentralWorld Co., Ltd.’s acquisition of Siam Future Development PCL. followed by Jay Mart PCL’s private placement to U City PCL and VGI PCL, both subsidiaries of BTS Group. The Telco, Media and Technology, and Real Estate, Infra & Construction sectors accounted for 71% of total Q3 2021 deal value. A notable deal in the Food & Beverage sector was Winsome Green Group’s strategic partnership with a leading Japanese Private Equity firm as part of their growth journey, a deal for which KPMG was exclusively retained as lead M&A advisor with integrated workstreams including Financial, Legal and Tax. Winsome Green is one of Thailand’s leading manufacturers and distributors of ice cream, milk, and bakery products under “Mingo”, “SoFresh”, and other brands in Asia.

Stimuli such as the increased public debt-to-GDP ceiling, access to test kits and growing vaccination rates, together with the gradual re-opening of the country for foreign tourists, are expected to ease pandemic tensions and stimulate M&A activities in Thailand going forward, despite the continued reserved growth projections.

M&A activity in Thailand

Q3 2021 Thailand M&A transaction value and volume.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Data criterion

|

||

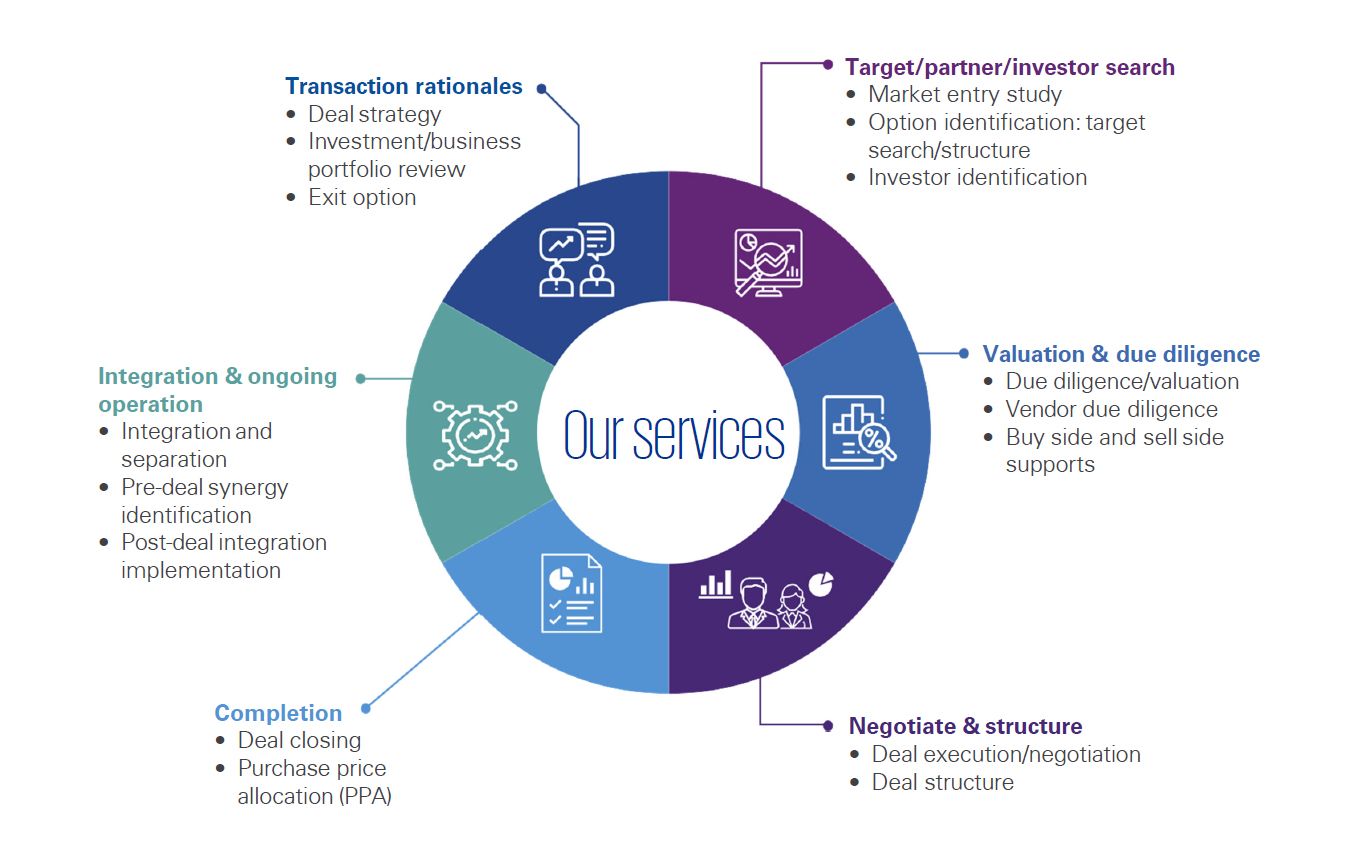

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.