The government's proposals to introduce a tax deduction for lease reinstatement costs and refine the existing IBA and CBA regimes are particularly encouraging. They demonstrate the government’s commitment to responding to concerns raised by stakeholders (including KPMG) and enhancing the competitiveness of the Hong Kong tax system.

In particular, the proposed tax deduction for lease reinstatement costs is more business-friendly than the one in Singapore6 in the following two aspects: (1) the lease reinstatement costs are not required to be contractually provided for in a tenancy agreement and (2) taxpayers are not prohibited from claiming the deduction in cases where the premises are vacated due to cessation of business.

However, under the current proposal, taxpayers can only claim a deduction based on the amounts of lease reinstatement costs actually paid or payable (normally at the end of the lease) and cannot claim a deduction based on the amounts of accounting provisions recognized in the financial statements7 during the lease period. This means that taxpayers would need to make tax adjustments for profits tax filing purposes and provide for deferred taxes during the lease period. In addition, taxpayers would not be able to benefit from the deduction in cases where insufficient assessable profits are derived or losses are incurred in the year the lease is ended and the business is ceased upon the end of the lease.

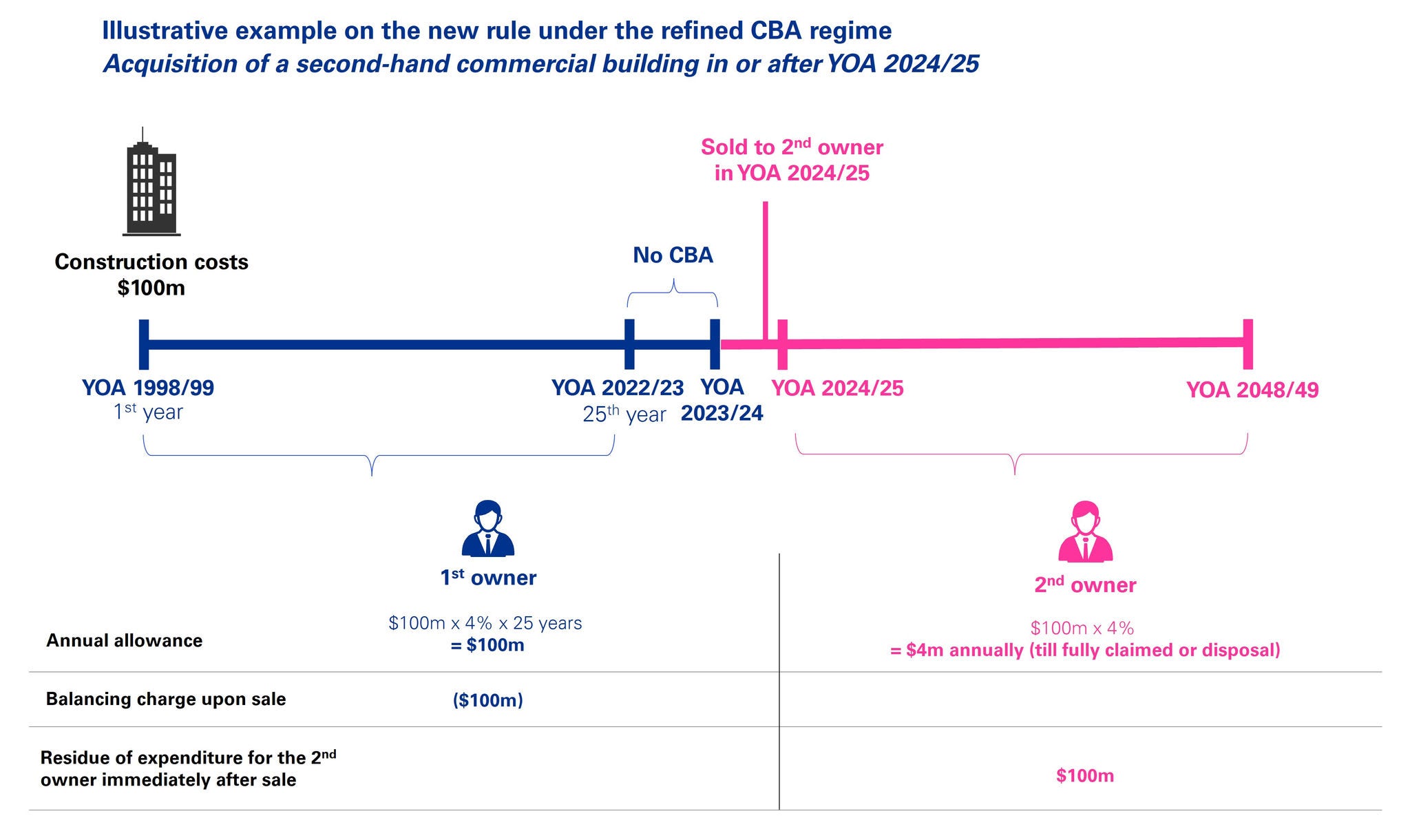

Taxpayers who have acquired or are planning to acquire a second-hand commercial or industrial building in or after the YOA 2024/25 should take note of the annual allowances available under the modified CBA/IBA regimes. For second-hand industrial buildings acquired before the YOA 2024/25 of which the usage period has expired at the time of purchase but there is unclaimed residual expenditure, the buyers should take note of the new 4% IBA available for such industrial buildings starting from the YOA 2024/25 and consider whether the back-year information necessary for ascertaining the IBA amount can be retrieved.