As the highest court in Hong Kong, the CFA judgment is final and set the precedent for cases with similar fact pattern. It is noteworthy that the CFA included a remark in its judgment that (1) a significant number of stamp duty relief applications based on grounds similar to those in this case are pending and (2) whether section 45 should be rectified to account for cases similar to the present one is a matter for the legislature. A clear signal that reform of the law is required (as suggested in our previous coverage of this case3) and it is not up to the courts to fix this type of problem.

As highlighted in our previous tax alerts3, given the diversified forms of legal entity employed by business groups nowadays and that some of them do not have share capital in a narrow sense, it would be more sensible from a policy perspective to amend section 45 of the SDO to (1) grant stamp duty relief to associated legal entities in any forms (and not just limited to bodies corporate) and (2) allow the 90% association relationship be established by other means (e.g. ownership interests other than shareholding) rather than just through issued share capital.

In this regard, we will continue to advocate and lobby with the government for a law change. References could be made to (1) the change in the HMRC’s view of the law in the UK which it now regards a “body corporate” as including an LLP for the purposes of the stamp duty group relief (though the HMRC still holds the view that an LLP does not have issued share capital) and (2) the legislation on stamp duty group relief in Singapore which uses the term “permitted entities” that is defined to specifically include a limited liability partnership where the contributed capital of the partnership is entirely held by permitted entities.

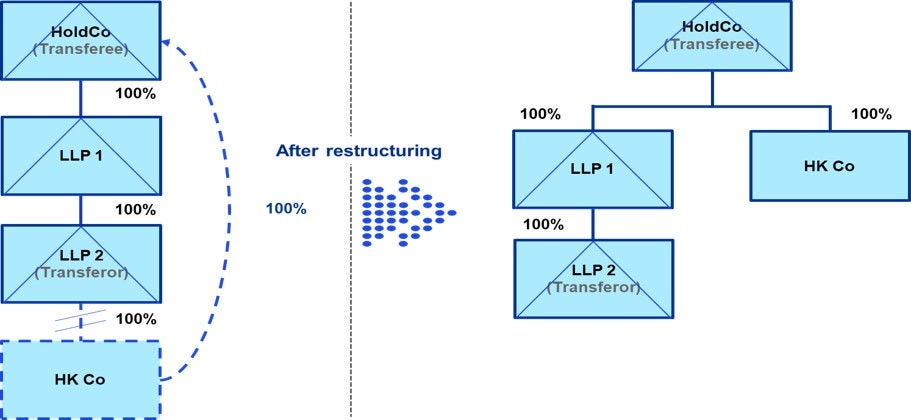

In the meantime, business groups contemplating an intra-group transfer of a Hong Kong company or immovable property between legal entities other than in the form of a company or legal entities without issued share capital (e.g. an LLP, LLC, or other forms of body corporate) should consider what other options are available.