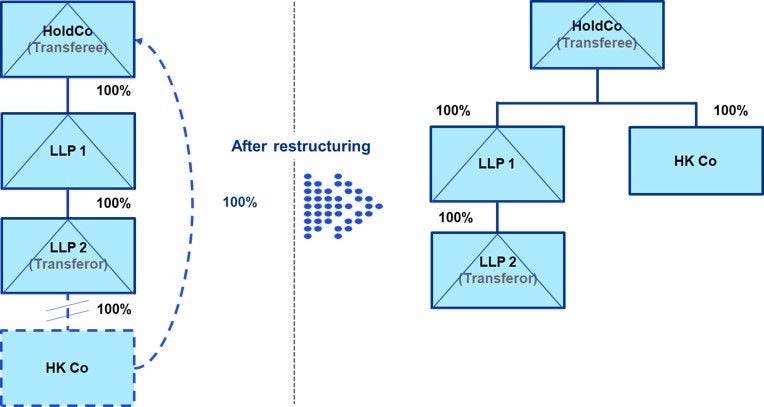

The Court of Appeal (COA) recently overturned the lower court’s judgment in the John Wiley case. The COA held that the stamp duty relief for intra-group transfer under section 45 of the Stamp Duty Ordinance (SDO) (s.45 relief) is only available to associated companies which satisfy the 90% association requirement via issued share capital. Given that the transferor (which is a UK limited liability partnership) involved in the intra-group share transfer in this case is not a company and does not have share capital, s.45 relief is not available to the transfer.

In this news alert, we summarise the COA’s analysis and share our observations from the case.