Amid a disruptive and rapidly changing landscape, CEOs of companies headquartered in mainland China and Hong Kong tell us of their increased confidence in the growth of the global economy, as well as their intent to invest in advanced technologies and pursue M&A to grow.

This year’s report features the China findings from a global survey of 1,300 CEOs – including 125 from mainland China and Hong Kong – across a wide range of industries, and provides valuable insight into their investment priorities, growth strategies and concerns.

Contents

Growth takes centre stage in China

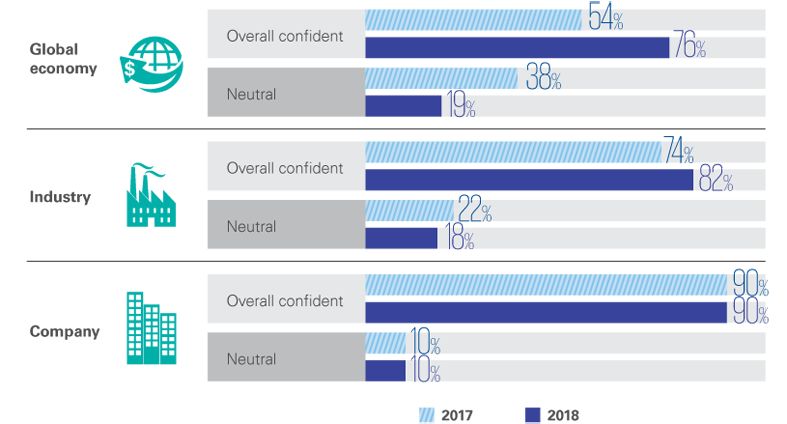

Against the backdrop of a fast-changing and dynamic global environment, the majority of CEOs of companies headquartered in mainland China and Hong Kong are confident about the growth prospects of the global economy (76 percent) and their industry (82 percent), a marked increase compared to 2017. This year’s Global CEO Outlook report featured 1,300 survey respondents from 11 core countries,1 with 125 from China, and finds that China CEOs are investing in advanced technologies and pursuing M&A in order to achieve their growth objectives.

China CEOs’ confidence in the growth outlook

1 The 11 core countries are Australia, China, France, Germany, India, Italy, Japan, Netherlands, Spain, the UK and the US.

Innovating for the future

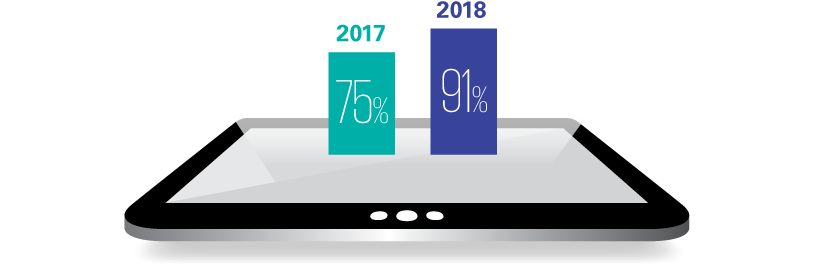

The survey results show that an overwhelming majority of China CEOs (91 percent) view ‘technological disruption’ as more of an opportunity than a threat, a significant increase from 2017. This finding supports the fact that technological disruption has become the ‘new normal’ for China CEOs, echoing a key message from last year’s China CEO Outlook.

Technological disruption as an opportunity

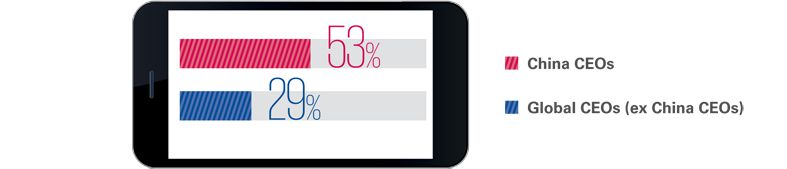

Disruptive technologies such as artificial intelligence (AI), Internet of Things, cloud computing and big data analytics continue to attract significant investment, and are being widely applied across sectors in China. This is highlighted in this year’s results, with a majority of China respondents stating their intent to increase their use of predictive models or analytics over the next three years, compared to less than a third of global CEOs.

Plans to increase the use of predictive models or analytics

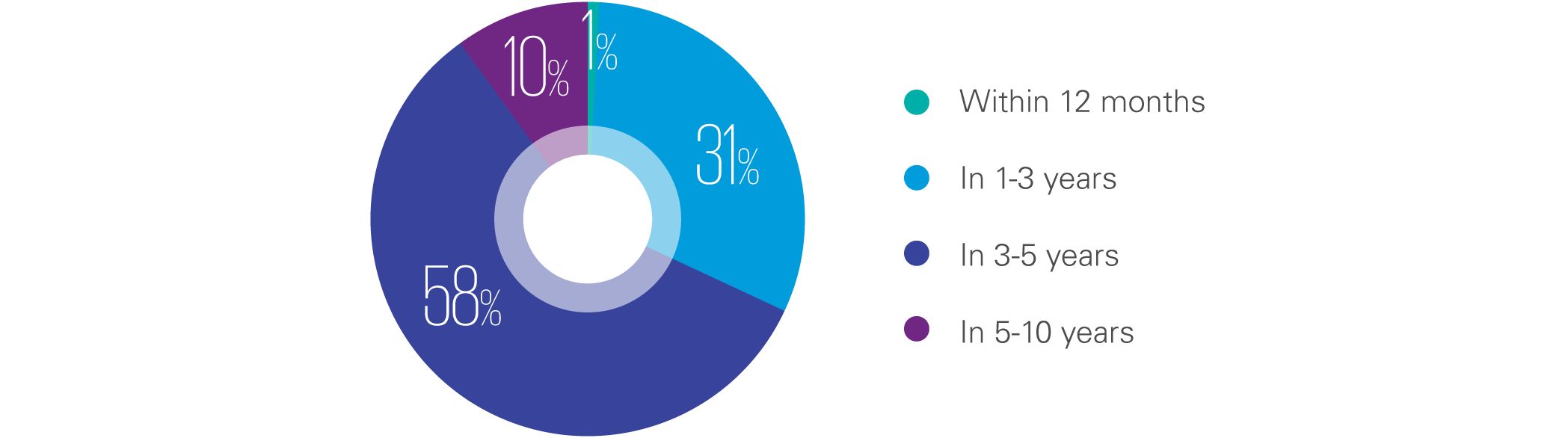

In addition, KPMG’s recent report on disruptive technologies notes that AI is developing rapidly in China, and is closing the gap with other technologically advanced countries due to its deep talent pool and large amount of available data. Consistent with this, more than half of the China CEOs surveyed in the 2018 Global CEO Outlook say they have begun a limited implementation of AI, with the key benefits of AI including the improvement of data analytics capabilities, data governance and customer experience. In addition, nine in ten China CEOs expect a significant return on investment (ROI) from AI in five years or less, with 32 percent looking for a significant ROI in less than three years.

China CEOs expect to see significant ROI from AI

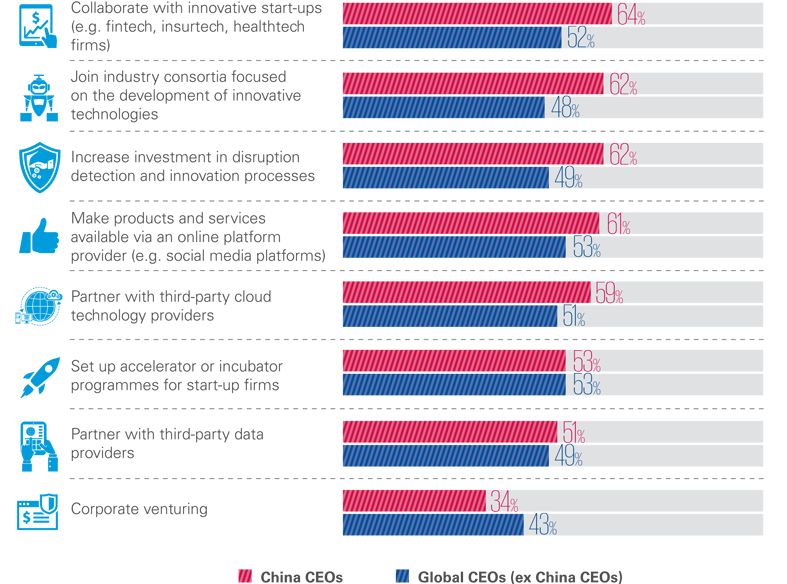

Consistent with the view of technological disruption as an opportunity, to pursue growth objectives over the next three years, more China CEOs than their global peers intend to collaborate with innovative start-ups, join industry consortia focused on the development of innovative technologies, and increase investment in disruption detectionand innovation processes.

CEO actions to pursue growth objectives

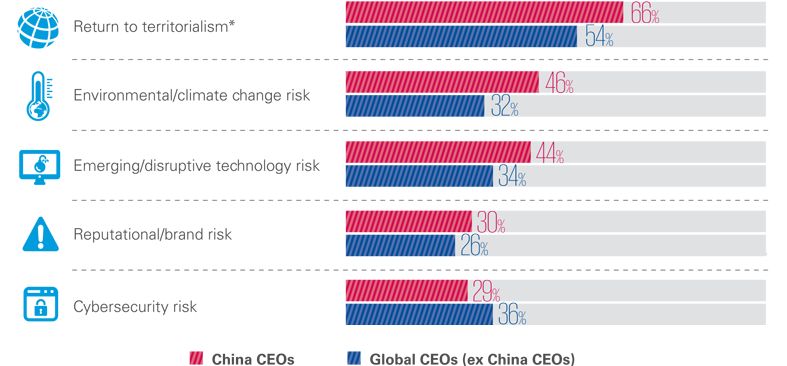

The adoption of new and disruptive technologies can also create a number of associated risks and challenges for companies. For example, nearly half of the surveyed China CEOs state that their organisations are struggling to keep pace with the rate of technological disruption in their sectors. In line with this, “emerging/disruptive technology risk” is among potential risks to growth for China CEOs.

Potential challenges to growth

* Perceived risks such as the US renegotiating NAFTA and the UK leaving the EU.

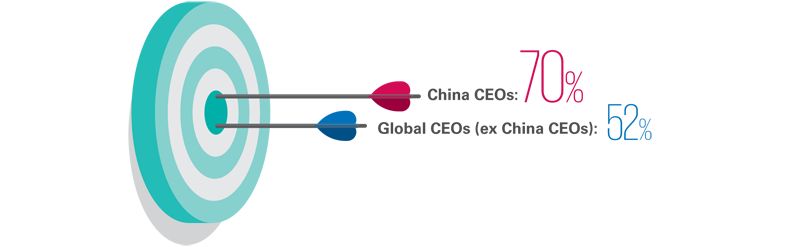

Cybersecurity is also cited as an important issue for China CEOs. The survey results show that significantly more China CEOs (74 percent) than their global peers (52 percent) agree that a strong cyber strategy is critical to engender trust with key stakeholders.

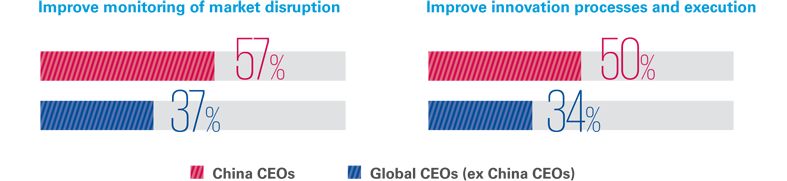

Consistent with the focus on cybersecurity and emerging technology risk, the findings indicate that significantly more China CEOs than their global peers say they will need to improve the way they monitor disruption, as well as their innovation processes and execution.

Plans over the next three years to:

Realising outbound ambitions

M&A and collaborative growth are also high on the agenda for many China CEOs. More than three-quarters of China respondents have either a “moderate” or “high” appetite for M&A in the next three years. The survey indicates that the key drivers of M&A appetite among China CEOs are to take advantage of favourable valuations, reduce costs through synergies/economies of scale, and to transform their organisations’ business models faster than organic growth will deliver.

China CEOs’ M&A appetite over the next three years

KPMG’s Global China Practice adds that as the country has become stronger and its companies more competitive, more Chinese privately and state-owned companies are investing abroad, and outbound M&A is emerging as an important way for them to ‘go out’.

The survey also indicates a move towards greater collaboration between parties, with more than three-quarters of China CEOs ranking “strategic alliances with third parties” as a key growth initiative. Furthermore, a significantly larger proportion of China CEOs than their global peers agree that the only way for their organisation to achieve the agility it needs is to increase the use of third-party partnerships.

Third-party partnerships are key to maintaining an agile business

Key takeaways

China CEOs should ensure that their businesses are agile enough to adapt to today’s disruptive and fast-evolving global landscape, and need to be confident in their ability to execute their growth strategies to remain competitive and succeed. The key takeaways are:

About this survey

The 2018 Global CEO Outlook is based on a survey of 1,300 chief executive officers (CEOs) from Australia, China, France, Germany, India, Italy, Japan, Netherlands, Spain, the UK and the US. Of the CEOs, 312 came from companies with revenues between USD 500 million and USD 999 million, 546 from companies with revenues from USD 1 billion to USD 9.9 billion, and 442 from companies with revenues of USD 10 billion or more.

This report is based on the responses of the 125 CEOs of China-headquartered companies (94 from mainland China and 31 from Hong Kong) who were interviewed for the 2018 Global CEO Outlook. These 125 CEOs operate in 11 key industries – asset management (11), automotive (13), banking (6), retail/consumer markets (8), energy (11), infrastructure (5), insurance (9), life sciences (13), manufacturing (38), technology (6) and telecommunications (5).

The survey was conducted between 22 January and 27 February 2018.

Note: Some figures throughout the report may not add up to 100 percent due to rounding.

A note about the data

Our data calculations are based on the results of the survey that was conducted for the 2018 Global CEO Outlook.

For the results presented throughout this report for ‘global peers’ and ‘global CEOs (ex China CEOs)’, the responses of China CEOs have been excluded from the calculations.

Contact us

Chairman

Senior Partner, Northern Region

Senior Partner, Southern Region

Global Chair,

Linda Lin

Louis Sun |

Chairman

Senior Partner, Eastern & Western Region

Senior Partner, Hong Kong

Ayesha Lau

Reynold Liu

Irene Chu |

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia