The world will change more in the next decade than it has in the last century. Digitalization, new technologies, the climate crisis, biodiversity loss, geopolitical shifts and changing values will shape our future.

The speed and scale of this transition will depend on regulation, technology, consumption and available capital.

These factors will reshape industries and financial systems. Regulation, consumer behavior, technology and capital flows will drive the pace of this change. Inspired by the “Green Deal” launched by the European Union, the EU Action Plan on Sustainable Finance or the Action Plan on Financing Sustainable Growth are two examples of initiatives that support the shift to a sustainable future.

Sustainable finance is key to directing capital to the right opportunities and managing new risks, especially ESG risks. Achieving this shift depends on transparency. Investors and companies need a common language that enables them to collaborate effectively in order to assess risks, opportunities and long-term impacts.

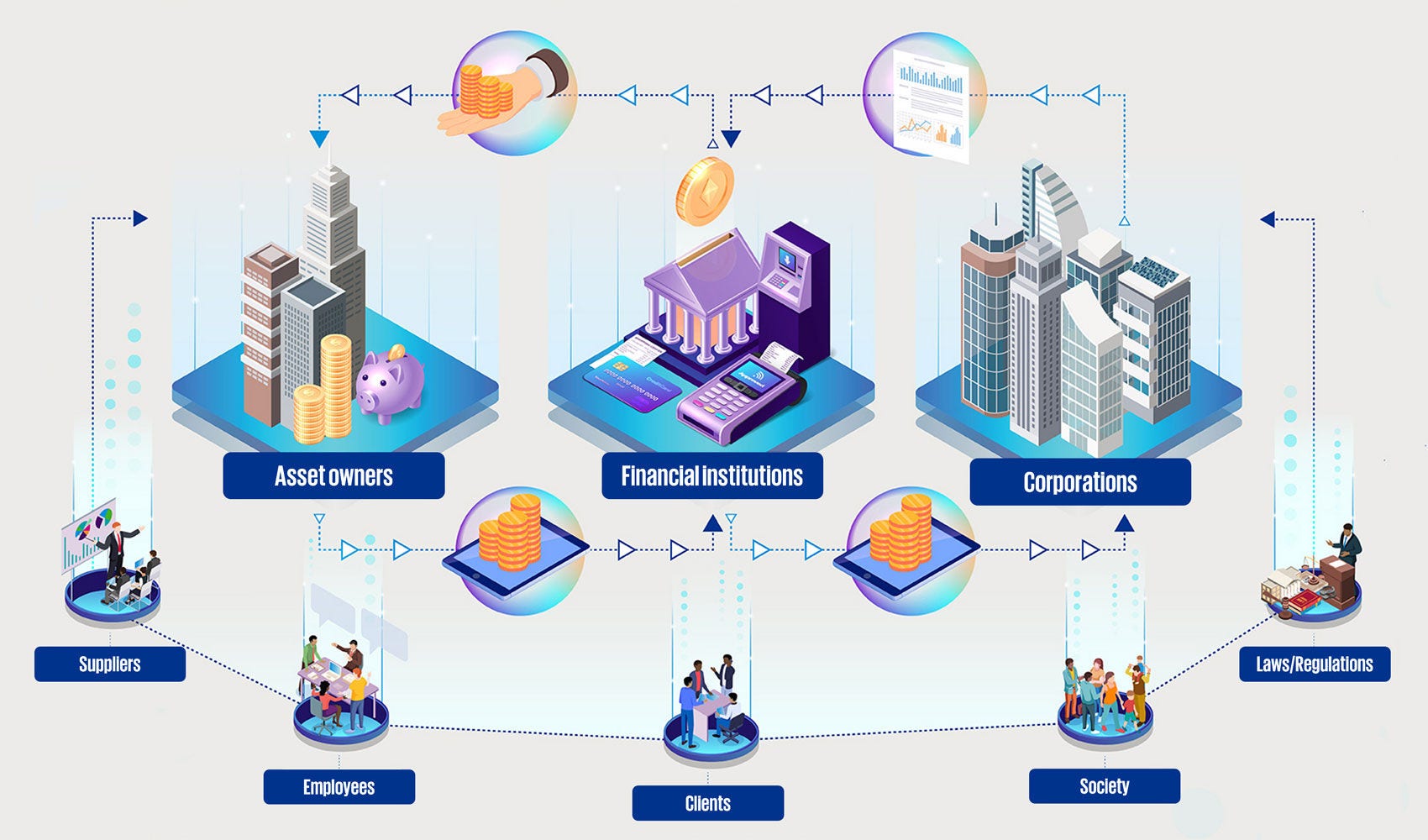

Mechanics of sustainable finance

Mechanics of sustainable finance

Sustainable Finance in Switzerland

Switzerland plays a pivotal role in the global shift towards sustainable finance.

As a significant financial hub, it presents substantial business opportunities while aligning its practices with environmental and social goals. Swiss Sustainable Finance (SSF) works closely with EU Sustainable Finance regulations, including the EU Sustainable Finance Action Plan, ensuring frameworks meet international standards.

On 16 December 2022, the Swiss Federal Council endorsed fifteen initiatives within the financial sector. These initiatives, to be implemented between 2022 and 2025, focus on positioning Switzerland as a top destination for sustainable finance.

Switzerland is committed to the Paris Agreement and aims for net-zero emissions by 2050. These commitments are driving sustainability in the financial sector. By engaging with EU initiatives, Switzerland ensures its leadership in sustainable finance and contributes to a greener future.

The Swiss government supports pricing greenhouse gas emissions through market-based mechanisms, such as levies and emissions trading. This helps raise awareness of the environmental risks linked to economic activities.

Asset owners’ perspective

Information about a company’s risk and return is crucial for investors. It helps pension funds, insurance companies and sovereign wealth funds decide where to invest.

More institutional investors agree that issues like climate change, biodiversity loss and human rights abuses can constitute investment risks. They need to understand and manage these risks to make the right investment decisions. This helps protect the value of their assets on behalf of their beneficiaries (outside-in perspective).

Some institutional investors want to go beyond just risk and return metrics. They aim to understand the positive and negative impacts of the companies’ ESG factors (inside-out perspective).

This may be motivated by:

- a desire to help solve global issues, like through the Net Zero Asset Owner Alliance (NZAOA)

- the need to manage reputational risk

- assessments to determine whether a company’s business model can survive megatrends, like preparing for biodiversity loss

- providing finance for sustainable development

The lack of corporate reporting on these issues makes it hard for financial institutions to get this information. It remains a key challenge for sustainable finance as a result.

Asset owners rely on financial institutions like banks or asset managers for investment solutions. These solutions must meet their specific needs.

Financial institutions’ perspective

Since financial institutions act on behalf of their clients (the asset owners), three key responsibilities are essential:

- understanding clients’ goals

- including these goals in investment decisions

- clearly reporting on how these goals have been met

Financial institutions will adapt their approach based on clients’ requirements:

- For clients focused on managing financial risks from climate change or biodiversity loss, institutions must:

- develop new models

- run stress tests

- identify, quantify and manage these risks

- For clients aiming to make a real-world impact with their money, institutions need to:

- engage with investee companies

- implement strong, reliable processes to measure the impact

This clear structure helps financial institutions effectively address different client goals while maintaining transparency.

Risk models and support for borrowers

Banks use risk models in their credit business to assess the risk of default. They can also support borrowers with products that encourage sustainable changes, like green bonds or sustainability-linked loans.

To include risk and impact in their investment or financing decisions, financial institutions need detailed data from the companies or borrowers they work with. This data helps them make better decisions and adjust their models accordingly.

Corporate perspective

Today, businesses are expected to help solve global sustainability challenges. Their success will depend on how well they adapt to the changing expectations of customers and stakeholders.

This adaptation must be built on transparency, accountability and forward-thinking strategies, as outlined in their sustainable finance action plan. Companies need to go beyond traditional financial reports and clearly show how they manage emerging ESG risks.

By setting clear sustainability targets, KPIs and action plans, companies can attract investors and secure financing through instruments like:

- green bonds

- sustainability bonds

These actions align with the action plan for sustainable growth.

Regulations like the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy set clearer standards for ESG reporting.

This builds trust among investors and financial institutions as transparency and comparability improve.

ESG Regulatory Essentials

This regular KPMG publication provides key updates on the latest ESG regulations.

They affect financial institutions in Switzerland, the EU and the UK.

How mature is your company in terms of how it implements ESG practices?

This ESG Health Check gives you a quick overview of how mature your company is in implementing ESG practices.

The survey covers key topics like governance and reporting for your internal setup and investment or funding activities.

For each topic, you will choose the statement that best describes your organization.

Feel free to contact us if you need more information or want to work with us.

The questionnaire takes about 10 minutes to complete.

Haven’t found what you were looking for?

Sustainable finance as a strategic priority. We help you ensure transparent capital allocation and effective risk management in the financial system.

Meet our experts

A sustainable future impacts everyone. Stay ahead in this fast-changing environment.

We provide tailored services by combining industry expertise with ESG knowledge and are backed by a global network of experts.

Contact us for questions or to discuss trends.