Steuerbehörden üben mehr Druck auf Unternehmen aus, Steuerprüfungen nehmen weltweit zu. In einer digitalisierten, automatisierten und vernetzten Welt brauchen auch Verrechnungspreise automatisierte Prozesse. Unternehmen müssen auf den zunehmenden Druck reagieren.

Verrechnungspreise sind ein multinationales Thema – grenzüberschreitende Zusammenarbeit, um Herausforderungen zu lösen, ist deshalb von überragender Bedeutung für den Projekterfolg. Weltweit arbeiten mehr als 2'300 Verrechnungspreisexperten bei KPMG Transfer Pricing Services in allen relevanten Ländern. Wir arbeiten gemeinsam mit Spezialisten in sämtlichen Steuerbereichen, eingebettet in das starke KPMG Netzwerk von Audit, Tax und Advisory Experten.

So kontaktieren Sie uns

- KPMG Standorte finden kpmg.findOfficeLocations

- kpmg.emailUs

- Social Media @ KPMG kpmg.socialMedia

Unsere Expertise

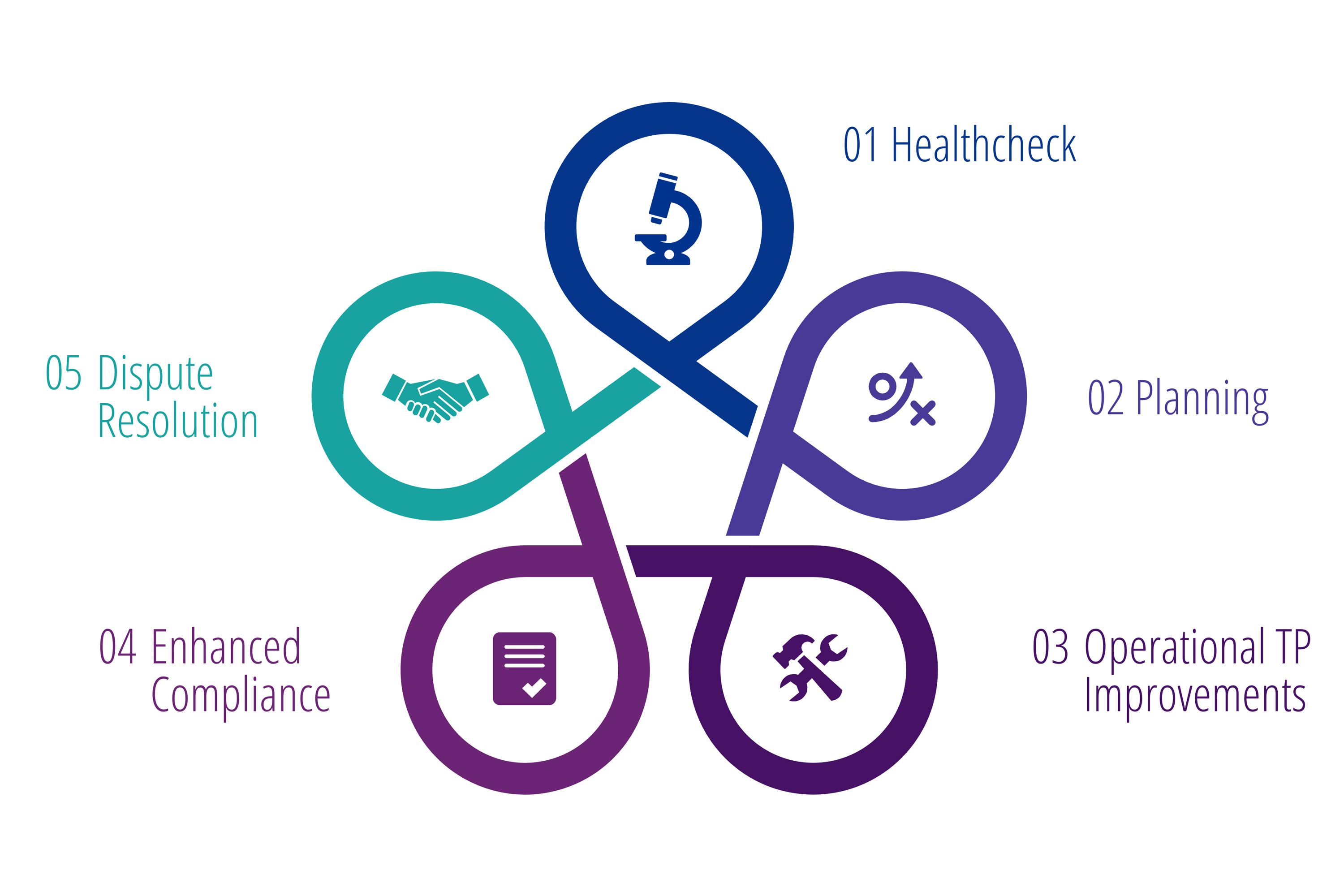

Verrechnungspreise werden angesichts zunehmender Digitalisierung, neuer Geschäftsmodelle und grösserer Transparenz immer wichtiger. Multinationale Gruppen brauchen einen Partner, der ihnen hilft, diese Komplexität zu meistern. Wir unterstützen bei der Identifikation von Chancen und Risiken im Bereich konzerninterner Transaktionen. Wir planen nachhaltige und pragmatische Verrechnungspreissysteme und helfen bei der operativen Umsetzung. Wir unterstützen bei der Compliance und helfen dabei, Risiken in Steuerprüfungen zu managen. So erschliessen wir konzerninternen Mehrwert und schützen Ihren guten Ruf.

Wir verstehen die Bedürfnisse unserer Kunden und nennen diesen dauernden und nachhaltigen Verbesserungsprozess «KPMG’s TP Lifecycle».

KPMG's TP Lifecycle

Unsere Kunden profitieren von einem Verrechnungspreissystem, das nicht nur die Kosten senkt, sondern auch die Effizienz in der täglichen Umsetzung der Verrechnungspreise durch sinnvolle Daten und Analysen erhöht. Unser seit langem bewährter Ansatz ermöglicht Compliance durch automatisierte Prozesse. Damit tragen wir zu Governance, Risikomanagement und Compliance bei.

5 Minuten mit dem Schweizer Transfer Pricing Team

Erfahren Sie interessante Fakten über das Team und wie es seine Kunden unterstützt

Das Transfer Pricing Team von KPMG Schweiz stellt Ihnen die Menschen vor, die täglich mit multinationalen Unternehmen in verschiedenen Verrechnungspreisangelegenheiten zusammenarbeiten. Wir haben unser Team gebeten, eine Momentaufnahme der wichtigsten Herausforderungen und Erfolge zu teilen, die sie bei ihrer Arbeit zur Unterstützung von Kunden erleben.

In dieser Interviewreihe lernen Sie die Mitglieder des Swiss Transfer Pricing Teams kennen, erfahren, was sie wirklich einzigartig macht, und erhalten einen Einblick in ihre tägliche Arbeit.