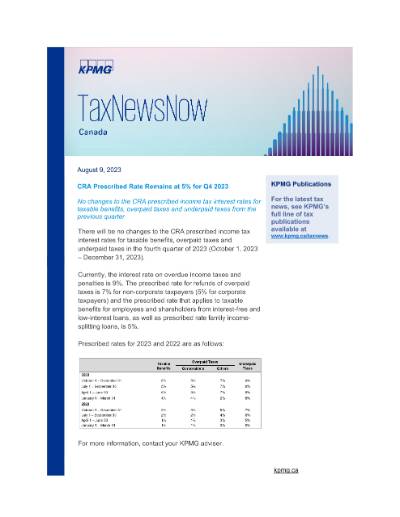

There will be no changes to the CRA prescribed income tax interest rates for taxable benefits, overpaid taxes and underpaid taxes in the fourth quarter of 2023 (October 1, 2023 – December 31, 2023).

Currently, the interest rate on overdue income taxes and penalties is 9%. The prescribed rate for refunds of overpaid taxes is 7% for non-corporate taxpayers (5% for corporate taxpayers) and the prescribed rate that applies to taxable benefits for employees and shareholders from interest-free and low-interest loans, as well as prescribed rate family income-splitting loans, is 5%.

Download this edition of TaxNewsNOW to learn more.

The way you get your tax news is changing – Starting January 1, 2024, all tax news will be delivered exclusively through our TaxNewsFlash publication. If you're a current TaxNewsNow subscriber, you'll automatically receive TaxNewsFlash — no additional steps needed. If you're not subscribed but want insights from KPMG's Canadian tax professionals, subscribe to TaxNewsFlash.