Article Posted date

26 May 2023

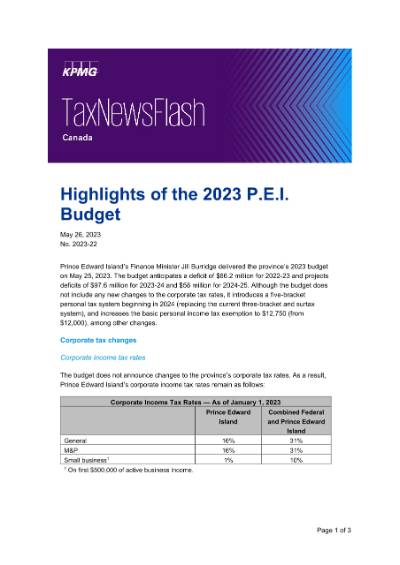

The budget anticipates a deficit of $66.2 million for 2022-23 and projects deficits of $97.6 million for 2023-24 and $58 million for 2024-25. Although the budget does not include any new changes to the corporate tax rates, it introduces a five-bracket personal tax system beginning in 2024 (replacing the current three-bracket and surtax system), and increases the basic personal income tax exemption to $12,750 (from $12,000), among other changes.

Download this edition of the TaxNewsFlash to learn more.