Polluting companies may be subject to mandatory targets set by a government under an emissions scheme or may set such targets voluntarily – e.g. as part of their net-zero transition plan.

The accounting may require judgement, based on the specific facts and circumstances of a mandatory scheme or a voluntary commitment, which may vary.

This summary compares key features of mandatory schemes and voluntary commitments in relation to emissions targets that may be relevant for the analysis under IAS 37.

This is an event that creates a legal or constructive obligation that results in a company having no realistic alternative to settling that obligation.

Determining what an obligating event is under a mandatory emissions scheme may require judgement based on the specific terms of the scheme. These include the activity to which a target or threshold is linked, the type of target or threshold – i.e. absolute vs cumulative – the compliance period and the settlement mechanism (see Question 3).

In our view, a present obligation in relation to a mandatory emissions scheme arises when a company:

- has commenced the activity to which the threshold is linked; and

- has exceeded the allowable threshold.

In addition to the criteria above, we believe that in determining whether it has a realistic alternative to settling the obligation, a company should apply judgement, based on the specific facts and circumstances. This should include the company considering whether it is able to take future action to avoid the obligation. Example considerations may include, but are not limited to, whether the cost of taking future action exceeds the cost of settling the obligation, and whether the outcome of the company’s action is impacted by market conditions or other events.

However, we believe that avoiding the obligation by ceasing operations is unlikely to be a realistic alternative to settling the obligation if there is no evidence that the company plans to do so.

Setting and announcing a voluntary emissions target does not, on its own, automatically trigger a liability. An obligation in relation to a voluntary emissions target arises only when:

- the company’s public statement has created a valid expectation (see Test 1: Does the commitment give rise to a constructive obligation? in the Net-zero commitments talkbook); and

- the company has missed the emissions target it had promised to achieve (see Test 2: Are the criteria to recognise a liability met? in the Net-zero commitments talkbook).

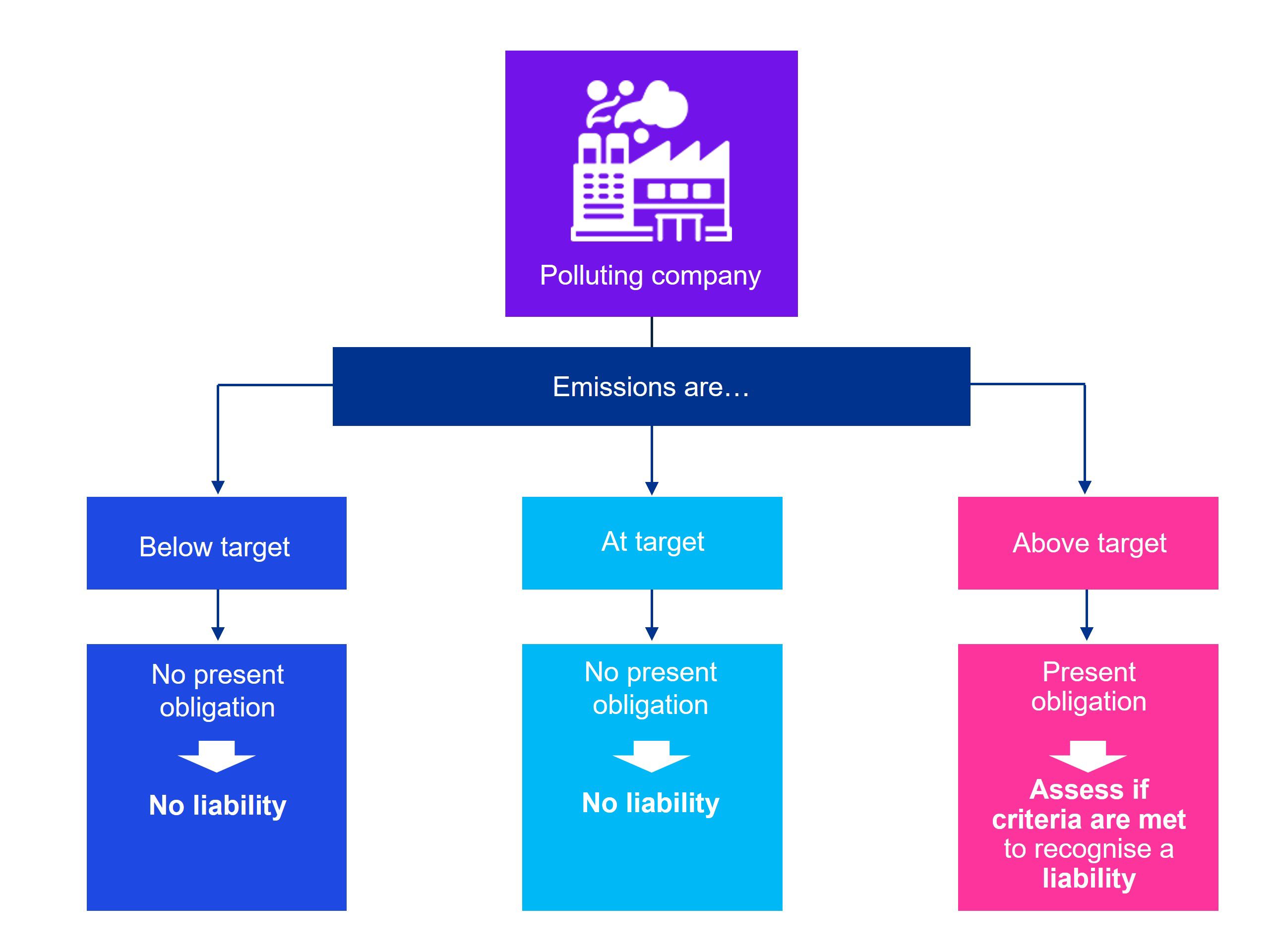

Having a present obligation is only one of the three criteria to recognise a liability in the financial statements. Other criteria also need to be met (see Question 5). Use this diagram to help with your analysis.

A provision is recognised when all of the following recognition criteria are met.

| Recognition criteria | Mandatory emissions targets | Voluntary emissions targets |

| There is a present obligation as a result of a past event (i.e. ‘damage done’). | See Question 3. | See Question 4. |

| It is probable than an outflow of cash or other resources will be required to settle it. | An outflow of resources is regarded as probable if it is more likely than not to occur – i.e. the probability that the outflow will occur is greater than the probability that it will not. | |

| The amount can be reliably estimated. | Except in extremely rare cases, a company will be able to determine a range of possible outcomes and make a sufficiently reliable estimate of the obligation for recognising a provision. | |

Under cap-and-trade schemes, companies can generally settle their obligation created by emitting pollutants only by surrendering emissions allowances to the local regulator. Generally, a company cannot settle its obligation by making a cash payment or by transferring other assets. In our view, when other means of settlement are not possible, the provision could be measured based on the current carrying amount of the allowances available if the company owns sufficient allowances and expects to use them to settle the current obligation. This is because the company could view this as the best estimate of the expenditure required to settle the obligation. Otherwise, the provision should be based on the current market value of the emissions allowances at the reporting date.

If the number of emissions allowances required to settle a company’s obligation exceeds the actual number of allowances available at the reporting date, then the best estimate of the expenditure required to settle the actual shortfall will generally be measured at the current market value of the emissions allowances needed to cover the shortfall.

A company may sell emissions allowances during the year and create a shortfall in the actual number of allowances held compared with the total pollutants emitted. In this case, if the portion of the obligation related to the shortfall is not already measured at the current market value of the emissions allowances at the reporting date, then the company needs to remeasure it at the current market value of the allowances.

Either – a company needs to choose an accounting policy.

IFRS® Accounting Standards do not provide specific guidance on accounting for emissions allowances. In our view, a polluting company participating in a cap-and-trade scheme should choose an accounting policy, to be applied consistently, to account for emissions allowances based on one of the following approaches.

As intangible assets: Under this approach, a company considers that emissions allowances are identifiable non-monetary assets that do not have physical substance and therefore meet the definition of an intangible asset.

As inventories: Under this approach, a company considers that emissions allowances are effectively an input to be consumed in the production process, similar to inventories.

We believe that this accounting policy choice should be applied regardless of whether emissions allowances are bought or received from the government. We also believe that it may be applied to emissions allowances or carbon credits purchased to comply with other types of mandatory schemes.

This page references specific IFRS® Accounting Standards – see our glossary for the full list of standards.

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explore

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia