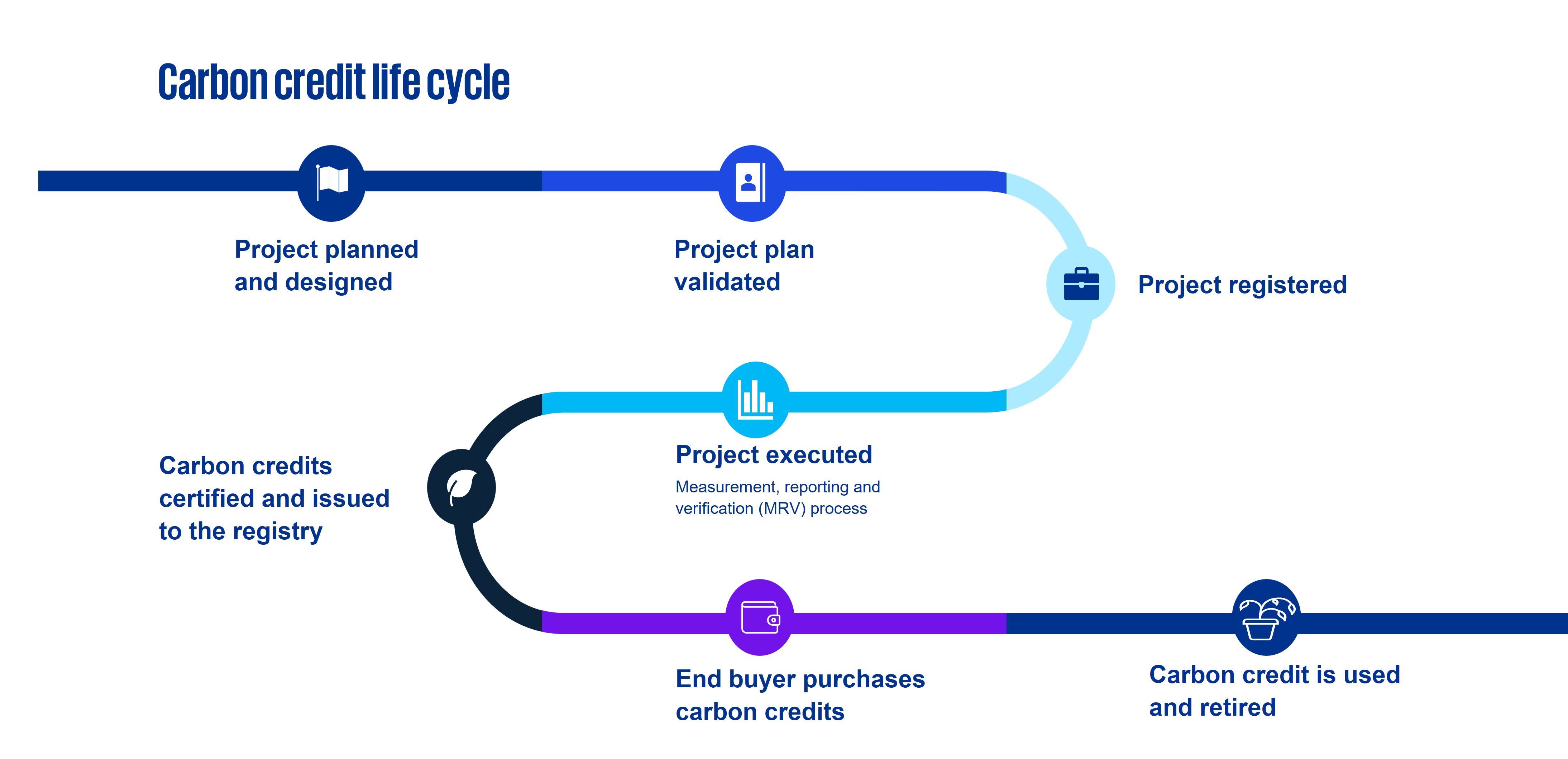

A polluting company may voluntarily purchase carbon credits that typically represent a reduction or removal of emissions (e.g. CO2 or other greenhouse gas) through a certified offsetting project – e.g. the planting of trees. Credits are often registered with a registry authority and a company may be able to trade or sell them to a third party (see the life cycle of a carbon credit below). However, the arrangements vary significantly and a company needs to carefully consider the specific facts and circumstances to determine the appropriate accounting treatment.

To determine the appropriate accounting for carbon credits, a company needs to consider the nature of the arrangement and its business purpose for purchasing the credits. For example, it may use the following considerations in its analysis.

| Key consideration | Potential impact |

| Is the credit purchased together with other goods or services? | A company considers if the credit is part of the cost of another good or service or if it is a separate unit of account. If it is part of the cost of another good or service, then there is no separate accounting for it – i.e. a company accounts for the cost of that good or service in accordance with other relevant accounting standards. |

| Is the credit purchased with the intention of selling it in the ordinary course of business? | A company accounts for the credit as inventory and considers whether the guidance for commodity broker-traders applies. |

| Is the credit purchased to fulfil contracts with customers? | |

| Is the credit purchased for advertising or promotional activities? | A company recognises expenditure for advertising and promotional activities when the benefit of those goods or services is available to it. However, in our experience, credits are typically not acquired with the sole purpose of undertaking advertising or promotional activities. |

If none of the considerations in the table above applies, then in our experience the carbon credit is generally a separate unit of account purchased to offset the company’s own emissions – i.e. it will be held for use (see Questions 2 and 3).

It depends. A company first considers the nature of the arrangement and its business purpose for purchasing the credits as discussed in Question 1. If none of the considerations in Question 1 applies, then in our experience the carbon credit is generally a separate unit of account purchased to offset the company’s own emissions – i.e. it will be held for use.

When determining if carbon credits held for use should be recognised as an asset, a company needs to consider the nature of the economic benefits and when they are consumed. In our experience, the company’s ability to use the carbon credit to offset its own emissions generally represents economic benefits flowing to the company from the credit. If economic benefits arise from the ability to offset, then the company may have an asset – intangible in nature – because it has the power to obtain the future economic benefits and restrict others’ access to those benefits.

For example, if the economic benefits are the ability to offset, then their consumption typically occurs when the company retires the credits – i.e. the credits are recognised as an asset and derecognised when they are retired. Alternatively, if the credits are retired immediately at the time of purchase, then the expenditure is recognised as an expense because the economic benefits are immediately consumed.

A company may determine that carbon credits meet the definition of an intangible asset considering the guidance in Question 2. However, intangible assets that meet the definition of inventories are accounted for under IAS 2. Therefore a company considers, based on its specific facts and circumstances, whether the credits it holds to offset its own emissions meet the definition of inventories – e.g. if they will be consumed in the production process or in the rendering of services.

Setting and announcing a climate-related target does not, on its own, automatically trigger a liability. There are specific requirements in IAS 37 for determining if a liability exists at the reporting date and if it needs to be recognised in the financial statements. Because a company cannot recognise a liability for future operating losses, its commitment needs to create a present obligation at the reporting date as a result of a past event (e.g. ‘damage done’).

Read our Net-zero commitments talkbook and When do you recognise a liability for an emissions obligation? for more detail on when to recognise a liability.

This page references specific IFRS® Accounting Standards – see our glossary for the full list of standards.

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explore

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia