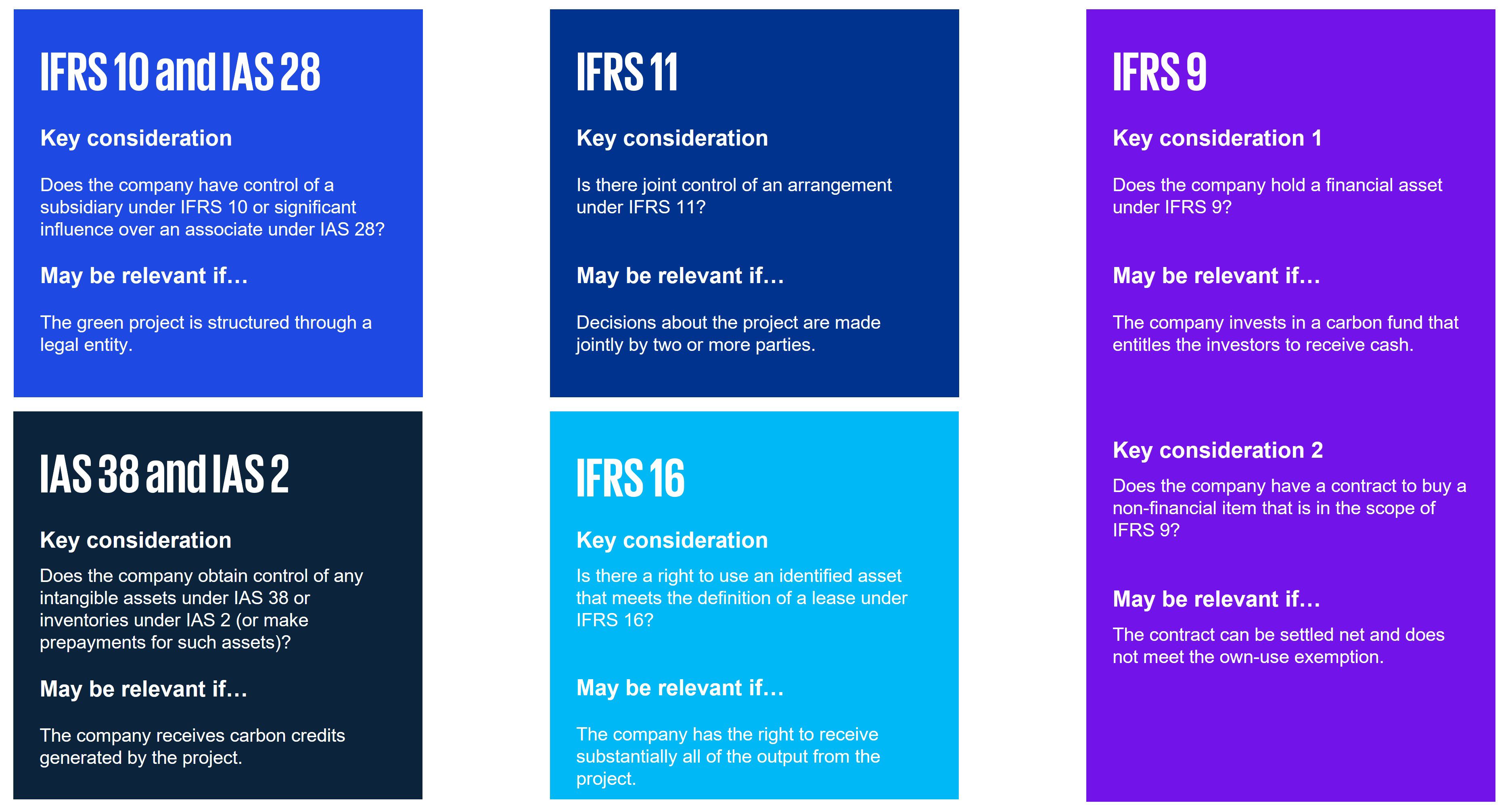

A company may invest in projects that generate carbon credits for a variety of reasons and in different ways. The accounting treatment can differ depending on the specific facts and circumstances, so a company first needs to determine which accounting standard(s) to apply. The following considerations may be helpful.

It depends. A ‘carbon fund’ invests in green projects and pays distributions in the form of the carbon credits generated by those projects. Companies that invest in carbon funds need to consider whether such investments are financial assets under IAS 32. This will require judgement that considers:

- all of the contractual rights associated with the investment, including the company’s contractual right to receive cash or another financial asset; and

- whether those rights represent an equity instrument in another company.

It depends. Under some investment arrangements, a company may enter into a contract to buy non-financial items that can be settled net in cash or another financial asset – e.g. if carbon credits to be purchased are readily convertible into cash. In such cases, a company needs to assess whether the contract qualifies for the own-use exemption or whether it should be accounted for as a financial instrument (often as a derivative) in accordance with IFRS 9.

If the definition of a financial asset is not met and the contract is not otherwise in the scope of IFRS 9, then the investment may represent a prepayment for non-financial assets (e.g. carbon credits) to be received in the future. It may also be relevant to consider whether there is an embedded derivative to account for.

This page references specific IFRS® Accounting Standards – see our glossary for the full list of standards.

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explore

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia