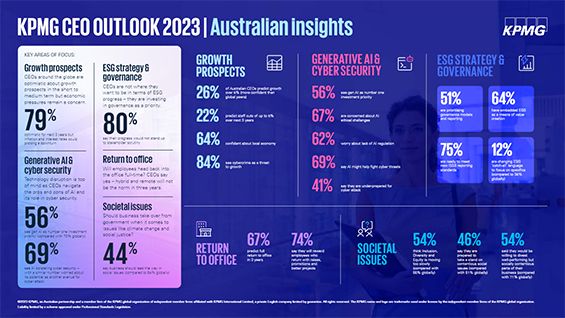

Despite cost of living and interest rate challenges, our latest survey finds Australian CEOs optimistic about business growth over the next 3 years. Generative AI is moving up the investment agenda, as leaders unpack its potential and face into the ethical and regulatory challenges. ESG governance continues to be a top priority with leaders keen to make more progress in the space.

Our 2023 survey was conducted with 1325 CEOs across 11 key markets in August and September 2023 and provides unique insights into what matters for Australian and international CEOs.

Key Australian developments

What's topping the agenda for Australian CEOs?

are optimistic about growth over next 3 years

see cybercrime as a threat to growth

see investing in generative AI as top priority (compared to 70% globally)

say progress on ESG in not enough to withstand stakeholder scrutiny

predict a full return to office in 3 years

CEOs around the world are optimistic about the growth possibilities for their companies over the next three years – though economic pressures are cause for concern. While almost 80% are confident about the short to medium term, a similar number worry about a protracted downturn due to interest rates and cost of living.

Australian CEOs are the most upbeat with 26% predicting growth over 5% and 65% expressing confidence in the local economy.

Job losses are on the cards though, with 22% of Australian CEOs (compared to 8% globally) predicting cuts of up to 5% percent over the next 3 years.

What do Australian CEOs see as the main threats to growth?

- Cybercrime – 84%

- Cost of living – 82%

- Trade regulation – 74%

- Disruptive technology – 70%

Globally, 70% of CEOs rate generative AI as the top investment priority. This is lower among Australian leaders (56%) who tend to see return on investment taking longer than their global peers.

Rather than viewing AI as a threat to employees, Australian CEOs see AI as a driver of job creation and profitability.

But what are they concerned about?

- Ethical impacts – 67%

- Technical capability and skills – 60% (compared with 50% globally)

- Lack of regulation – 62%

- Employee adoption – 52%

An alarming 41% of Australian CEOs say they are underprepared for cyberattack compared to 20% of global leaders who express the same concern.

In an interesting catch-22, most CEOs (69% Australia, 82% global) see AI as an avenue for bolstering their cyber security defences while at the same time recognising its potential as a new attack surface for adversaries.

While talent has, perhaps surprisingly, slipped down the list, challenges remain over the short term as the labour market remains tight with unemployment at a low 3.7% and businesses compete for the same scarce skills in cyber and tech to fuel investment priorities like AI and address threats to growth in cyber-crime/insecurity.

Andrew Yates

KPMG Australia CEO

Though ESG has been a top priority in recent years, most Australian CEOs (80%) say their current progress would not hold up under stakeholder or shareholder scrutiny.

ESG governance is a stand-out priority with 51% putting governance models and reporting at the top of the investment agenda.

64% of Australian CEOs say they have embedded ESG into strategy as a means of value creation compared with 69% globally.

75% of leaders in Australia and overseas are confident they have the capability and capacity to meet required new ISSB standards.

Globally, two-thirds of CEOs agree that in three years’ time white-collar roles will return to the office – with only a small number believing it will be hybrid or completely remote.

Interestingly, most leaders (89% global, 75% Australian) say they would reward employees who returned to the office with raises, promotions and better projects.

Is the public looking for business to take the lead role from governments in societal changes like climate change, social justice and Inclusion, Diversity, Equity (IDE)?

44% of Australian CEOs say yes, compared with 64% of their global peers.

54% of Australian leaders say IDE is moving too slowly in the business world and only 46% are prepared to take a stand on contentious issues if their boards had concerns.

Similarly, 54% locally (compared with 71% globally) say they would be willing to divest well performing but socially contentious parts of the business.

It is encouraging to see business leaders both here and overseas growing in confidence, when we were still emerging fully from the pandemic. There is clearly some concern about inflation and interest rates dampening prospects but overall, the figures are positive.